In morning trading on Thursday, the Dow Jones industrials were down 1.14%, the S&P 500 down 0.64% and the Nasdaq 0.19% lower.

After U.S. markets closed on Wednesday, Disney missed the consensus earnings per share (EPS) estimate but did beat revenue expectations. That was not good enough to overcome a decline in its cable networks business. Shares traded down nearly 9% in the first half-hour of trading on Thursday.

Robinhood beat estimates on both the top and bottom lines, and investors have responded warmly to the company’s plan to begin 24-hour trading in a selected bag of stocks, including Tesla, Amazon, and Apple. The stock is up 6.5%.

Unity Software missed analysts’ EPS estimate but beat on revenue and issued upside guidance for the second quarter. Shares traded up 10.5%.

Before U.S. markets opened on Thursday, Algonquin Power also beat on both the top and bottom lines. Algonquin said it will conduct a strategic review of its renewable energy business with the goal of “enhancing shareholder value.” Shares traded up about 0.3%.

JD.com hammered estimates, handily beating both EPS and revenue forecasts. Shares traded up more than 6%.

Faraday Future, News Corp and Petrobras are scheduled to report quarterly results after markets close on Thursday. No notable results are scheduled for release on Friday.

Here is a look at two companies scheduled to report results first thing Monday morning.

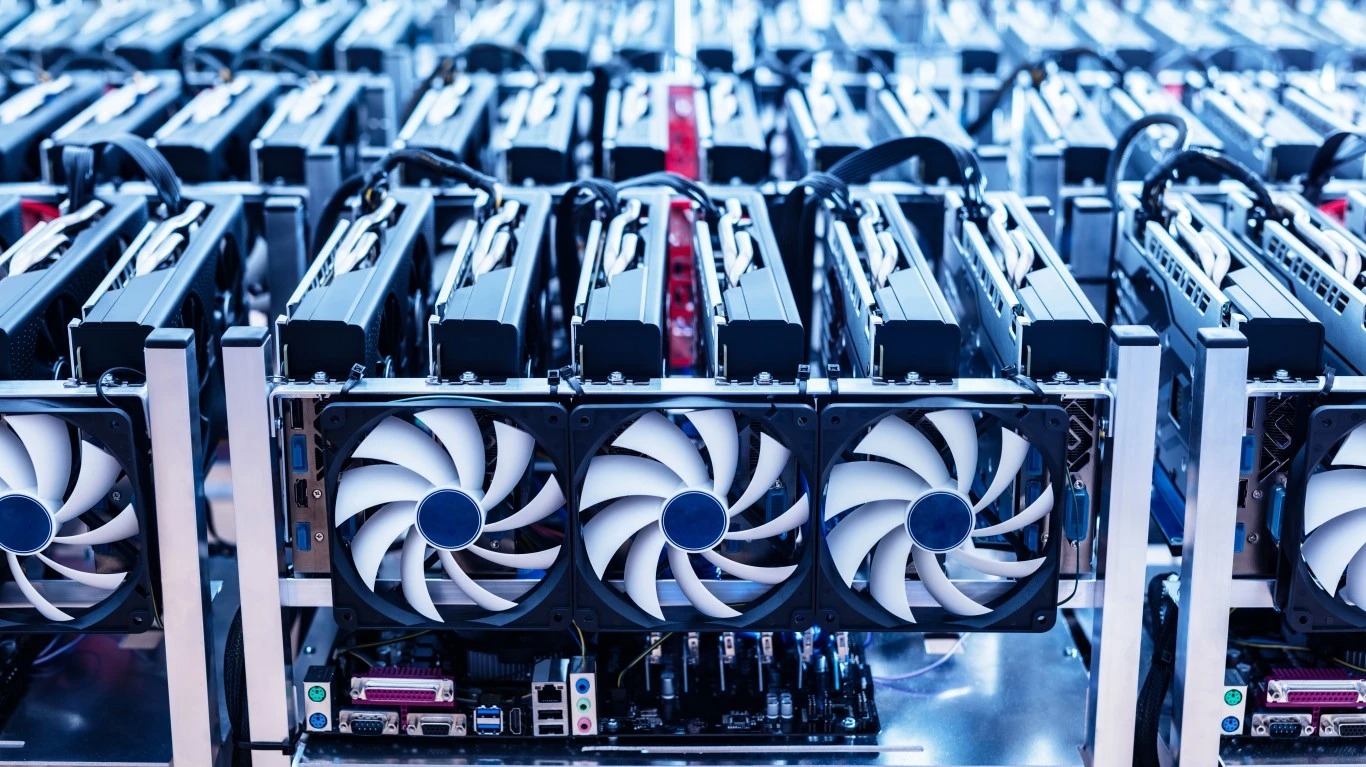

Bitfarms

Toronto-based cryptomining firm Bitfarms Ltd. (NASDAQ: BITF) came public in late June 2021, and the shares reached their all-time high of around $9.00 in early November. Since then, the stock has plunged by more than 87%. That is almost 20 percentage points worse than Bitcoin’s loss over the same period.

What may be more interesting about crypto mining than the crypto itself is the beginning of a move by some miners to repurpose their expensive mining machines to work on AI and other compute-intensive applications. Bitfarms competitor Hut 8 generated nearly $17 million in 2022 revenue from hiring out its mining machines for high-performance computing and AI clients.

Even though the stock trades about 5 million shares daily, only two analysts cover it, and both have Strong Buy ratings and a price target of $4.00. At a recent share price of $1.10, the stock’s upside potential is more than 350%.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.