Premarket action on Tuesday had the three major U.S. indexes trading lower. The Dow Jones industrials were down 0.2%, the S&P 500 down 0.14% and the Nasdaq 0.01% lower.

The Federal Reserve’s open market committee (FOMC) meeting begins Tuesday and ends Wednesday with a press conference when the Fed announces whether the federal funds rate will change. The current range of 4.75% to 5.00% is expected to rise by a quarter point to a range of 5.00% to 5.25%. Investors are unlikely to make any more big moves until Wednesday’s announcement is in the books.

JPMorgan Chase & Co. (NYSE: JPM) got a 2.1% boost to its share price Monday, following its acquisition of First Republic Bank after the regional bank was seized by the Federal Deposit Insurance Corporation (FDIC). There was much less drama this time than there was a month ago when Silicon Valley Bank and Signature Bank faced a similar fate. The big difference was that the FDIC already had established a process for a private solution to First Republic’s failure.

When SVB and Signature collapsed, the two banks had to be declared a systemic risk, and the FDIC had to guarantee all the banks’ deposits. With First Republic, its demise was less of a surprise. JPMorgan had an offer ready to go that was clearly the best of those the FDIC received, so the nation’s biggest bank was quickly granted a waiver to a restriction that prevents banks with 10% or more of U.S. deposits from making further acquisitions.

JPMorgan offered $10.6 billion for all of First Republic’s deposits, and the FDIC gave the bank a $50 billion line of credit along with a loss-sharing agreement. The federal government does have some skin in the game, but not to the levels needed in early March.

Will the failure of First Republic lead to further reforms of the U.S. banking system? Democratic Senators Sherrod Brown and Elizabeth Warren are calling for additional regulation, including stress testing for banks with less than $250 billion in assets and which were exempted from the testing requirement in 2018. Instead of waiting for a bank to surpass the $250 billion line, new regulations could pay closer attention to a bank’s assets as it approached that line.

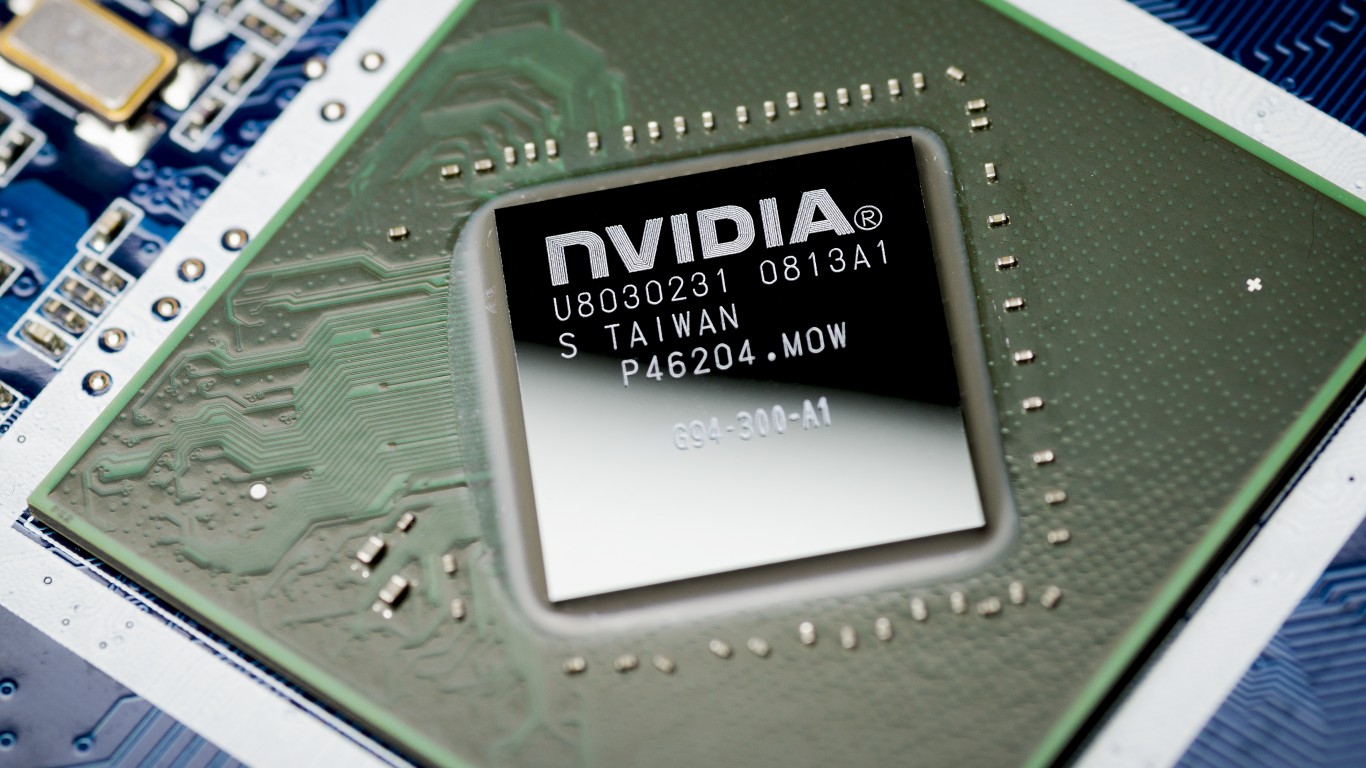

Nvidia Corp. (NASDAQ: NVDA) added about 4.2% to its share price on Monday as more than 54 million shares of the company’s stock changed hands. Nvidia has been widely acknowledged as the chipmaker most likely to prosper from the current boom in artificial intelligence development. The company’s graphics processors do a lot of math really fast, and those calculation abilities are vital to AI. For all its potential power, AI still depends on throwing as much silicon as possible at the data. This was true 30 years ago. The big difference is the chipmaking technology available now and its relatively low priced.

Here is a look at how the markets fared on Monday.

Seven of 11 market sectors closed lower on Monday. Energy (−1.26%) and consumer cyclicals (−1.06%) posted the day’s biggest losses. Health care (0.59%) and industrials (0.55%) put up the best gains. The Dow closed down 0.14%, the S&P 500 down 0.04% and the Nasdaq down 0.11% on Monday.

Two-year Treasuries added 10 basis points to end Monday at 4.14%, and 10-year notes jumped by 15 basis points to close at 3.59%. In Tuesday’s premarket, two-year notes were trading at around 4.13% and 10-year notes at about 3.54%.

Monday’s trading volume was below the five-day average. New York Stock Exchange losers outpaced winners by 1,776 to 1,212, while Nasdaq decliners led advancers by about 6 to 5.

Before U.S. markets open on Tuesday, 65 companies are scheduled to report quarterly results. Eighty-one firms will release earnings reports after markets close.

Monday’s best-performing S&P 500 stock was Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH). The stock added 8.91% on Monday after the company reported earnings and revenue that beat consensus estimates. The cruise line operator also said that demand continues to be strong and the company has not seen unusual booking or cancellation activity.

Newell Brands Inc. (NYSE: NWL) lost 11.03% Monday, the worst loss among S&P 500 index stocks. After reporting quarterly results last Friday, the company’s own outlook sees 2023 profit at the low end of its range and cannot quite quell fears of the impact that the bankruptcy of Bed Bath & Beyond, one of Newell’s largest customers, could have going forward.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.