Faraday Future

Since its SPAC IPO in late July 2021, ultra-luxury EV maker Faraday Future Intelligent Electric Inc. (NASDAQ: FFIE) has lost 98% of its value, and the shares have traded below $1.00 every day but one since the beginning of the year. The stock traded up nearly 14% in Wednesday’s premarket session following an announcement that the company has received commitments for a financing package totaling $100 million in unsecured convertible notes from a group of investors and current shareholders.

With a starting price of around $200,000, the first delivery of the company’s first EV, the FF 91, is now set for the end of June. That is about five years late.

Faraday Future gets a Hold rating from the only analyst who follows the company. In other words, it cannot get much worse, so if you own the stock, maybe you will get lucky. Few investors are taking this advice, though. Faraday Future trades an average of around 62 million shares a day.

The company made no revenue in 2022 and is expected to post $140 million in sales this year. That estimate includes $26.25 million in the current quarter, but that will not happen because the first delivery is not scheduled until the end of the quarter. Last year’s loss per share was $1.50, and the single estimate is calling for a 2023 loss of $0.43 per share. That probably will worsen too because of the late delivery.

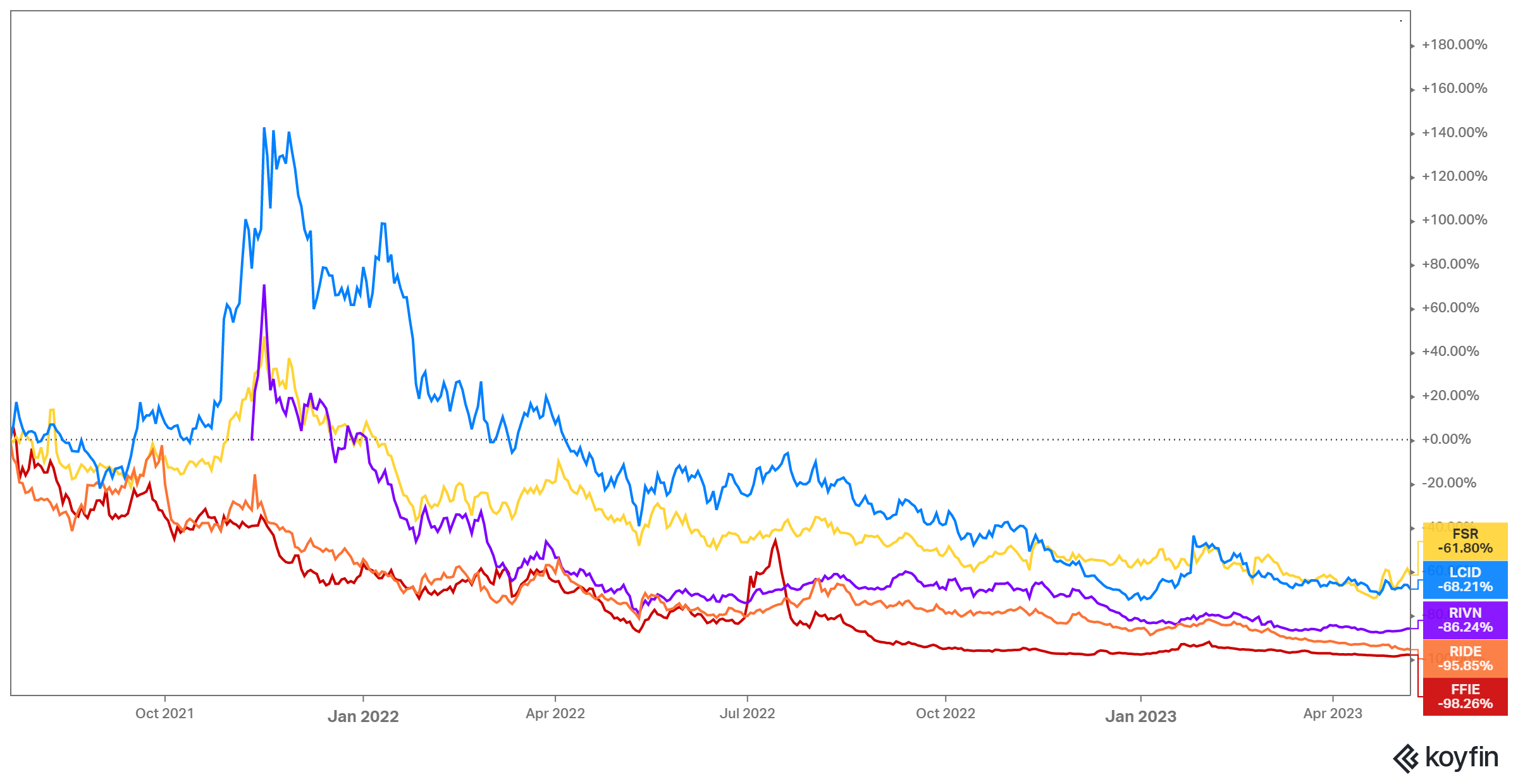

Here is a chart showing share price changes for Fisker, Rivian, Lordstown and Lucid since Faraday’s July 2021 IPO.

News Corp

Media and information services company News Corp. (NASDAQ: NWSA) is among the country’s largest financial publishing companies, with ownership of The Wall Street Journal and Barron’s, along with information services Dow Jones and Factiva.

Like Fox, the company is controlled by Rupert Murdoch, who in January killed a proposed merger of the two companies. News Corp was contemplating selling its Realtor.com business to commercial real estate firm CoStar, but that deal, too, sputtered out in late February, not long after News Corp announced it planned to fire about 1,250 employees.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.