Premarket action on Wednesday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.13%, the S&P 500 up 0.16% and the Nasdaq 0.26% higher.

All 11 market sectors closed lower on Tuesday. Financials (−2.54%) and materials (−2.5%) fell the most. Consumer staples (−0.97%) and communications services (−1.14%) posted the day’s smallest losses. The Dow closed down 1.72%, the S&P 500 down 1.53% and the Nasdaq down 1.25%.

Two-year Treasuries closed up 11 basis points at 5.00% on Tuesday, and 10-year notes dipped by one basis point to close at 3.97%. In Wednesday’s premarket, two-year notes were trading at around 5.04% and 10-year notes traded at about 3.99%.

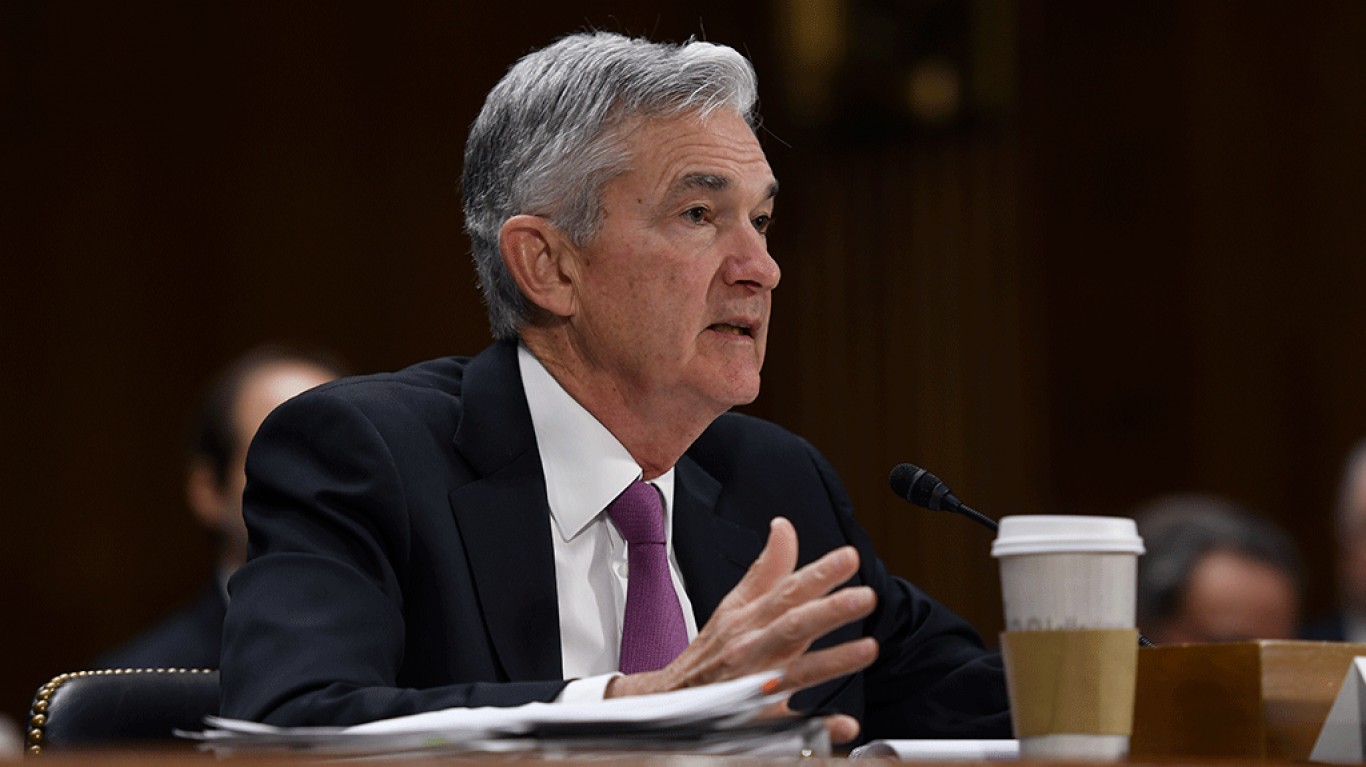

Federal Reserve Chair Jerome Powell told the Senate Banking Committee Tuesday that the central bank has a long way to go before returning the inflation rate to its 2% target. And if the economy continues to heat up, the Fed is “prepared to increase the pace of rate hikes.” That policy could go on “for some time.” Powell will appear before the House Financial Services Committee Wednesday morning and deliver the same message.

Economic data due out this week include Thursday’s weekly report on initial claims for unemployment benefits, currently pegged to rise slightly week over week. The nonfarm payrolls report for February will be released Friday. Analysts are expecting a sharp drop, primarily in private payrolls. The unemployment rate is expected to remain unchanged at 3.4%.

Tuesday’s trading volume was near the five-day average. New York Stock Exchange losers outpaced winners by 2,430 to 630, while Nasdaq decliners led advancers by more than 2 to 1.

Dish Network Corp. (NASDAQ: DISH) rose 4.04% on Tuesday to lead the S&P 500 index stocks. Company co-founder Jim DeFranco purchased some $16 million worth of the company’s stock, helping erase the nearly 20% share price decline brought on by a ransomware attack that disrupted the company’s satellite TV service.

Tuesday’s biggest loser among S&P 500 stocks was software provider DXC Technology Co. (NYSE: DXC). Shares fell 7.06% following a company statement issued late Monday in which DXC revealed that a potential takeover was not going to happen because the prospective buyer had run into “challenges in raising the necessary capital.”

On Tuesday, electric vehicle maker Rivian Automotive Inc. (NASDAQ: RIVN) announced a prospective private placement of $1.3 billion in green convertible debt. Shares fell more than 14%. Early Wednesday morning, Rivian priced the offering at 4.625%. The senior, unsecured notes will pay interest twice yearly, in March and September, on debt that reaches maturity on March 15, 2029.

A few brave souls were buying the dip in Rivian stock in premarket trading. Shares were up about 0.8% early Wednesday, after dropping by 14.54% after announcing its new debt issuance.

Speaking of brave souls, Warren Buffett’s Berkshire Hathaway has acquired almost 6 million shares of Occidental Petroleum Corp. (NYSE: OXY) over the past several days, raising his stake in the oil and gas producer to more than 200 million shares, or about 22.1% of the company.

Berkshire still owns some 84 million warrants to acquire more Oxy stock at a price just under $60 a share, along with $10 billion in preferred stock for which Oxy pays Berkshire 8% in annual interest. Berkshire fronted the money to help Oxy beat Chevron in a bidding war for Anadarko Petroleum back in 2019. Oxy shares traded up by about 3% in Wednesday’s premarket.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.