Russians have been increasingly buying ASIC crypto mining rigs in Q4, according to a report by Kommersant. The buying spree has been spurred by low equipment and electricity prices, while the supply remains robust and could increase even further in the future.

Mining Equipment Prices in Russia Fell 20% From August to October

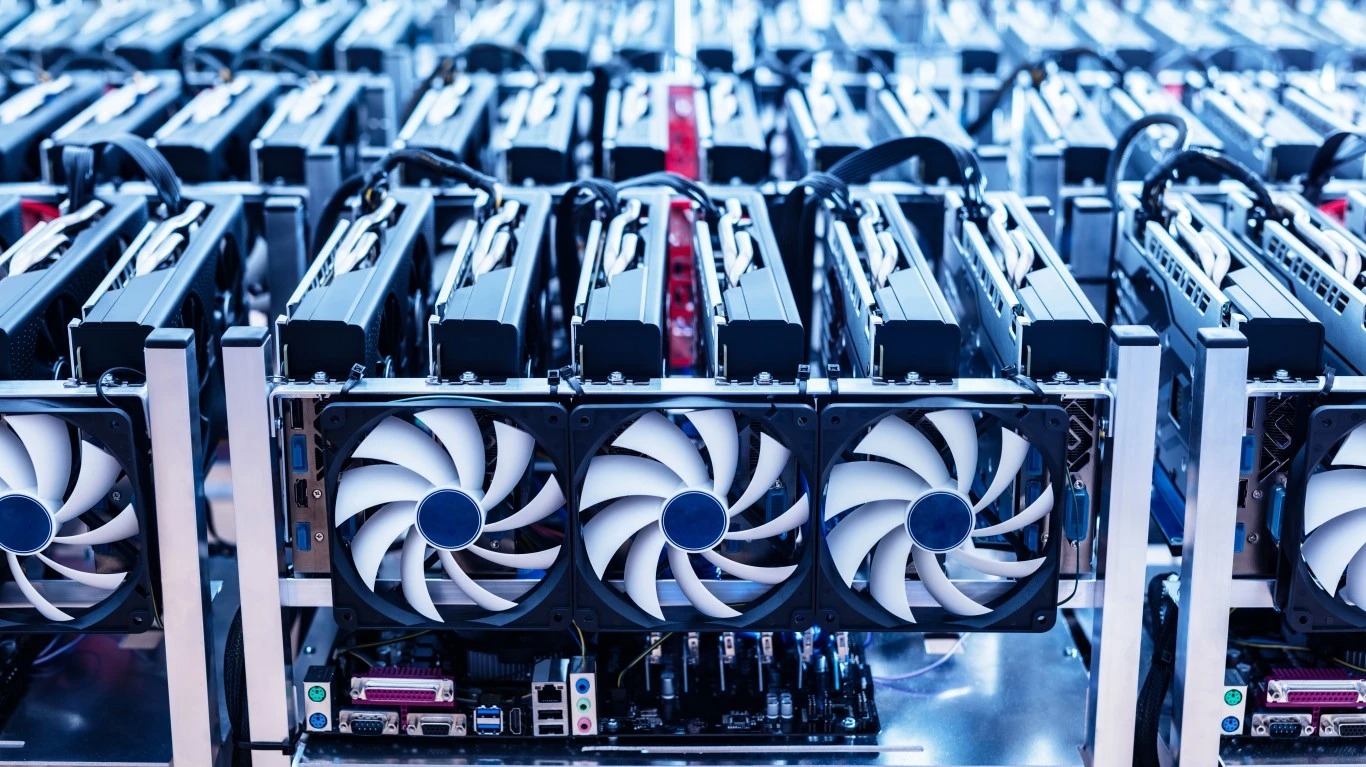

Demand for Application-Specific Integrated Circuits (ASICs) miners, specialized cryptocurrency mining rigs, has increased significantly in Q4 2022 in Russia, as reported by a local news outlet Kommersant. The surge in demand was driven by low equipment and electricity prices, the report added.

The increased interest in ASIC rigs comes despite weaker demand for graphic processing units (GPUs), Kommersant reports. The news agency says sales of Chilkoot, one of the official distributors of crypto mining rigs in Russia, were greater during the first two months of Q4 compared to the entire Q3. Further, during the first nine months of 2022, Chilkoot’s sales were 65% higher than last year.

BitRiver analyst Vladislav Antonov said the Russian industrial market welcomed the latest developments as the price of ASIC mining equipment stands as close as possible to the cost of production. During the period between August and October, mining rig prices plunged by nearly 20%, Chilkoot added. However, prices have not dropped further since October, it added.

Chilkoot CEO Artem Eremin said his company is collaborating with legal entities and noticed that their mining equipment purchases in one transaction increased by 30% compared to the start of the year. He said one of the reasons behind lower GPU prices is Ethereum’s transition from the proof of work (PoW) to the proof of stake (PoS) consensus mechanism.

Global Crypto Mining Firms Defaulting on Equipment-Backed Loans

Taking into account the current favorable conditions, entering the bitcoin mining market in Russia could yield users substantial profits over the next three years, Antonov added. The supply of mining equipment in the country remains strong and could increase even further as major mining firms leave the deteriorating crypto market.

On a global level, crypto miners have been dealing with notably tougher circumstances. Numerous mining firms have been defaulting on machine-backed loans, adding to crypto lenders’ woes.

According to Bloomberg, mining companies, which have secured a whopping $4 billion in financing when profit margins were as high as 90%, are now facing bankruptcy and sending thousands of expensive mining machines back to lenders. The situation has been further exacerbated since the FTX collapse, which has had a contagious impact on the industry.

This article originally appeared on The Tokenist

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.