Premarket action on Wednesday had the three major U.S. indexes trading mixed. The Dow Jones industrial were down 0.12%, and the Nasdaq 0.21% lower, while the S&P 500 was up 0.18%.

Wednesday is all about interest rates, inflation and oil demand. At 2:00 p.m. ET, the U.S. Energy Information Administration will release its report on petroleum inventories for last week. After U.S. markets closed Tuesday, the American Petroleum Institute reported an increase of just over a million barrels in the country’s crude oil inventories for the week. The average estimate called for a decline of around 300,000 barrels.

While the short-term report is likely to move oil markets, the bigger news in the oil patch comes in two reports on medium-term demand. On Tuesday, Bloomberg NEF released a new forecast indicating a decline in demand for oil in transportation that will lead to peak oil demand in 2029.

That decline is the direct result of surging sales of electric cars, buses and two- and three-wheeled vehicles. In 2022, EV passenger car sales accounted for 14% of all passenger car sales and now account for about 26.6 million of the 250 million or so passenger cars on the world’s roads.

Demand for oil as a transportation fuel has dropped by more than 1.5 million barrels a day. By the end of the decade, Bloomberg NEF’s forecast calls for demand for transportation fuel to fall by about 6 million barrels per day.

Wednesday morning, the International Energy Agency (IEA) released its medium-term “Oil 2023” report. The agency expects demand for oil to rise by about 6% between 2022 and 2028, primarily due to demand for petrochemicals and aviation fuel. But demand growth is expected to “shrivel from 2.4 [million barrels per day] to just [400,000 barrels per day] in 2028, putting peak demand in sight.”

According to the IEA, oil demand for transportation fuel will begin to decline in 2026, but in the very near term, the outlook is less rosy:

Global oil markets could tighten significantly in the coming months, as production cuts by the OPEC+ alliance temper an upswing in global oil supplies. However, the multifaceted strains on markets look set to ease in the following years ….

In news from the oil patch, Shell PLC (NYSE: SHEL) announced Wednesday morning that it is boosting its dividend payment by 15% for the second half of this year, committing at least $5 billion in share buybacks in the second half and increasing its production of oil and gas. The company, which made a lot of noise when it cut its dividend and cut back fossil fuel production three years ago, now targets returns to investors of 30% to 40% of cash flow from operations.

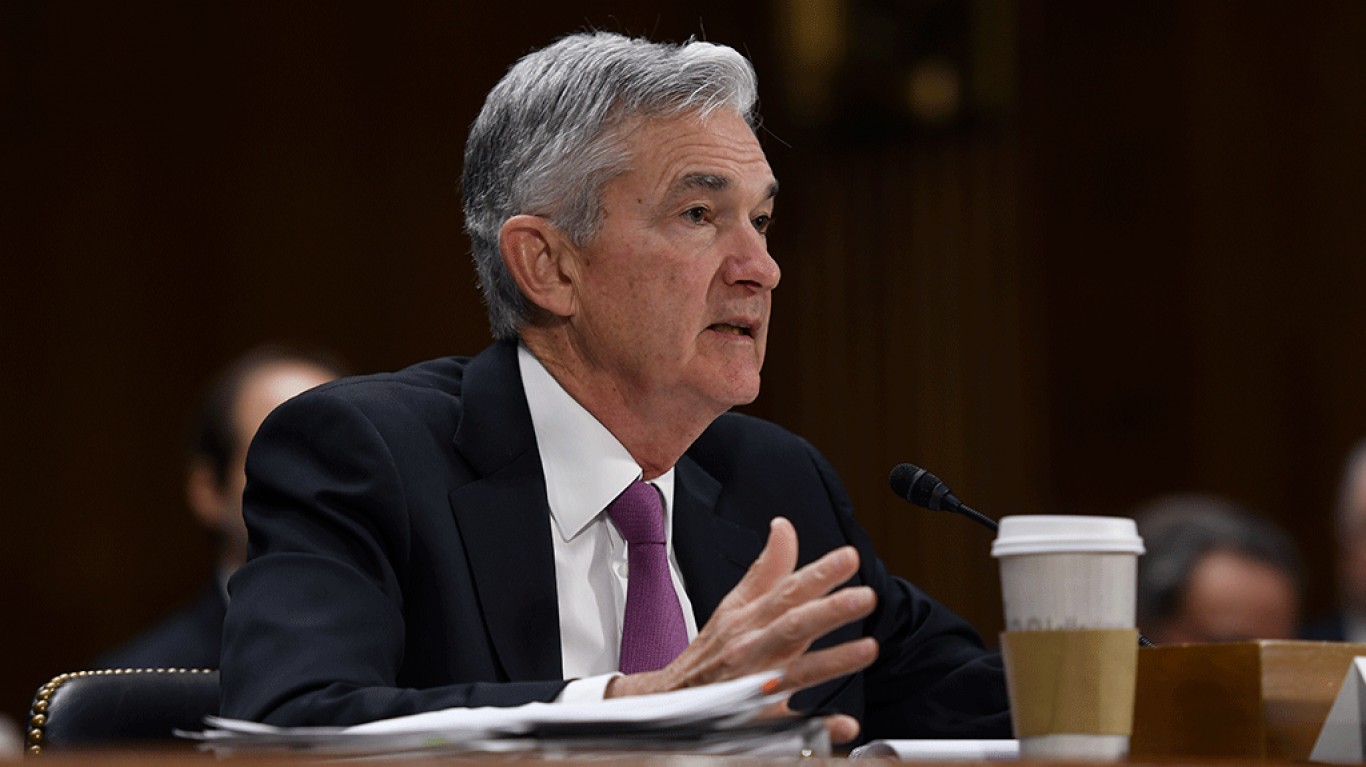

In the much nearer term, the Federal Reserve’s open market committee is expected to pause its interest rate hikes at its meeting that concludes Wednesday afternoon. The federal funds futures market has also reduced the odds of a July increase from 71% to 64.2%. Tuesday’s report on the consumer price index (CPI) was a bit of a mixed bag, with total CPI increasing by 4.0%, the smallest increase in more than two years. Core CPI, however, rose by 5.3%, slightly less than the April increase, mostly due to the high cost of housing.

Before markets open Wednesday, the Bureau of Labor Statistics is set to report the producer price index (PPI) for May. Economists are expecting a decline of 0.1% compared to an increase of 0.2% in April. Core PPI is forecast to increase by 0.2%, equal to the April increase.

Here is a look at how U.S. markets fared on Tuesday.

Ten of 11 market sectors closed higher Tuesday. Materials (2.33%) and industrials (1.16%) had the day’s best gains. Utilities (−0.06%) was the day’s only decliner. The Dow closed up 0.43%, the S&P 500 up 0.69% and the Nasdaq up 0.83% on Tuesday.

Two-year Treasuries added 12 basis points to end Tuesday at 4.67%, and 10-year notes closed up 11 basis points at 3.84%. In Wednesday’s premarket, two-year notes were trading at around 4.68% and 10-year notes at about 3.82%.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.