Perhaps our readers have seen the video of President Trump speaking at the United Nations a few years ago, and warning Germany and the rest of Europe that being dependent on the Russians for their natural gas supply was dangerous. In the video, the German delegation is seen snickering at his remarks. Likely, they are not laughing anymore, as Russia has cut off natural gas supplies to Europe, claiming the harsh and punitive economic sanctions imposed by the West are responsible for the indefinite halt to gas supplies via Europe’s main pipeline the Nord Stream 1.

Now Germany and the rest of Europe is scrambling to replace the Russian supply. With autumn arriving on Thursday, September 22, that means one thing for sure: winter and cold weather will not be far behind. Bad news for Europe is good news for U.S. energy companies, especially those who are significant producers of natural gas. We screened our 24/7 Wall St. looking for energy companies that are big natural gas producers that also pay strong and reliable dividends.

Seven companies fit the bill. While all are rated Buy across Wall Street, it is important to remember that no single analyst report should be used as the sole basis for any buying or selling decision.

Cheniere Energy

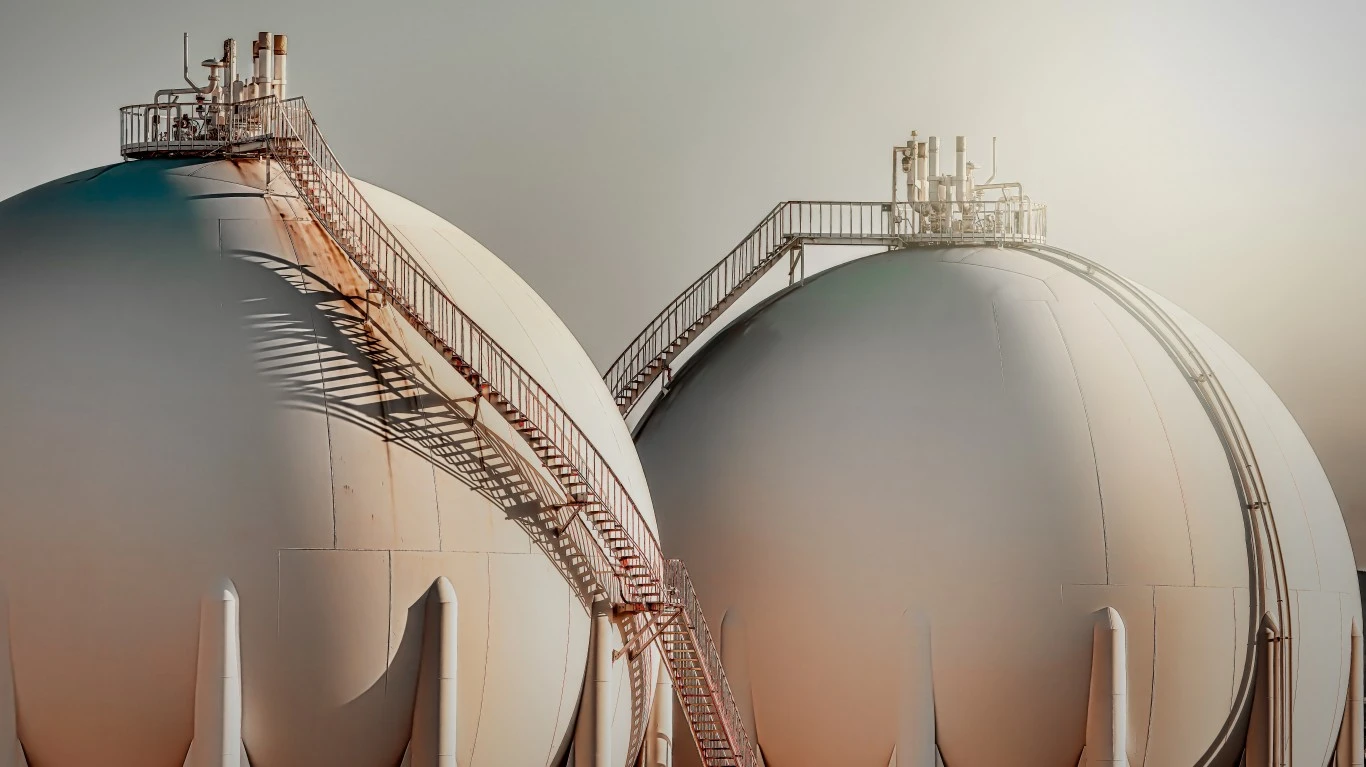

This top liquefied natural gas (LNG) play has made a huge move off the October 2020 lows. Cheniere Energy Inc. (NYSEAMERICAN: LNG) is an energy company primarily engaged in LNGelated businesses. The company operates through two segments.

Cheniere’s LNG terminal segment consists of the Sabine Pass and Corpus Christi LNG terminals. Its LNG and natural gas marketing segment consists of LNG and natural gas marketing activities by Cheniere Marketing.

Cheniere Marketing is developing a portfolio of long- and medium-term sale and purchase agreements with professional staff based in the United States, the United Kingdom, Singapore, and Chile. The company conducts its business through its subsidiaries, including the development, construction, and operation of its LNG terminal business and the development and operation of its LNG and natural gas marketing business.

Cheniere Energy stock investors receive a 0.80% dividend. Barclays has a $186 price target, and the consensus target is $172. The shares closed on Wednesday at $155.67.

Coterra Energy

This company was formed by the closing of the $17 billion merger of Cabot Oil & Gas and Cimarex Energy in 2021. Coterra Energy Inc. (NASDAQ: CTRA) is an independent oil and gas company engaged in the development, exploration and production of oil, natural gas and natural gas liquids (NGLs) in the United States. It primarily focuses on the Marcellus Shale, with approximately 177,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.