Have recent and imminent initial public offerings (IPOs) shaken the trees enough to generate more IPOs? There are more than 1,300 global startups with valuations of more than $1 billion. Which among these unicorns, as they are known, is a likely candidate to come public at a price that everyone notices?

Let’s review. Arm Holdings plc (NASDAQ: ARM) raised $4.87 billion last week in the largest IPO in 2 years. On the same day, Germany’s Birkenstock filed for a U.S. IPO that could value the venerable sandal maker at as much as $7 billion. The preliminary filing does not include details of the offering.

Grocery delivery business Instacart (Maplebear Inc.) (NASDAQ: CART) on Monday priced its IPO at $30, the high end of its upwardly revised range. The company will sell 20 million shares for gross proceeds of $660 million at a valuation of nearly $10 billion. The stock begins trading Tuesday.

Business software platform Klaviyo on Monday raised its share price range of $25 to $27 to a new range of $27 to $29. At the top end of the new range, Klaviyo would raise about $557 million at a valuation of around $8.9 million. The company will receive about 40% of the IPO’s sale price, and selling shareholders will get the rest. The shares are expected to price Tuesday and begin trading Wednesday on the New York Stock Exchange under the ticker symbol KVYO.

Is this one-week spurt the start of something big or just an anomaly in a year that has seen a mere 75 IPOs? Still, that is better than the 2022 total of just 71 IPOs but still a long way from the 397 IPOs that priced and began trading in 2021.

According to CBInsights, the largest unicorn at the moment is China-based ByteDance, which has raised some $7.4 billion in venture funding and has a valuation of around $225 billion. ByteDance is the company behind social media site TikTok. The company was founded in 2017.

Elon Musk’s SpaceX is the second-largest unicorn, with a valuation of $137 billion. The company has raised about $9.7 billion in venture funding since its founding in 2002.

But what about artificial intelligence firms, Wall Street’s latest darlings? Canva, a maker of design tools that allow users to create all kinds of visual content, has raised some $571 million since its founding in 2013 and has a valuation of $40 billion. It is the fifth-largest unicorn.

Databricks, with a total valuation of $31 billion, is a provider of machine-learning software to help companies build and integrate AI-powered solutions to commercial problems. The company was founded in 2013 and has raised $4 billion in venture funding.

The company that blew open the AI doors, OpenAI, is valued at $29 billion. The company has raised $14 billion in funding since its founding in 2015, including a $10 billion investment from Microsoft earlier this year.

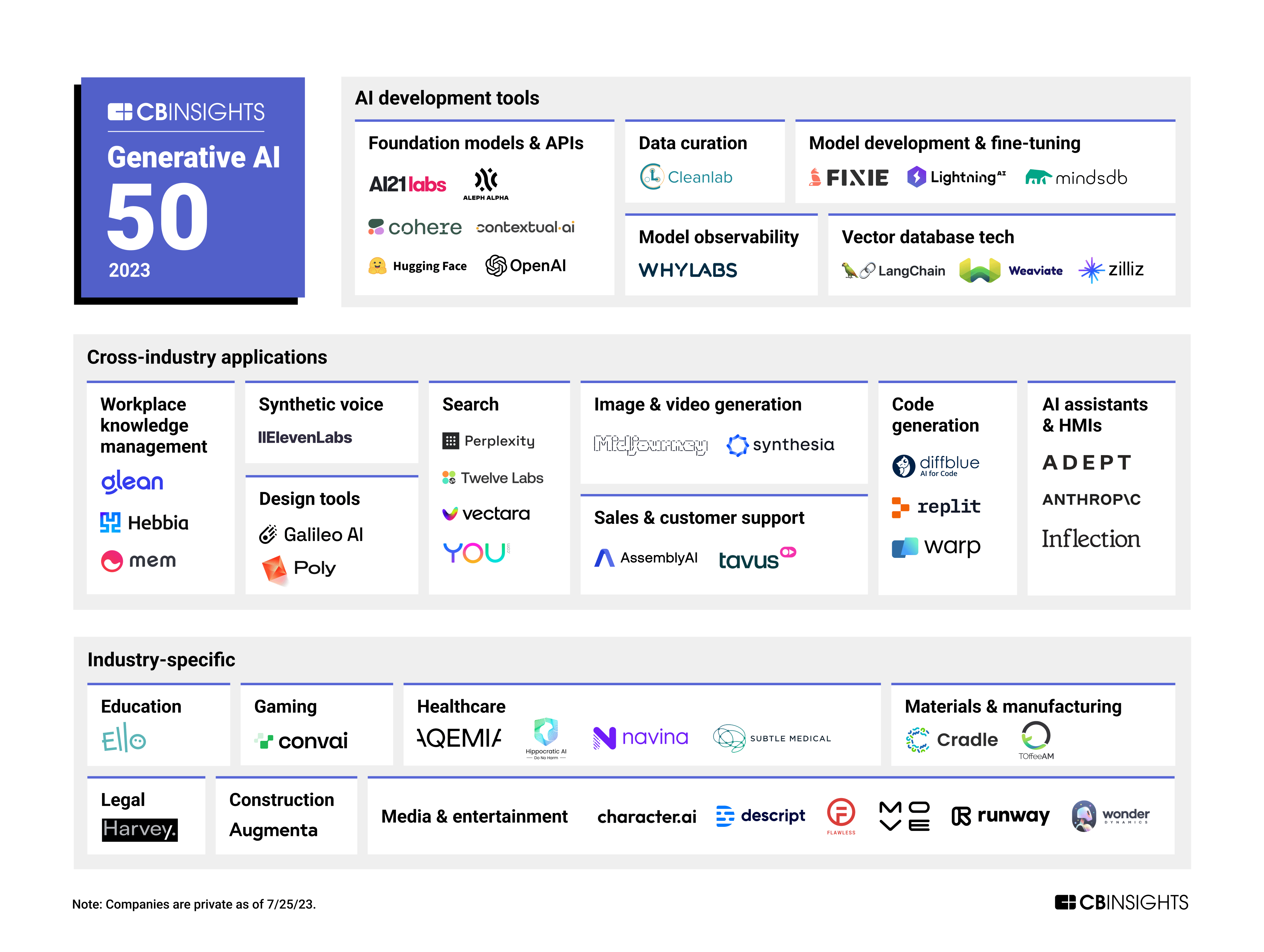

Of seven private companies to achieve unicorn status in the second quarter of 2023, five were generative AI firms: Cohere, Replit, Runway, Synthesia and Typeface. Again according to CBInsights, there were 86 merger and acquisition deals involving AI companies in the second quarter, but only two IPOs and no SPAC mergers. Those numbers were the same as in the first quarter.

What the IPO market needs is some relief from high interest rates. That may be coming, beginning Wednesday when the Federal Reserve’s open market committee announces its decision on rates. Right now, the betting is that the Fed will pause, and there is a good chance that the pause could last through the end of the year. If rates began to come down next year, the IPO market could show more recovery. It will not be 2021 again, but it would be a lot better than 2022 and 2023.

Here is an illustration from CBInsights of the 50 most promising privately held generative AI companies.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.