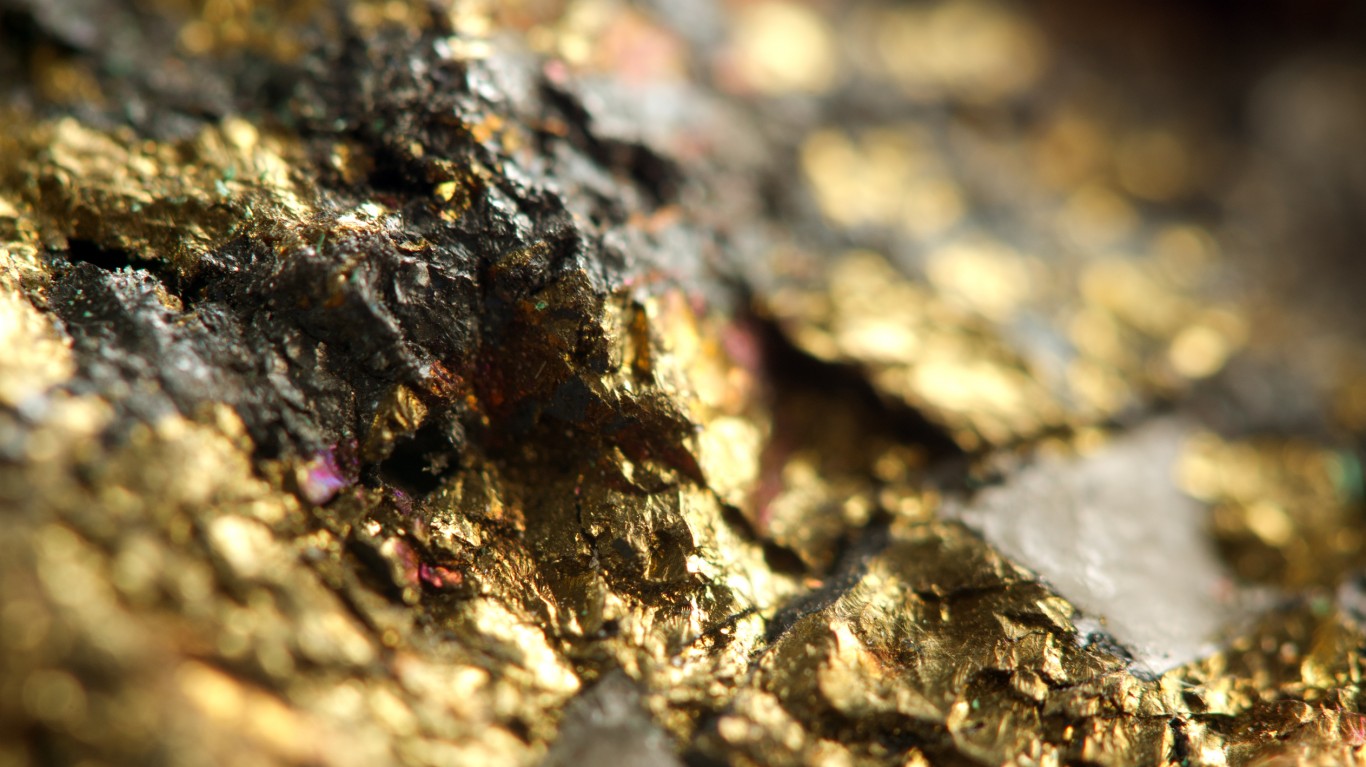

There always has been a degree of scorn from Wall Street and so-called investment professionals for those that invested in gold. They are laughed at as “gold bugs.” The argument against the precious metal, which is one of the largest financial assets in the world, and central banks have been loading up on it, is that typically it is not really a tradeable investment. Warren Buffett owns zero and has said in the past that it is an investment with “no utility.”

The argument for gold and gold miners is twofold, in that the precious metal can provide a strategic hedge against inflation, and some of the top miners also mine silver and other needed commodities that are used in industrial applications. One thing is for sure. From a technical standpoint, there could be a massive breakout to the upside as spot gold is trading through the downtrend line from highs printed back in March.

We screened our 24/7 Wall Street commodity database looking for the top miners and royalty companies that are rated Buy and pay dependable (and in some cases big) dividends. The following six top stocks make the cut. While all are rated Buy at top Wall Street firms, it is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Agnico Eagle Mines

This top stock is one of Wall Street’s most preferred North American gold producers. Agnico Eagle Mines Limited (NYSE: AEM) is a senior Canadian gold mining company that has produced precious metals since 1957. Its eight mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions as well as in the United States and Sweden.

The company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. The stock has been crushed as gold has sold off last year’s highs. And with a surge of inflation, you can bet many savvy portfolio managers are ready to add back top companies like this. Agnico Eagle has declared a cash dividend every year since 1983.

Shareholders receive a 3.29% dividend. BofA Securities has set a $57 price target. However, the Wall Street consensus target on Agnico Eagle Mines stock is much higher at $86.66. Shares closed on Friday over 2% higher at $48.70.

Barrick Gold

This is another top gold stock, and it still offers a solid entry point. Barrick Gold Corp. (NYSE: GOLD) and Randgold Resources completed their merger on January 1, 2019. This created the world’s largest gold company in terms of production, reserves and market capitalization.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.