The U.S. government appears finally to be ready to review its categorization of marijuana as a dangerous drug, reviving hope among investors and marijuana producers for an industry that took off like a rocket five years ago before sinking like a rock less than two years later.

According to a Wednesday report from Bloomberg, an unidentified “top official” of the Department of Health and Human Services wrote to Drug Enforcement Agency (DEA) administrator Anne Milgram recommending the reclassification of marijuana from its current listing as a Schedule I drug to a new listing as a Schedule III drug. A DEA spokesperson acknowledged receipt of the letter and said the agency will begin its own review.

Even if the DEA agrees to reclassify marijuana, that will not make it legal in the federal government’s eyes. Schedule I drugs include heroin and other drugs that have a high risk of abuse. Schedule III drugs may be legally purchased with a prescription. Weed will not be completely legal, but it will be a lot closer than it ever has been.

Here is a quick rundown of six companies traded on U.S. exchanges that got a boost from Wednesday’s news. Four are based in Canada, and the other two are U.S.-based. The six firms are Innovative Industrial Properties Inc. (NYSE: IIPR), Tilray Brands Inc. (NASDAQ: TLRY), Cronos Group Inc. (NASDAQ: CRON), SNDL Inc. (NASDAQ: SNDL), Canopy Growth Corp. (NASDAQ: CGC) and Aurora Cannabis Inc. (NASDAQ: ACB).

