Bitcoin mining revenue rose 50% to over $24.4 million from more than 15.3 million on Jan. 3, Blockchain.com data showed. While it relieves troubled bitcoin miners, the revenue remains down more than 30% year-over-year.

Bitcoin Mining Revenue Soars Above $24M in One Month

Bitcoin mining revenue surged to almost $23 million in January, marking a 50% increase in just 30 days, according to data by Blockchain.com. The jump comes after the mining revenue for the world’s top cryptocurrency tumbled to $13.6 million on Dec. 28, 2022, before slightly recovering to $15.3 million on Jan. 1, 2023.

However, bitcoin mining revenue remains down compared to January 2022, when it stood at more than $34.1 million. This represents a year-over-year decrease of more than 32%. The revenue soared beyond $50 million in February 2022 but quickly lost those gains as the crypto rout continued to deteriorate.

Still, the latest 50% jump marks a notable relief for the embattled bitcoin miners. The industry has witnessed several bankruptcies in the past year, including the well-known Core Scientific. The bitcoin miner filed for Chapter 11 bankruptcy protection in December 2022, with its liabilities ranging from $1 billion to $10 billion.

Bitcoin Network Adoption and Security Improving as Hash Rate Peaks

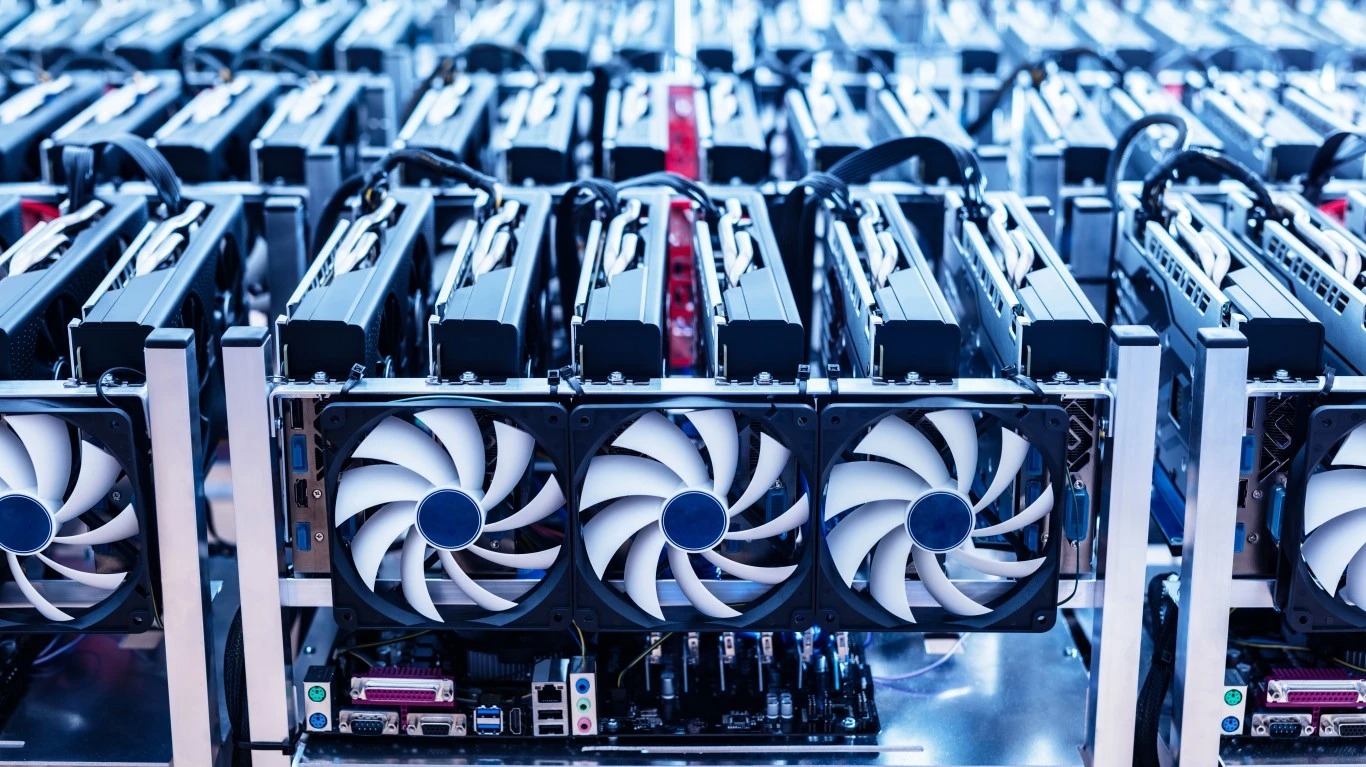

Meanwhile, the Bitcoin hash rate – the amount of processing and computing power provided to the bitcoin network through mining – continues to hit fresh all-time highs. It currently stands at more than 300 million EH/s, up from around 182 million EH/s in January 2022.

An increase in hash rate typically suggests rising network adoption and signals that the network is becoming more secure. While it does not suggest that BTC’s bear market is ending, a growing hash rate is usually a good sign for BTC owners as it indicates that the network is strengthening despite the extreme price decline in 2022.

The decline led to immense pressure on the mining industry last year as the US Federal Reserve delivered several consecutive interest rate hikes, driving the US dollar to a 2-decade high. This did not bode well for risk assets, including cryptocurrencies, pushing some of them to multi-year lows. The downturn worsened following the collapses of Terraform Labs in May and FTX in November.

This article originally appeared on The Tokenist

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.