Premarket action on Wednesday had the three major U.S. indexes trading lower. The Dow Jones industrials were down 0.16%, the S&P 500 down 0.20% and the Nasdaq 0.14% lower.

On Tuesday, U.S. markets opened higher after the long weekend, thanks in large part to the announced deal between President Joe Biden and House Speaker Kevin McCarthy on the debt ceiling. It did not take long for traders to figure out that there was some doubt that the deal would make it through the House of Representatives.

The first hurdle was a strictly procedural one: getting the bill out of the House Judiciary Committee. That happened Tuesday night. The next hurdle is getting the bill through the full House, and that will (or will not) happen late Wednesday.

The uncertainty weighed on stocks and, perhaps more heavily, on oil. By noon Tuesday, West Texas Intermediate (WTI) crude oil had dropped by more than 4% to near $69 a barrel. In early trading Wednesday, WTI fell below $68. Doubts about the ability of the U.S. Congress and president to close the deal on the debt ceiling got the early blame, but traders eventually began worrying more about the state of the global economy. Was the macroeconomic environment positive enough to support higher oil prices? Were consumers going to start spending again?

OPEC energy ministers will meet in Vienna Sunday to discuss further cuts to production. Russia, an OPEC+ heavyweight, already has said it will not cut production further.

Production cuts, in theory, raise demand and, of course, prices. Russia, the only OPEC+ member that really counts, needs cash, and oil is its only way to raise much of it. What is really worrying to OPEC, and to oil traders in general, is that Russia will raise production again, or, more likely, lie about how much it is producing.

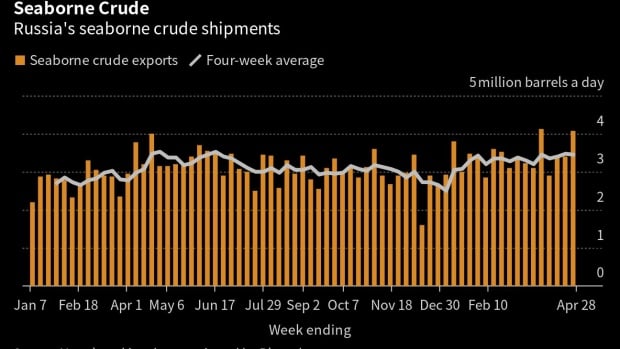

At the end of March, the country’s energy minister said production had fallen by 700,000 barrels a day to around 9.4 million barrels. Bloomberg News reported that by its calculation, Russia produced 10.4 million barrels a day, down by 700,000 barrels from production of 11.1 million barrels a day in February. In February, Russia had pledged a production cut of 500,000 barrels a day.

But Russian seaborne exports have not fallen.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.