Key Points

-

Some chip stocks are extending their gains after a Biden-era chip rule is no longer going into effect.

-

A trade deal with the UK is also driving up optimism.

-

Several stocks have made big moves in both directions due to them reporting their Q1 earnings.

-

Your future is too important to leave to chance. See if you’re on track for retirement by taking this simple quiz and matching with a fiduciary financial advisor serving your area. It only takes a moment, and is totally free. Click here to begin. (sponsor)

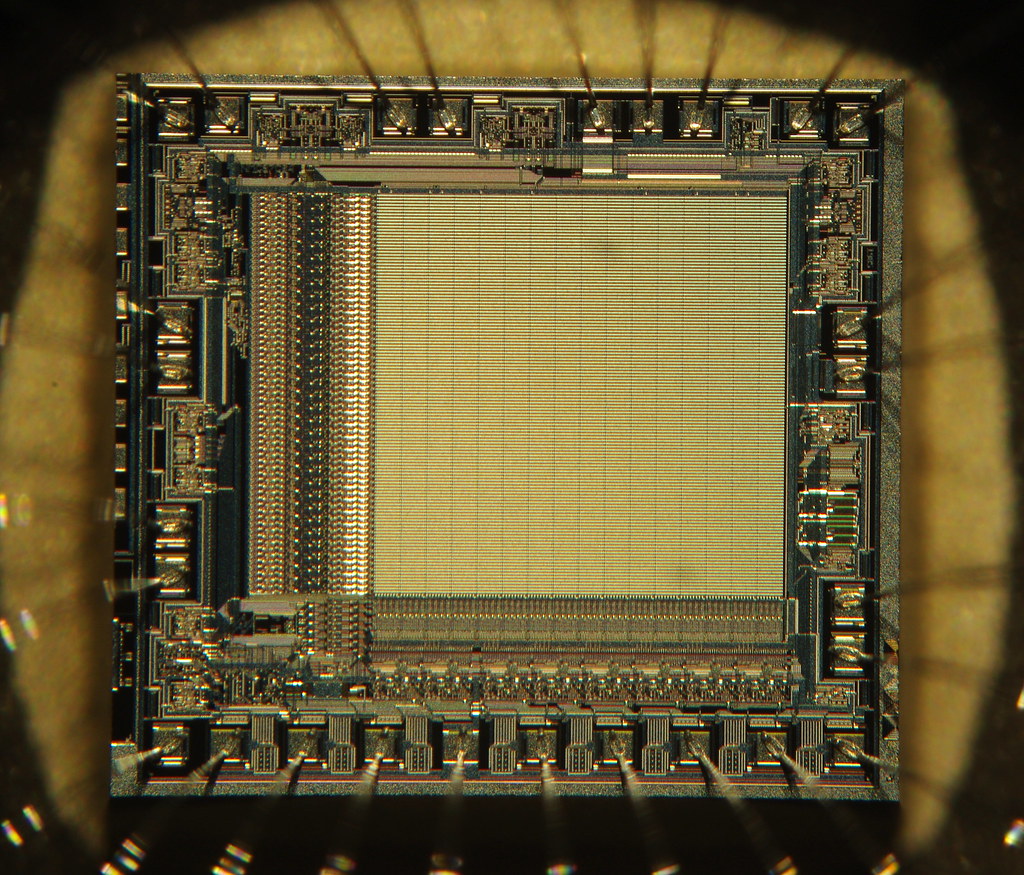

Yesterday, the Trump administration announced its intention to rescind and replace a Biden-era regulation that was designed to curb the export of advanced artificial intelligence (AI) chips. This Biden-era rule was scheduled to take effect on May 15, 2025.

This is called the “AI diffusion rule” and would’ve tightened restrictions on AI chips and tech exports to maintain US dominance in AI and limit China’s access to chips. Without this rule, chip stocks are likely to benefit from a more “open” chip policy. But again, the Trump administration previously mandated a license for Nvidia’s (NASDAQ: NVDA) H20 chip exports, so the change is less linked to opening up more trade.

According to a spokesperson from the Commerce Department’s Bureau of Industry and Security, “The Biden AI rule is overly complex, overly bureaucratic, and would stymie American innovation”. Instead, the Trump administration wants to implement a simpler rule.

Here’s a market update as of 11:00 A.M (ET) today.

- The S&P 500 is up 12.03 points, or 0.21%.

- The Nasdaq Composite is up 64.96 points, or 0.36%.

- The Dow Jones Industrial Average is up 116.88 points, or 0.28%.

Chip Stocks Gain

Unlike yesterday, semiconductor stocks haven’t gained across the board, but some have still extended their gains.

- Advanced Micro Devices (NASDAQ: AMD) is up 2.7%. The company also reported solid Q1 earnings. EPS beat estimates by 2.83%, and revenue beat estimates by 4.47%.

- Intel (NASDAQ: INTC) is up 2.3%.

- Micron Technology (NASDAQ: MU) is up 1.9%.

- Broadcom (NASDAQ: AVGO) is up slightly by 0.35%.

Notable Gainers Today

- Sezzle (NASDAQ: SEZL) is up 47% after the company trounced Wall Street estimates in its Q1 earnings report. It raised its net income guidance for the full year by almost 50% to $120 million. EPS guidance was also raised from $2.21 to $3.25 per share. On top of that, the company announced a $50 million share repurchase program.

- Dave (NASDAQ: DAVE) is up 38% after the company’s Q1 earnings beat estimates, and guidance was boosted. It reported EPS of $2.48 vs. the forecast of $0.75. Revenue also came in at $108 million vs. the $92.63 million forecast.

- D-Wave Quantum (NYSE: QBTS) is up 32% after reporting Q1 results. Revenue grew by over 500% year-over-year.

- Groupon (NASDAQ: GRPN) is up 29% after solid Q1 earnings. EPS came in at $0.17 vs. the -$0.1 forecast.

- LegalZoom.com (NASDAQ: LZ) is up 27.7% after Q1 earnings. Revenue beat estimates by 3.74%.

Notable Losers Today

- Krispy Kreme (NASDAQ: DNUT) is down 21% after it paused it reported a sales drop and paused its dividend. The company also paused its donut partnership with McDonald’s (NYSE: MCD)

- ADMA Biologics (NASDAQ: ADMA) is down 19% after missing Q1 earnings and revenue estimates. EPS of $0.14 missed estimates of $0.16.

- Cleveland-Cliffs (NYSE: CLF) is down 17.3% after it reported a Q1 loss. It will be pausing operations at several plants.

- Genpact (NYSE: G) is down 16.5% after it revised its revenue forecast.

- Argenx SE (NASDAQ: ARGX) is down 13.7% despite earnings and sales beating estimates, but Wall Street expected its autoimmune disease drug to do even better.

The image featured at the top of this post is ©Openverse.