China’s three U.S.-traded EV makers reported September deliveries Sunday that added up to the second-best month ever for the Chinese Three. Combined, Nio Inc. (NYSE: NIO), Li Auto Inc. (NASDAQ: LI) and Xpeng Inc. (NYSE: XPEV) delivered 66,831 deliveries for the month, a year-over-year increase of 116% and not far behind the August total of 68,203.

Nio delivered 15,641 vehicles in September, up 43.8% year over year, but down 19% from the August total of 19,239 deliveries. The September total included 11,504 electric SUVs and 4,137 sedans. For the third quarter, Nio delivered 55,432 vehicles, an increase of 75.4% year over year, and for the year to date, the company has delivered 94,352 vehicles. From its beginnings, Nio has sold 399,549 EVs.

Li Auto delivered a record 36,060 EVs in September, up 212.7% year over year and a new monthly delivery record. Third-quarter deliveries totaled 105,108, up nearly 300% year over year, and deliveries so far in 2023 total 244,225 vehicles. Li Auto does not sell its vehicles outside China. In its report, the company said it had received a record number of more than 40,000 new orders in September.

Xpeng reported deliveries of 15,310 vehicles in September, up 81% year over year and up 12% month over month. EV deliveries for the third quarter of 2023 reached 40,008 units, a sequential increase of 72%. At the end of the month, Xpeng began making deliveries of its G6 model to four European countries: Norway, Sweden, the Netherlands and Denmark. Xpeng broke a streak of 11 consecutive months of decreasing year-over-year deliveries in August.

Tesla Inc. (NASDAQ: TSLA) is expected to report third-quarter deliveries on Monday that will be lower than the 466,000 vehicles the company delivered in the second quarter. Analysts’ consensus estimate calls for deliveries of 461,000.

And in a surprise move, Tesla released an updated version of the Model Y in China. The updated vehicle was announced on the company’s official Weibo social media account. Tesla watchers say the update is not significant enough to earn a “total refresh” badge, and the Teslarati website noted: “Nonetheless, the recent upgrades to the Tesla SUV would make it difficult to choose between the updated Model Y and the refreshed Model 3 Highland.”

The updated version has a sticker price of around $36,000, unchanged from the earlier version.

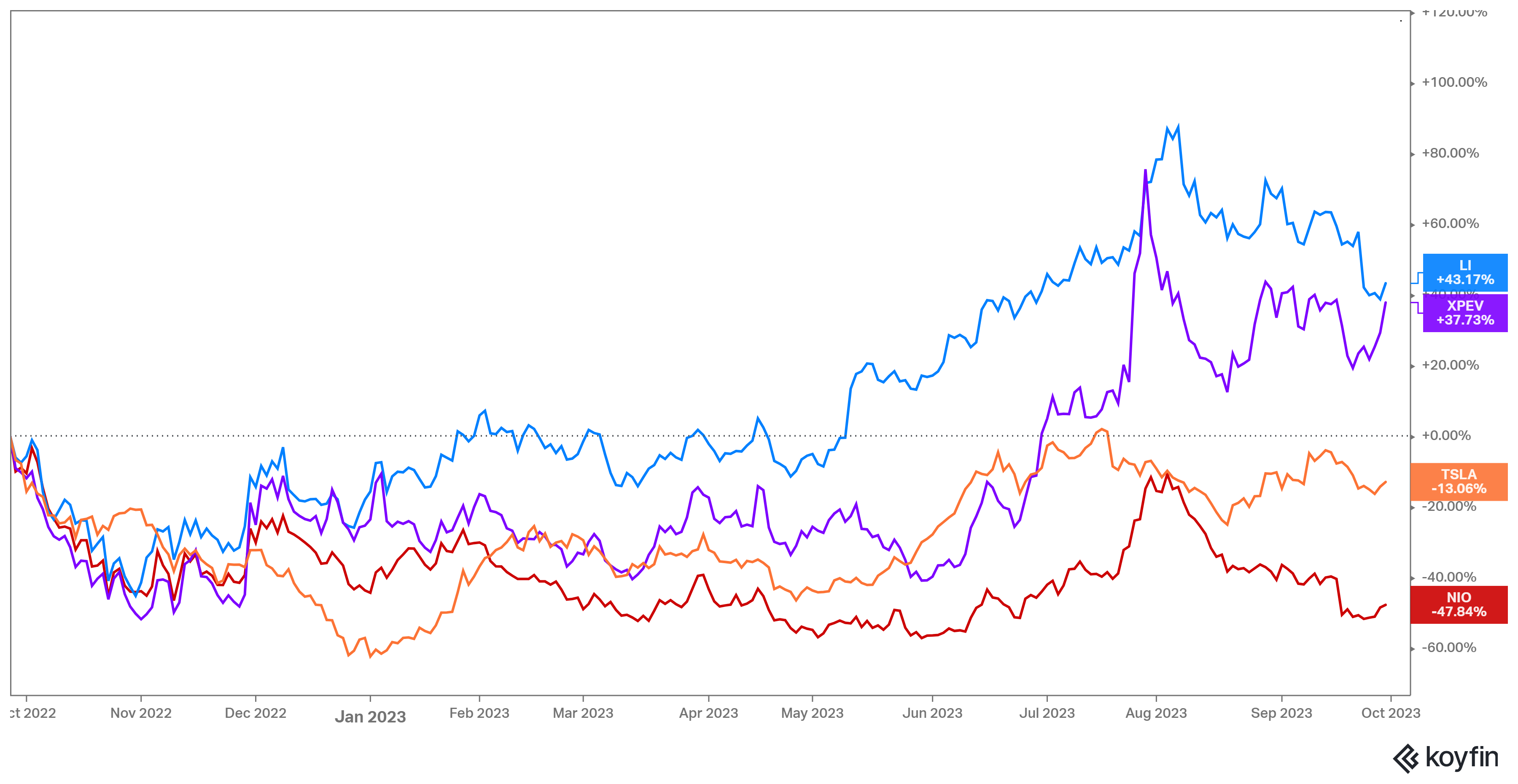

Shares of Nio traded up about 0.3% in Monday’s premarket session. The stock’s 52-week range is $7.00 to $16.88.

Li Auto traded up about 1.6%, at $36.21 in a 52-week range of $12.52 to $47.33.

Xpeng shares traded up about 1.0%. at $18.55 in a 52-week range of $6.18 to 23.62.

Tesla stock traded up about 0.5%, at $251.43. The stock’s 52-week range is 101.81 to 299.29.

Here is a chart of the four EV makers’ 12-month share price movement.

Bitcoin jumped by almost 4.5% at around 7:00 am ET Monday morning, up by nearly $1,000 in just over 24 hours. There are varying explanations for the jump. Cointelegraph says the crypto market “got a boost after the U.S. avoided a government shutdown.” Then why did it take 24 hours for the news to reach Bitcoin investors? The shutdown was dodged on Saturday.

Over at Barron’s, the story is less confusing: “There are few immediate catalysts to explain the move higher in Bitcoin, though leverage building up in the Bitcoin perpetual futures market—the most liquid market in all of crypto—likely helped prime the pump.” Translation: “It’s Bitcoin. Weird stuff happens.” October is historically a good month for crypto. Maybe that will be true again this year.

Bitcoin miners Marathon Digital Holdings Inc. (NASDAQ: MARA) and Riot Platforms Inc. (NASDAQ: RIOT) both traded up by nearly 7% in Monday’s premarket. Crypto exchange Coinbase Global Inc. (NASDAQ: COIN) traded up by more than 5%.

Originally published at 24/7 Wall St.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.