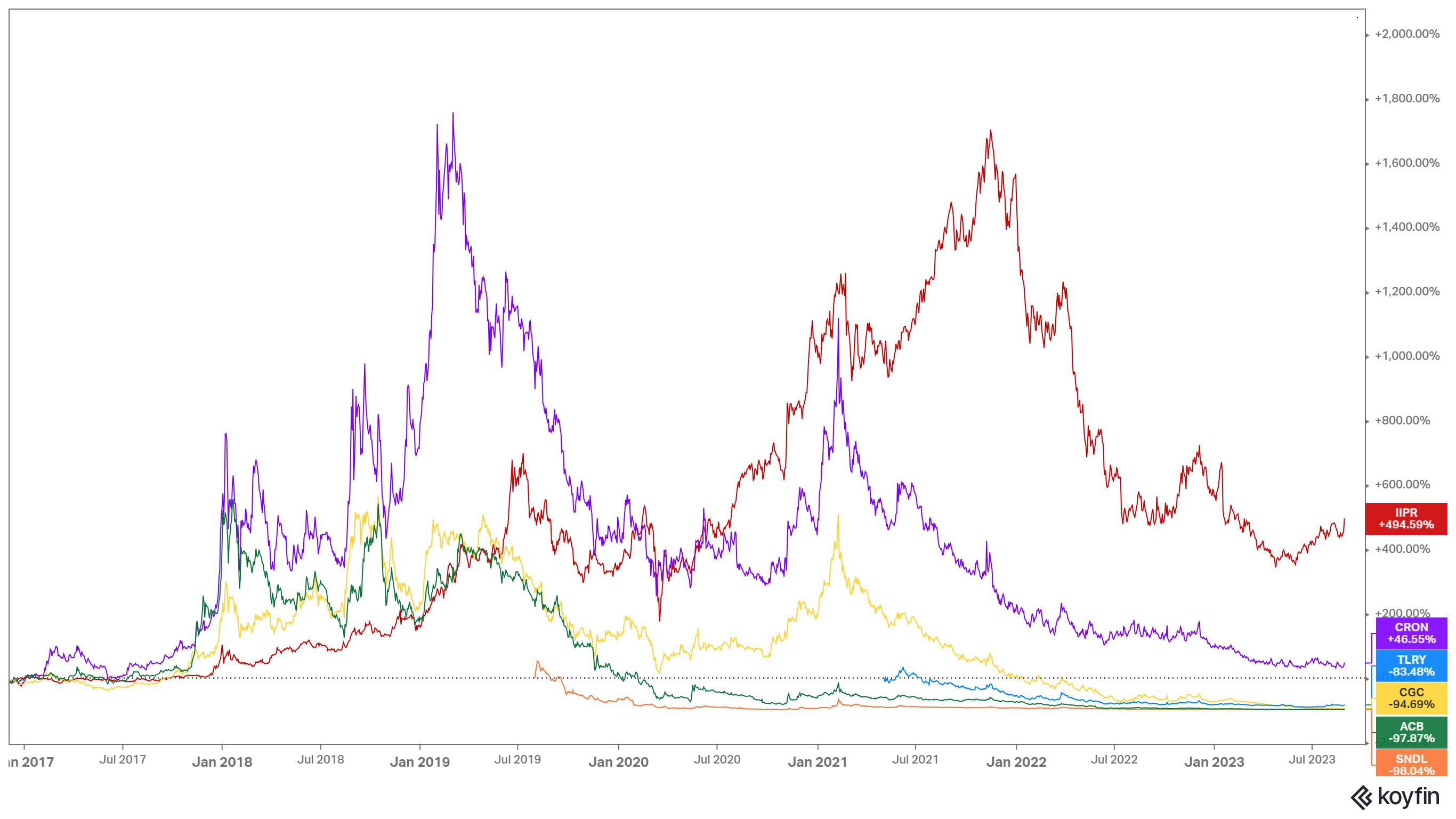

Here is a look at the share price movement of the six firms since October 1, 2018, the day that marijuana could be legally sold in Canada. Three of the six are trading more than 95% below their prices on that date or since their IPOs after that date.

Innovative Industrial Properties was founded in 2016 and reorganized as a real estate investment trust (REIT) at the end of 2017. The company is headquartered in Park City, Utah, and employs just 19 people. The company buys and manages specialized properties that it then leases to state-licensed cannabis growers and marketers. It had a market cap of around $2.4 billion at Wednesday’s closing price of $84.06, a gain of 6.9% on the day. The stock’s 52-week range is $63.36 to $125.38.

Tilray Brands is the result of a merger that concluded in 2021 between Canadian firms Aphria and Tilray. Primarily a grower at its inception, Tilray has branched out and become a distributor and marketer of numerous brands of both medical and recreational cannabis, beverages, and a variety of foods and wellness products. The company’s market cap at Wednesday’s close was $1.87 billion, with a share price of $2.66, up nearly 11% on the day. Tilray’s 52-week range is $1.50 to $5.12.

Cronos, like Tilray, is based in Canada and is both a grower and marketer of a number of cannabis and hemp-based products. The company said last month that it is reviewing a number of “unsolicited indications of interest” that might include a sale of the company. U.S.-based tobacco giant Altria owns a 41% stake in the company. Cronos’s market cap is $712.4 million, after jumping by about 7.5% on Wednesday to close at $1.87. The stock’s 52-week range is $1.64 to $3.62.

SNDL, based in Calgary, was founded as Sundial Growers in 2006 and came public in an IPO in August 2019. The company operates in four segments: liquor retail, cannabis retail, cannabis operations and investments. SNDL adopted its new name in July 2022. The company’s shares jumped nearly 8% on Wednesday to close at $1.66, in a 52-week range of $1.25 to $3.36. SNDL’s market cap at Wednesday’s close was $432.4 million.

Ontario, Canada-based Canopy Growth was the first publicly traded cannabis company in North America following its debut on the New York Stock Exchange in May 2018. The IPO price was $30.85 per share. The stock closed at $0.66 on Wednesday, following a jump of more than 13%. Canopy Growth operates in two segments, global cannabis and other consumer products, including Martha Stewart CBD. The company’s market cap is $324.7 million, and the 52-week price range on the stock is $0.35 to $4.77.

Aurora Cannabis is based in Leduc, Alberta, and has a market cap of $182.5 million. The company came public in October 2018 and operates in three segments: Canadian cannabis, European cannabis and plant propagation. The company’s stock closed up almost 4.5% on Wednesday at $0.47 in a 52-week range of $0.43 to $1.63.

Originally published at 24/7 Wall St.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.