Global central banks purchased 1,136 tons of gold in 2022, driving the demand for the yellow metal to the highest mark since 2011, CNBC reported. The figure, which represents the most central banks bought in 55 years, is 152% higher than the 450 tons they bought in 2021.

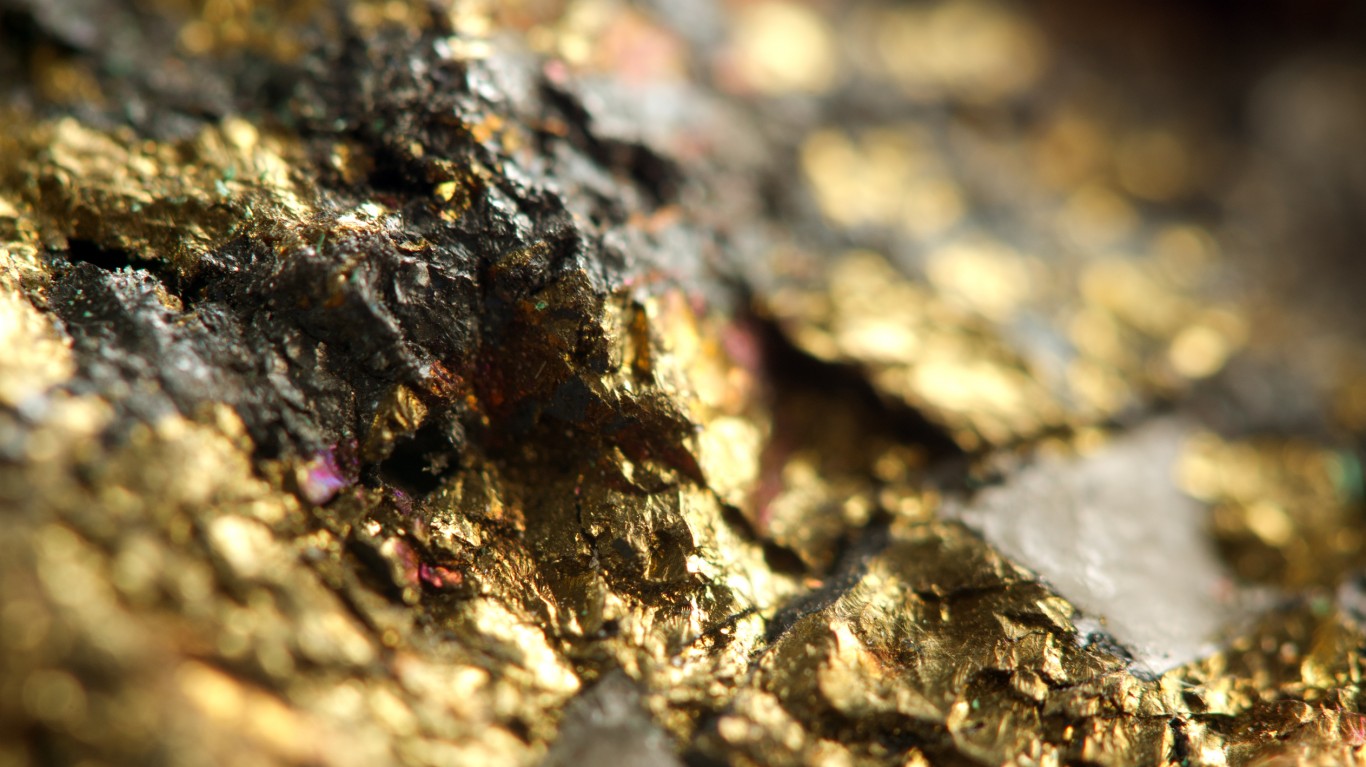

Central Banks Bought the Highest Amount of Gold in 55 Years in 2022

Gold demand skyrocketed to an 11-year high in 2022 after global central banks bought the most precious metal in over five decades. According to the World Gold Council (WGC), annual gold demand rose 18% to 4,741 tons across 2022, the most since 2011. These figures do not account for over-the-counter (OTC) gold trading.

The record surge in demand was fueled by “colossal central bank purchases, aided by vigorous retail investor buying,” said the WGC. In Q4 2022 alone, the demand for gold jumped to 1,337 tons.

The central banks bought 1,136 tons of gold last year, marking a 55-year high. The WGC said most of these purchases were “unreported.” The figure represents a 152% increase from 2021, when central banks purchased just 450 tons of yellow metal. The WGC believes the unprecedented jump came due to geopolitical turmoil and 40-year high inflation last year.

“Central bank net purchases in Q4 totalled 417t, lifting H2 total buying to 862t. Echoing Q3, data for the final quarter of the year was again a combination of reported purchases and a substantial estimate for unreported buying,” the WGC said. “Should more information about this unreported activity become available, these estimates may be revised.”

– the World Gold Council (WGC) said.

Data showed that investment demand for the bullion surged by 10% to 1,107 tons last year, while holdings of gold exchange-traded funds (ETFs) registered smaller outflows compared to 2021. Total annual gold supply rose 2% to 4,755 in 2022.

2022 Marked the Highest Level of Annual Demand for Gold in 72 Years

According to the WGC, 2022 marked the thirteenth year of net gold purchases. In addition, gold also saw the second highest annual demand in history in 2022 since 1950, fueled by strong demand in the last two quarters of the year.

This was not the case in Q1 and Q2 when interest in the precious metal was not as robust. Gold struggled to break above the $1,900 threshold during that period, compared to its current price of $1,927 per ounce.

WGC data showed that most gold purchases in 2022 came from emerging markets, with Turkey’s central bank leading the buying spree with a record 542 tons. Other countries that significantly added to their gold reserves last year included China, India, Qatar, the UAE, Egypt, and Iraq, among others.

This article originally appeared on The Tokenist

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.