In a recent survey of oil and gas, utilities, chemicals, mining, and agribusiness executives by Bain & Co., most said that their own companies are doing better than their competitors in the march toward net-zero emissions. Their firms are expected to target 24% of 2023 capex on new growth (i.e., lower emissions) businesses. Access to capital is not a major constraint, but “return on investment certainly is.”

One executive from India told Bain, “The success of the pivot to clean energy technologies will be determined by the extent to which people see the benefits while minimizing disruptions—with focus on affordability and fairness.”

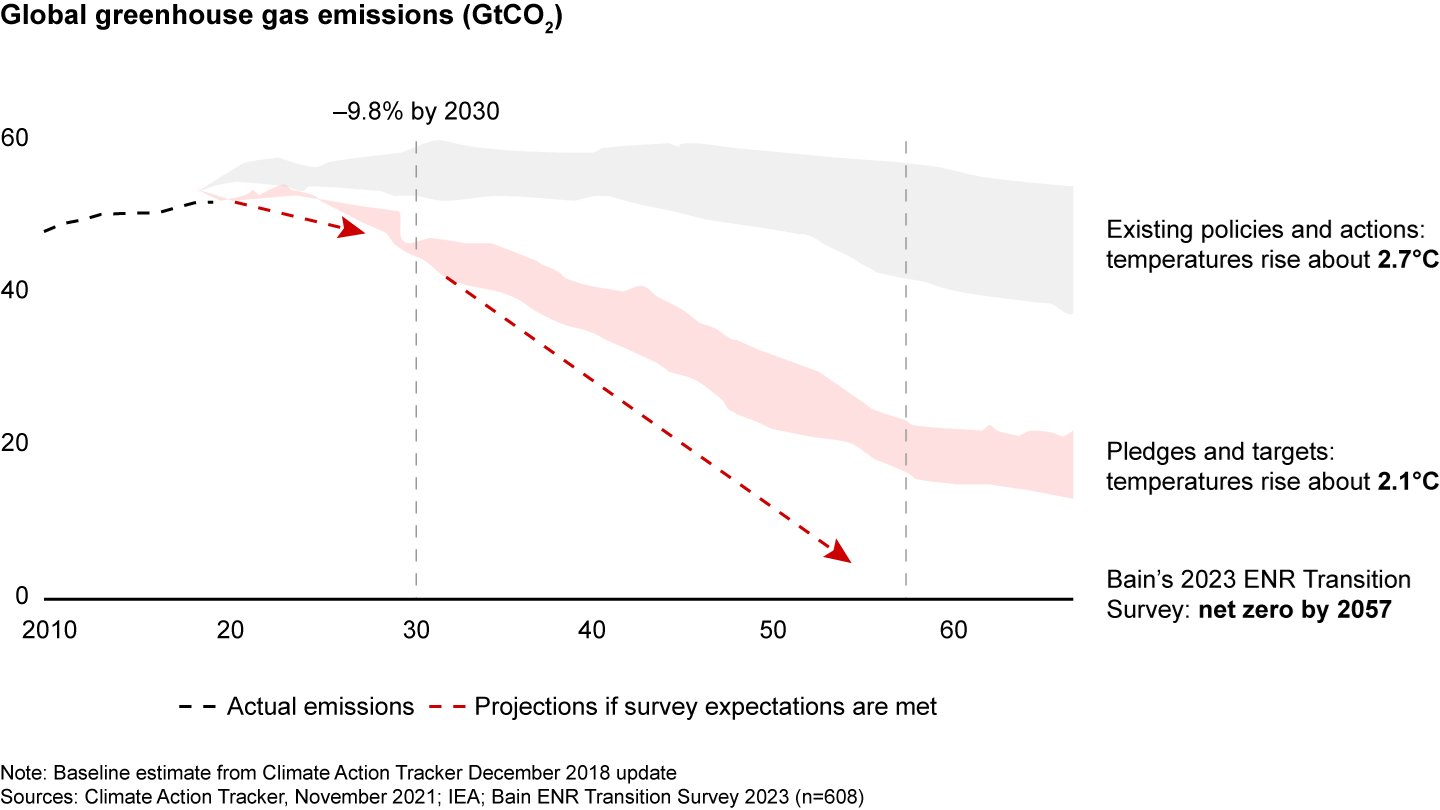

Here is a chart from the report showing the relationship between the survey’s estimated transition to net-zero emissions and the stated target of keeping the global temperature increase at around 2.1°C.

Here is a look at how the markets fared on Tuesday.

Ten of 11 market sectors closed lower on Tuesday. Materials (−1.54%) and technology (−1.5%) had the day’s biggest losses. Energy (1.04%) posted Tuesday’s only gain. The Dow closed down 0.69%, the S&P 500 down 1.12% and the Nasdaq down 1.26% on Tuesday.

Two-year Treasuries dropped three basis points to end Tuesday at 4.26%, and 10-year notes fell by two basis points to close at 3.70%. In Tuesday’s premarket, two-year notes were trading at around 4.29% and 10-year notes at about 3.68%.

In addition to the weekly report on petroleum inventories, the minutes of the May meeting of the Federal Reserve’s open market committee will be released at 2:00 p.m. ET Wednesday.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.