Premarket action on Tuesday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.12%, the S&P 500 up 0.55% and the Nasdaq 1.14% higher.

The Biden administration and House Republicans reached a deal Friday night that will avoid a default on U.S. federal debt at least through the 2024 election. U.S. equity markets traded higher Tuesday morning, but the oil market was down nearly 2% because oil traders are wary, of both the deal and of how the global economy will react. West Texas Intermediate crude traded at around $71 a barrel Tuesday morning.

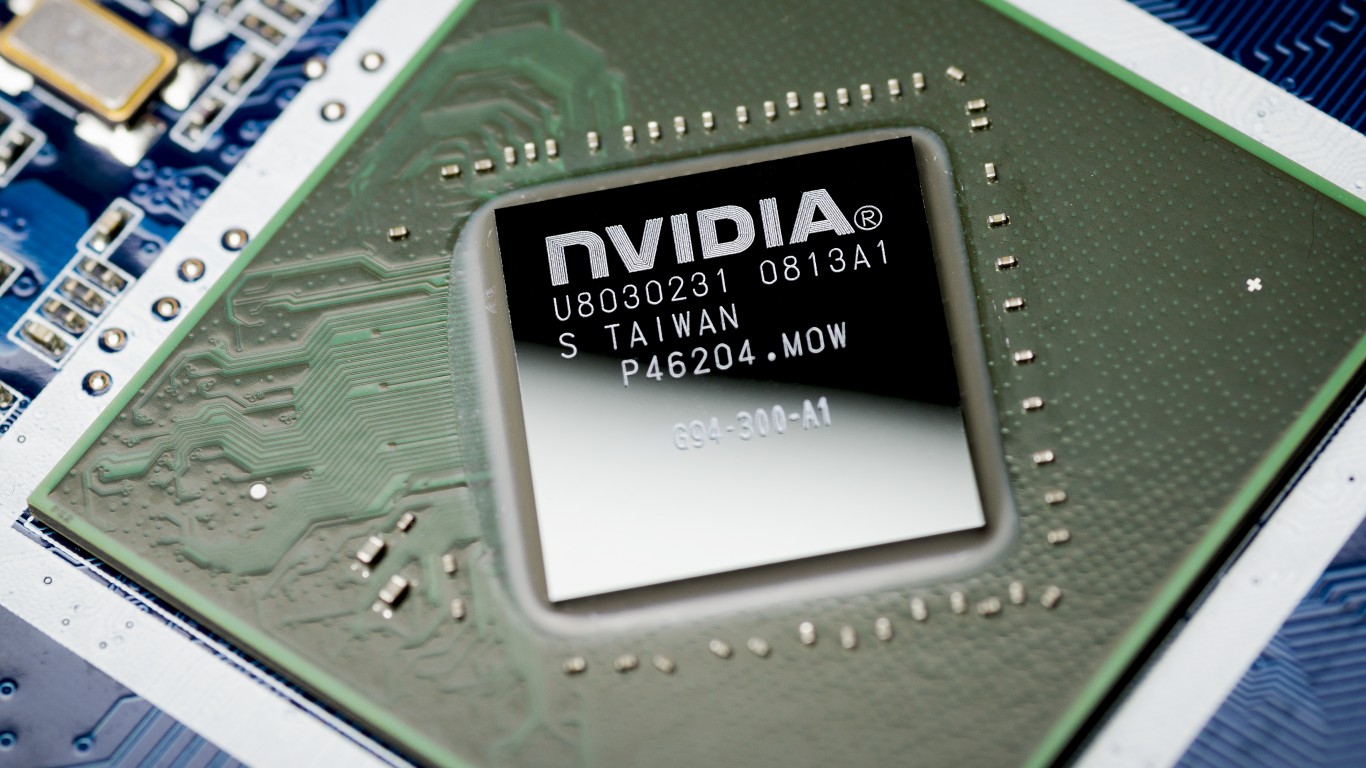

Shares of Nvidia Corp. (NASDAQ: NVDA) traded up by about 3.52% in Tuesday’s premarket session. If that price holds until markets close, Nvidia’s market cap will reach $998 billion. During a visit to Taiwan to deliver the commencement speech at the country’s national university, CEO Jensen Huang told a roundtable at the Computex trade show, “I have just turned everyone into a programmer.”

Huang also announced the company’s AI supercomputing platform, the DGX GH200, which connects 256 of the company’s Hopper superchip into a single graphics processing unit (GPU) with more than 18,000 Arm cores using 144 terabytes of memory. The new platform represents a full hardware and software stack for supercomputing and AI applications. While it is hard to make predictions about the future (h/t Yogi Berra), Nvidia’s head start in GPU computing is likely to last for at least a couple of years.

Huang has also turned on Nvidia’s money-printing machine. On Friday, Nvidia filed a shelf registration with the U.S. Securities and Exchange Commission to sell another $10 billion in equity and debt. Between February 2022 and January 2023, Nvidia repurchased some 63 million shares of its own stock at an average price of nearly $160 per share. Issuing $10 billion in new equity and debt at a price of around $400 per share is a coup, and the company would have been negligent to pass it up. The only question remaining is not if but when Nvidia will become the first chip company to reach a $1 trillion market cap.

Ahead of its fourth-quarter earnings report due after markets close Wednesday, C3.ai Inc. (NYSE: AI) added nearly 6% to its share price in Tuesday’s premarket session. The stock closed up nearly 16% on Friday and was up about 200% so far in 2023, even more than Nvidia’s year-to-date gain of around 170%.

A third big winner in the AI sweepstakes, according to Cathie Wood, founder of ARK Investment, is Tesla Inc. (NASDAQ: TSLA). Tesla’s full self-driving (FSD) software is an AI application that depends on fast image processing from the company’s camera-based autonomous driving software. CEO Elon Musk has consistently maintained that cameras are both better and cheaper than a lidar-based autonomous driving system. Still, Wood’s forecast that Tesla could be valued at more than double Apple’s current $2.75 trillion market cap by 2027 seems something of a stretch.

Here is a look at how the markets fared on Friday, before the three-day weekend and the debt ceiling deal.

Eight of 11 market sectors closed higher on Friday. Technology (2.68%) and consumer discretionary (2.38%) had the day’s biggest gains. Energy (0.37%) and health care (−0.17%) lagged. The Dow closed up 1.00%, the S&P 500 up 1.30% and the Nasdaq up 2.19% on Friday.

Two-year Treasuries added four basis points to end Friday at 4.54%, and 10-year notes dipped by three basis points to close at 3.80%. In Tuesday’s premarket, two-year notes were trading at around 4.52% and 10-year notes at about 3.73%.

Originally published at 24/7 Wall St.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.