The “Buy the Dip” financial news teleprompter readers and the 30-year-old portfolio managers that have never seen a market crash are suddenly very silent and cannot be found. Market veterans and “hey, boomer” professionals have seen this show before. Back in 1987, the Dow Jones industrial average plunged a stunning 22% in one day. The equivalent today would be a drop on the venerable index of almost 7,300 points.

During the period from 1929 to 1932, the stock market plummeted by 83% and many people lost everything. That debacle caused the Great Depression, which really only ended when the United States entered World War II in 1941.

In the years from 2007 to 2009, during the height of the mortgage and real estate collapse, one that brought nearly prompted another depression, the market dropped a huge 57%. When stocks finally bottomed at an ominous intraday low of 666 on the S&P 500 on March 9, 2009, the floor was put in for the longest bull market in history, one that has clearly come to an end.

So where do we stand now? Very possibly on the precipice of a much larger decline. Monday broke the market low of 3,666 set back in June, and some across Wall Street feel we could be on our way to 3,100 to 3,200 on the S&P 500. That is an additional 15% from where we stand now.

Last week Federal Reserve Chair Jay Powell paved the way for two more interest rate increases at the last two Federal Reserve meetings this year. While it is possible that the next two increases could move back to 50 basis points, Powell has indicated the terminal or ending funds rate in 2023 could be as high as 4.60%. This could also mean small increases next year as well.

One positive is that, for the most part, consumers and businesses are still in reasonably good financial shape. Stock portfolios and home prices have increased dramatically over the past few years. The financial system is not teetering on the brink as it was globally in 2008, when Bear Stearns and Lehman Brothers collapsed and Merrill Lynch had to be bought by Bank of America to avoid a similar fate.

One thing is for sure, the path of least resistance appears to be downward, and trying to “fight the Fed,” which has to continue to raise rates to slow the worst inflation in over 40 years, is a losing battle. There are some important things investors should consider now, as they may have to prepare for the worst:

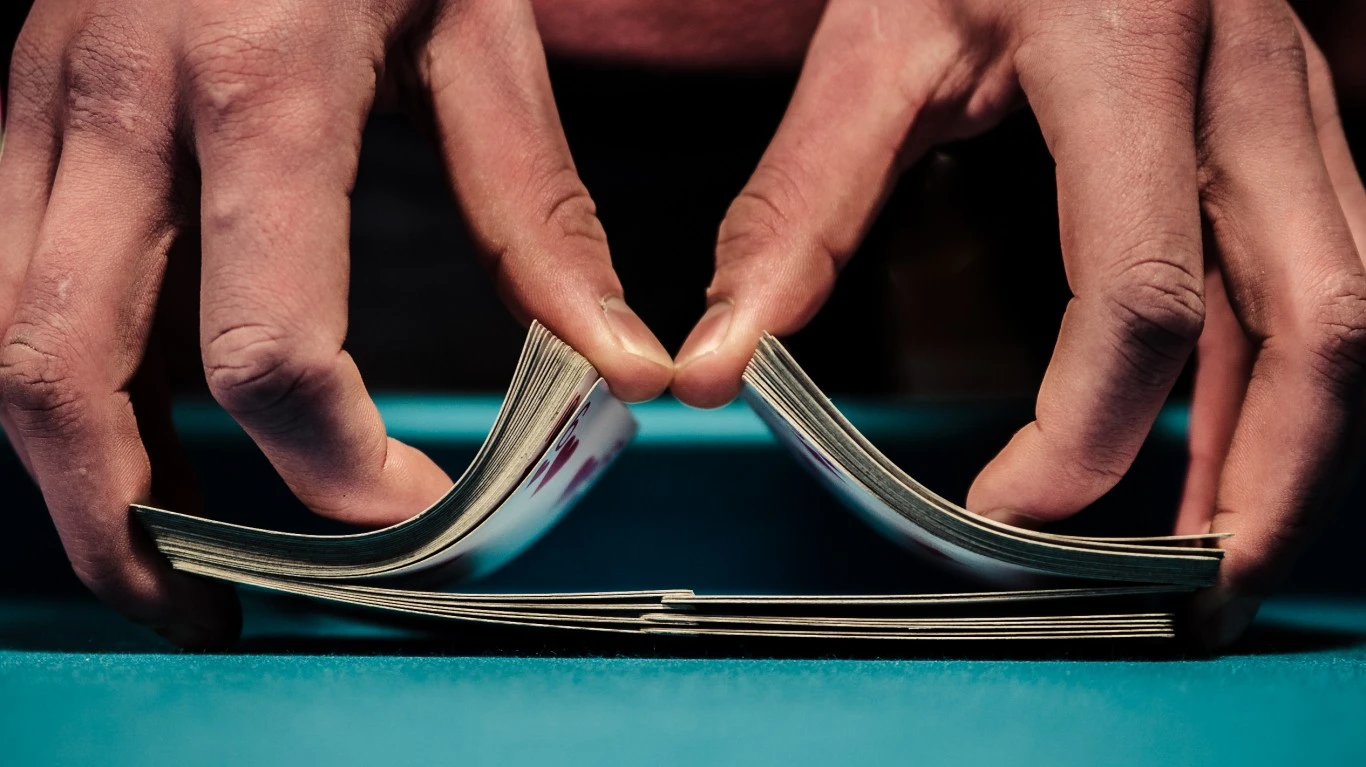

- Do not continue trying to catch the proverbial falling knife. Instead, it may make sense to match current losses against gains, even if they are short term in nature, to help build up a cash supply. Some dry powder may come in handy down the road.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.