Key Points

-

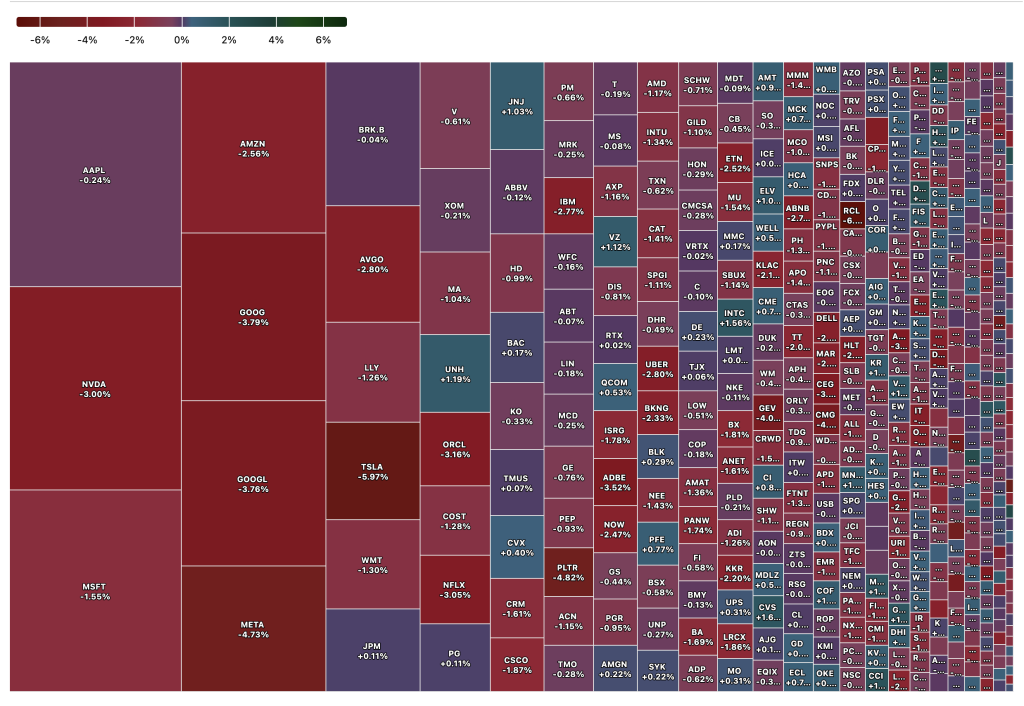

All Magnificent Seven stocks have declined today.

-

Fear has returned to the market due to Middle East instability and a weak macro outlook.

-

Investors are also waiting for the FOMC meeting and the Nvidia GTC conference to conclude before deciding to buy the dip.

-

Your future is too important to leave to chance. See if you’re on track for retirement by taking this simple quiz and matching with a fiduciary financial advisor serving your area. It only takes a moment, and is totally free. Click here to begin. (sponsor)

Yesterday, the Magnificent Seven stocks underperformed compared to the rest of the market. Today, these stocks have plunged due to economic uncertainty and chaos restarting in the Middle East again.

Moreover, investors are waiting for both the FOMC meeting and Nvidia’s (NASDAQ: NVDA) GTC conference to be completed. The FOMC meeting will give investors more clarity about the broader economy’s direction, and Nvidia’s GTC AI conference will give more insight into where the AI narrative is heading. Chip stocks are heading lower in the meantime.

Here’s a market update as of 11 A.M (ET) today.

- The S&P 500 is down points, 61 points or 1.07%.

- The Nasdaq Composite is down 331.14 points, or 1.86%.

- Dow Jones Industrial Average is down 253.73 points, or 0.61%.

Magnificent Seven Stocks Decline

The Mag 7 stocks have shown continuing weakness today on top of earlier underperformance.

- Alphabet (NASDAQ: GOOG, GOOGL): Has declined around 4.4%. The company recently agreed to buy an Israeli cybersecurity company for $32 billion.

- Amazon (NASDAQ: AMZN): AMZN has declined over 2.2%. This is mostly due to the broader market being volatile, along with Mag 7 overvaluation fears.

- Apple (NASDAQ: AAPL): Apple is the odd one out, as it is down slightly so far today. Evercore said the company is set for strong growth through 2029 and is a lower-risk way to play AI. The company has mostly stayed out of the AI hype and delayed its Siri AI rollout.

- Meta Platforms (NASDAQ: META): Declined 4.4% today due to continuing AI fears. KeyCorp issued a pessimistic forecast and reduced its price target from $750 to $710.

- Microsoft (NASDAQ: MSFT): Is down 1.21%.

- Nvidia (NASDAQ: NVDA): Down 2.76% as investors wait for the GTC conference announcements.

- Tesla (NASDAQ: TSLA): Continued declining as board members and an executive have sold off over $100 million since February. There has also been news of a new BYD car being able to fully charge in just five minutes.

Notable Gainers Today

Some stocks have delivered surprisingly solid gains today.

- Aditxt Inc (NASDAQ: ADTX): Rose by over 113% today due to advances in drug trials and acquisition strategies.

- Blue Hat Interactive (NASDAQ BHAT): Up 34% today. This is mostly due to gold surging. The company bought 1 ton of gold through its Hong Kong subsidiary earlier.

- Harrow Inc (NASDAQ: HROW): Up over 20% due to preliminary Q4 results and revenue outlook being bullish. It expects $280 million in 2025 revenue.

- FinVolution Group (NYSE: FINV): Up 15.6% due to strong Q4 growth. Citi raised its price target to $11. The company also announced a dividend increase.

- Elbit Sytems (NASDAQ: ESLT): The stock of this Israeli company is up over 10% as it beat Q4 earnings and the ceasefire collapse in Gaza.

Some Big Losers Today

Apart from the Mag 7, many other AI stocks like Palantir (NASDAQ: PLTR) fell significantly. PLTR is down 4.6% so far today. Royal Caribbean (NYSE: RCL) also declined over 6% due to soft economic data expected to hurt travel.

- Bakkt Holdings (NYSE: BKKT): Down over 36% as it lost BofA and Webull agreements. A securities fraud investigation was initiated shortly after.

- Ree Automotive (NASDAQ: REE): Down over 33.6% after it signed a $770 million deal. Investors likely see more dilution.

- BigBear.ai (NYSE: BBAI): This AI play is down over 14% after an accounting restatement.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.