In fact, Bloomberg also has reported that the number of wells that have been shut in by one producer rose from 29.2% in February to 44% in April. Other Russian oil companies also reported higher levels of shut-in wells but by smaller amounts.

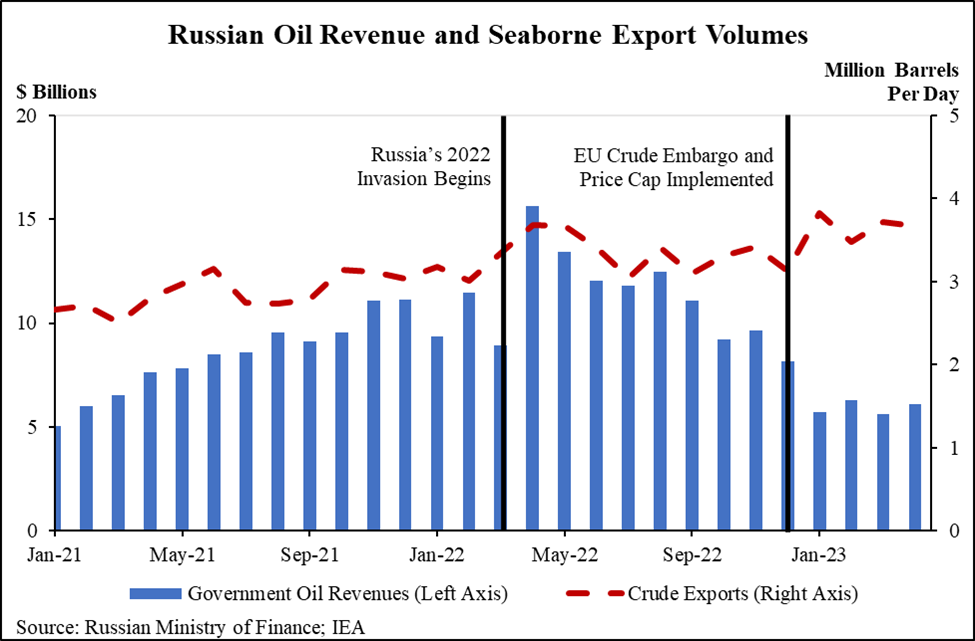

The U.S. Treasury Department reported in mid-May that Russian seaborne crude, which is allowed by the price cap program instituted after Russia’s February 2022 invasion of Ukraine, now fetches less than $60 a barrel compared to its pre-cap level of more than $100 a barrel. Before Putin’s invasion, oil revenue constituted about 30% to 35% of Russia’s total budget; that percentage has dropped to a current level of 23%, “despite Russia’s exporting roughly 5 to 10 percent more crude oil in April 2023 compared to March 2022.”

Russia’s Urals crude now trades for about $30 a barrel less than it did at this time last year.

The country cannot afford to cut production any further. That is what’s worrying crude oil traders right now. Will the OPEC ministers’ meeting sort that out? Unlikely.

Here is a look at how U.S. markets fared on Tuesday.

Seven of 11 market sectors closed lower on Tuesday. Consumer staples (−1.08%) and energy (−0.94%) had the day’s biggest losses. Consumer cyclicals (0.76%) and technology (0.63%) posted the day’s best gains. The Dow closed down 0.15%, while the S&P 500 closed unchanged and the Nasdaq up 0.32% on Tuesday.

Two-year Treasuries lost eight basis points to end the day at 4.46% on Tuesday, and 10-year notes dipped by 11 basis points to close at 3.69%. In Wednesday’s premarket, two-year notes were trading at around 4.44% and 10-year notes at about 3.65%.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.