Bitcoin (BTC) miners’ revenue jumped to more than $40 million a day on Wednesday following the latest uptick in the cryptocurrency’s price that took its year-to-date (YTD) gains to almost 70%. The revenue jump was also partly fueled by elevated Bitcoin network fees driven by recent interest in Ordinals.

Bitcoin Miners’ Revenue Sees a Meteoric Rise Amid BTC YTD Gains

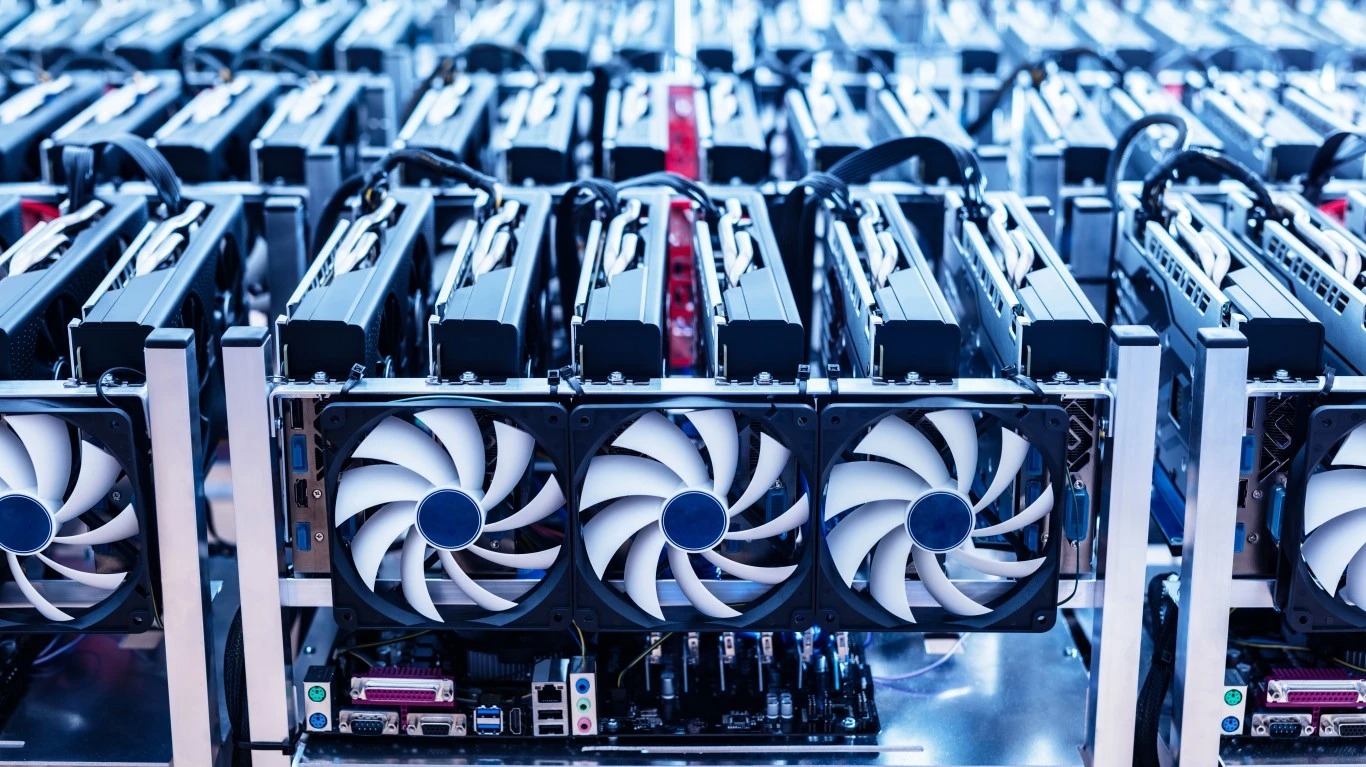

Bitcoin miners are generating revenue at the highest pace in more than a year as the cryptocurrency’s YTD gains rose to almost 70%, and transaction fees continue to mount amid recent demand for Ordinal inscriptions, also referred to as Bitcoin NFTs. At the moment, Bitcoin miners are bringing in around $40 million a day, according to data from Blockchain.com.

The surge in revenue comes as the world’s largest cryptocurrency saw its price almost double from $16,605 at the start of the year, marking a sharp rebound from its 2022 lows as a result of arguably the worst-ever crypto winter. Similarly, Bitcoin miners’ revenue also remarkably recovered since plunging to below $10 billion daily in December 2022.

On Wednesday, BTC rose by an additional 1.5% after a new consumer price index (CPI) report that showed inflation fell more than expected in April. At the time of the writing, BTC price stood at $28,171, up almost 2% in the past 24 hours. Bitcoin is now edging closer to reclaiming the $30,000 psychological threshold it reached last month for the first time since June 2022.

Demand for Bitcoin Ordinals Contributes to Revenue Surge

Apart from Bitcoin’s price surge, mounting transaction fees on the blockchain significantly contributed to the latest jump in miners’ revenue. Earlier this month, daily fees on the Bitcoin chain skyrocketed to $3.5 million, the highest since May 2021.

One of the main factors fueling the rising fees is the unprecedented demand for Bitcoin ordinals, digital assets that can be inscribed on a satoshi – the lowest denomination of a Bitcoin. These so-called Bitcoin NFTs have attracted substantial interest since the start of 2023 and have continued to do so in recent months, exceeding the 3 million mark.

But not all in the Bitcoin community share the same enthusiasm for Ordinals, causing a bottleneck on the Bitcoin network. On May 10, several Bitcoin developers mulled amending the Bitcoin codebase to kill Ordinals and BRC-20 tokens – a recently issued token standard that allows fungible tokens to be minted and transferred on the Bitcoin blockchain.

This article originally appeared on The Tokenist

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.