Bitcoin mining companies have struggled with shrinking revenue in 2022 amid rising energy costs and plunging cryptocurrency prices. The increasing Bitcoin mining difficulty has further eaten into miners’ profits, leaving only miners with the most efficient rigs and very competitive power rates afloat.

This has forced some major Bitcoin miners to look for new ways to hedge against thinning margins. One new possible solution is derivative financial instruments allowing miners to hedge their exposure to bitcoin’s price and the energy costs associated with mining.

Bitcoin Miners on Thin Ice

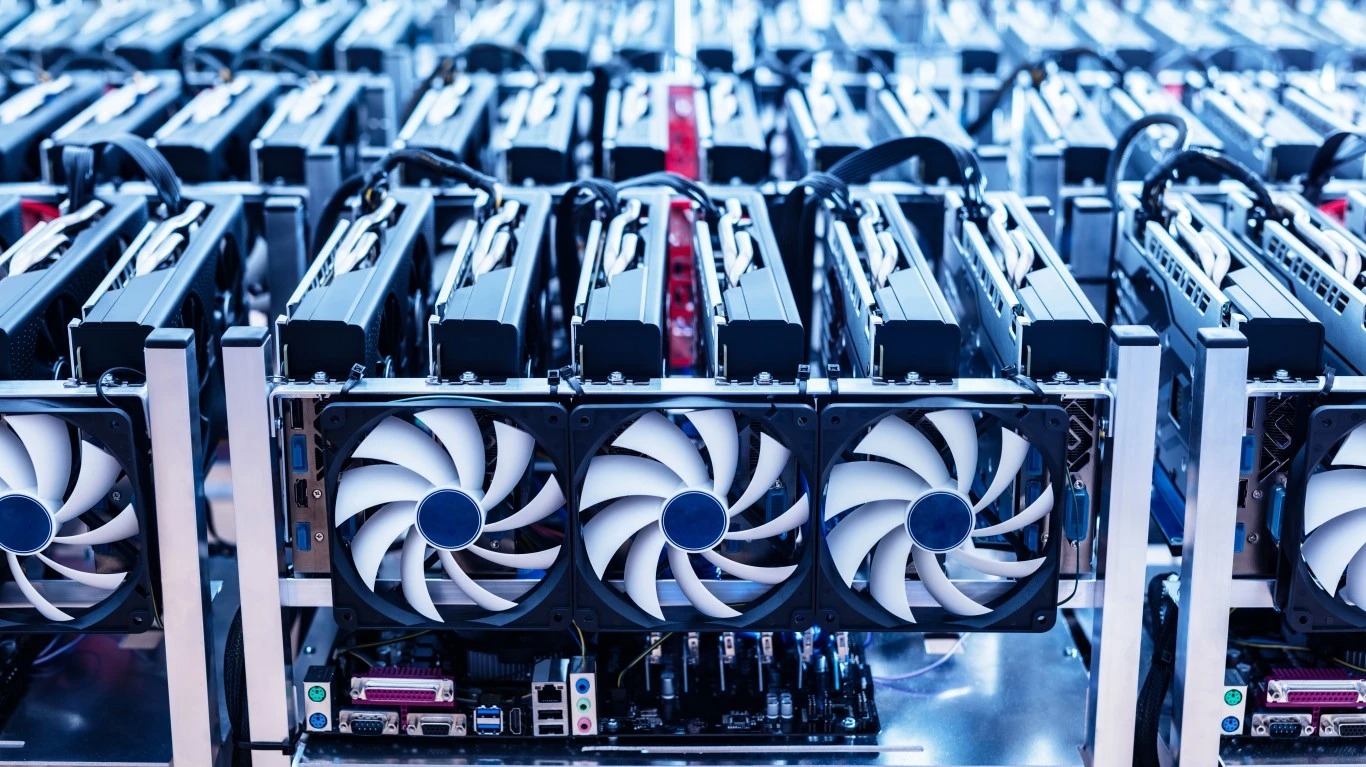

This year has been one of the worst for the crypto sector and the companies operating in the industry, particularly mining firms. With energy costs reaching historical levels amid soaring inflation, Bitcoin miners, who require a lot of electricity to power data centers packed with highly specialized computers to mine BTC coins, have seen their revenue hit rock bottom.

As reported, ten public Bitcoin mining companies, including Core Scientific, Riot, Bitfarms, Cleans Park, Marathon, Hut8, HIVE, Iris Energy, Argo, and Bit Digital, sold off almost all mined BTC from January 1 to November 30 this year. Earlier this year, some miners even had to sell more than they produced, according to a report from Arcane Research.

Plunging BTC and crypto prices have further exacerbated mining profitability. Following the collapse of FTX, Bitcoin plunged to below $16,000, dropping to two-year low levels.

The rising Bitcoin mining difficulty also eats into miners’ profits. The Bitcoin mining difficulty, currently sitting around the 35.36 trillion value, is up by around 25% compared to late August this year when the figure was sitting at 28.35 trillion.

All these headwinds have left only miners with the most efficient rigs and very competitive power rates afloat. This describes why Core Scientific, one of the largest Bitcoin mining companies, filed for Chapter 11 bankruptcy last week.

How Miners Can Hedge Against Shrinking Margins

Bitcoin miners can hedge against thinning margins using a newly-launched Bitcoin mining forward contract. Dubbed the Luxor Hashprice NDF, the derivative is an Over-the-Counter (OTC) non-deliverable forward contract (NDF) for Bitcoin mining hashprice by Luxor Technologies that allows miners to hedge their exposure to Bitcoin price and energy costs.

Hashprice is a term coined by Luxor that refers to the bitcoin mining revenue miners earn from a unit of hashrate over a specific timeframe. Meanwhile, hashrate measures the computational power in a proof-of-work (PoW) cryptocurrency network like Bitcoin.

One major advantage of the instrument is that contract sellers can lock in Bitcoin mining revenue and hedge against thinning margins. In contrast, contract buyers can tap into the upside potential of Bitcoin mining without the need for physical exposure. Nick Hansen, CEO and co-founder of Luxor, said:

“These products are a major step in the Luxor roadmap and something we have analyzed deeply since the company’s genesis; hashprice derivatives are the apotheosis of our vision of hashrate as an asset class, something we’ve been pioneering since we introduced hashprice with the launch of Hashrate Index in 2020.”

As of now, Bitcoin is trading at $16,607, down by 0.4% over the past day. The flagship cryptocurrency is down by more than 65% over the past year and down by 76% compared to its all-time high of $69,000 in November last year.

This article originally appeared on The Tokenist

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.