In mid-morning trading Friday, the Dow Jones industrials traded down 0.22% and the S&P 500 was down 0.22%, while the Nasdaq was up 0.07%. A decent start at the opening bell evaporated, and stocks were struggling to stay in the green.

After U.S. markets closed Thursday, Intel reported missed estimates on both adjusted earnings per share and revenue. Even worse, the company’s current quarter revenue guidance fell far short of the consensus estimate. Shares traded down about 8% Friday morning.

Another Dow stock, Visa, reported beats on the top and bottom lines, thanks to international travelers who raised their payment volume by 22% year over year and the rest of us who boosted payment volume and total transactions by 10% each. Shares traded up nearly 2% Friday morning.

Before markets opened on Friday, American Express reported results that missed on both EPS and revenue. Upside guidance for the new fiscal year and a 15% increase to the annual dividend had shares trading up by almost 11%.

Chevron also missed the consensus EPS estimate but beat the revenue estimate by about $2.5 billion. The company said it expects 2023 production to be flat to up 3%, with an average Brent crude price of $80 a barrel. Rising natural gas prices will increase costs at Chevron’s refineries, however, and performance at the company’s other segments is uncertain, tending toward lower. Shares traded down about 4.4% shortly in mid-morning action Friday.

Alliance Resource Partners, GE Healthcare, Li-Cycle and SoFi Technologies are set to report quarterly results first thing Monday morning. Look for Caterpillar, Exxon Mobil, McDonald’s, Pfizer and UPS to share their results early Tuesday.

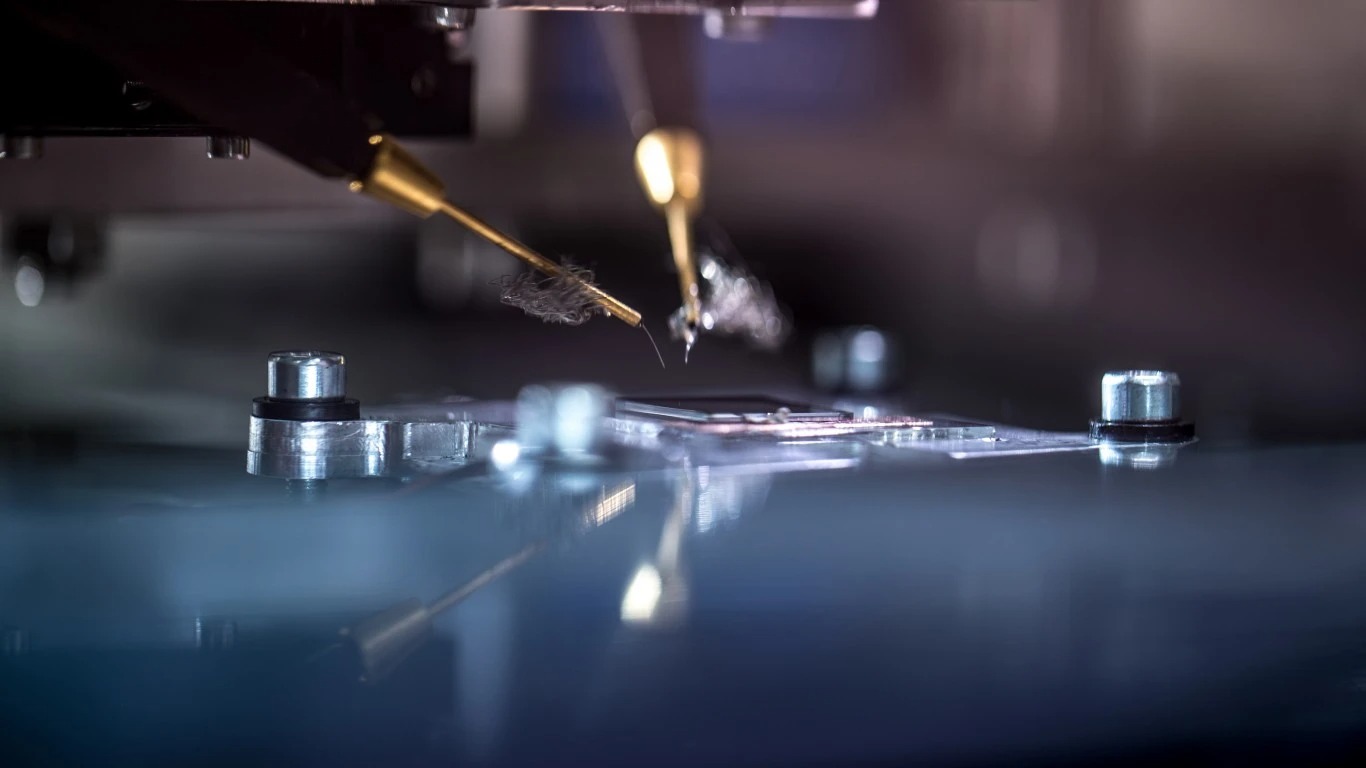

Netherlands-based NXP Semiconductors N.V. (NASDAQ: NXPI) is expected to post results after U.S. markets close on Monday. Since posting an all-time high share price in December of 2021, NXP has seen its share price fall by about 23%. The company has beaten EPS estimates for 11 consecutive quarters, and a relatively modest growth estimate for the fourth quarter could extend that streak to 12.

Following Intel’s debacle on Thursday, NXP stock traded a little higher Friday morning. The company’s focus on chips for automotive applications should give NXP some lift, both for the quarter just past and for the coming year. Guidance may make a difference in how investors react to the report.

Of 28 analysts covering the stock, 14 have a Buy or Strong Buy rating and 14 rate it at Hold. At a recent share price of around $181.00, the upside potential based on a median price target of $185.00 is just 2.2%. At the high price target of $225.00, the upside potential is 24.3%.

Fourth-quarter revenue is expected to come in at $3.3 billion, which would be down 4.3% sequentially but 8.6% higher year over year. Adjusted EPS are forecast at $3.63, down 4.7% sequentially and up 13.4% year over year. For the full 2022 fiscal year, analysts anticipate EPS of $14.31, up 33%, on sales of $13.19 billion, up 19.2%.

NXP stock trades at about 112.7 times expected 2022 EPS, 13.9 times estimated 2023 earnings of $13.07 and 12.7 times estimated 2024 earnings of $14.29 per share. The stock’s 52-week trading range is $132.08 to $211.83. NXP pays an annual dividend of $3.38 (yield of 1.94%). Total shareholder return for the past 12 months was negative 1.45%.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.