Nothing is more confusing and stressful than figuring out how much you will need to live comfortably in retirement. The big question is: What should you amass during your working years to fund a life of leisure during your retirement years?

The answer to this question varies from person to person and depends on a number of factors, even if the method of saving is often similar. As company pensions have become more and more a thing of the past, company-sponsored 401(k)s have risen as the alternative of choice to help workers save for their golden years.

According to the Bureau of Labor Statistics, 65% of private industry workers had access to a defined contribution retirement plan, or 401(k), in 2021. Though widely available, workers still have questions about how to reap the maximum benefit from their 401(k).

24/7 Wall St. created a list of considerations to factor into the decision of how big your 401(k) should be before retirement. This list is based on a report produced by financial technology company SmartAsset, entitled How Much Do You Need in Your 401(k) to Retire?

One consideration in how big your 401(k) should be is when you plan to retire and how much you will need for a comfortable lifestyle. Another important consideration is where you will live. Each state has different tax structures, so you will require more to live in a high tax state like California. Cost of living also varies widely among states. You can move to the best US city for retirees.

Although 401(k)s are a great savings vehicle, your contributions are limited. If you are under 50, you can contribute a maximum of $20,500 in 2022. Over 50, you can make a $6,500 catch-up contribution.

Your employer may also add to your plan with a matching contribution. The total allowed for an employee-employer pay-in is $61,000 per year for those under-50. If you are over 50 and add in the catch-up contribution, the limit is $67,500. Yet whatever you contribute will be worth it when you can relax and live a retirement free of financial worries. (When in retirement, these are the 8 best investments for retirees.)

Click here to see 8 things to consider about your 401(k) before you retire.

1. What is a 401(k)

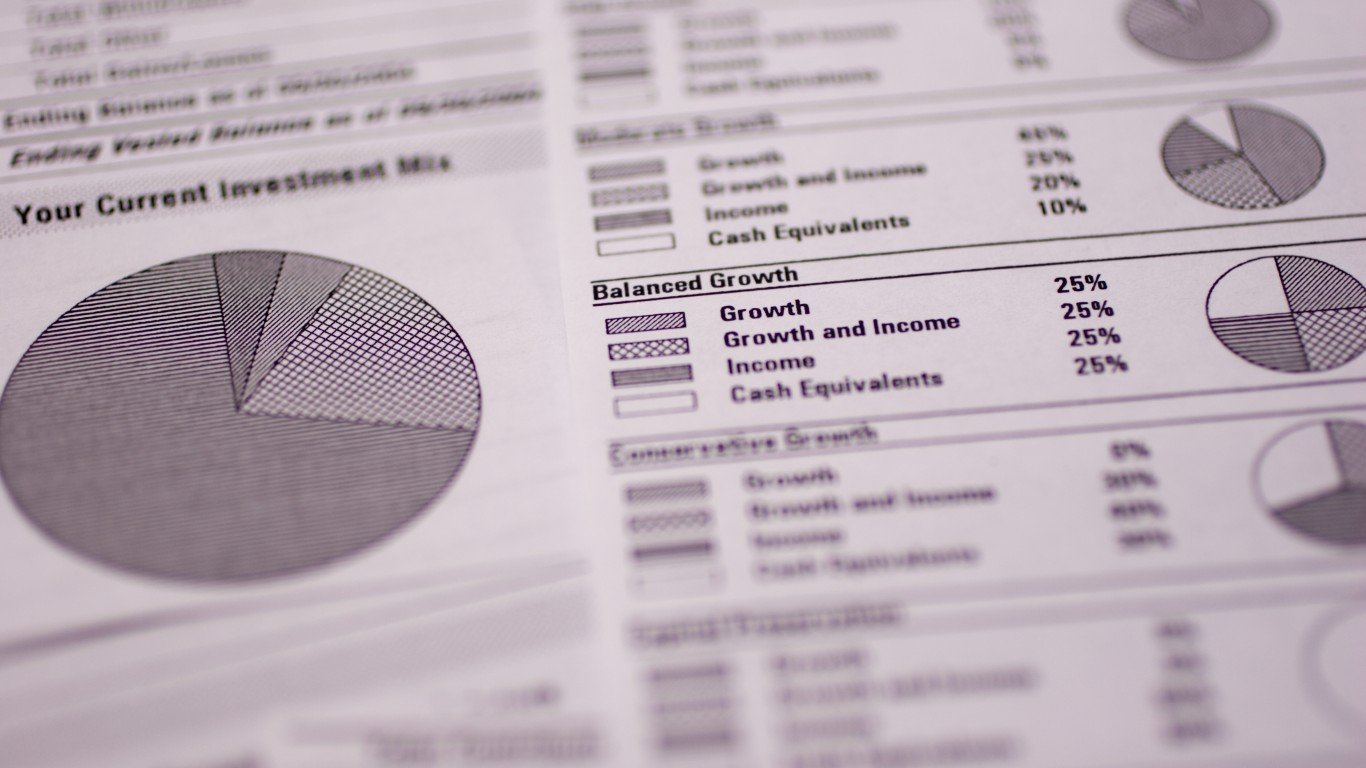

Similar to group health insurance, many companies offer a 401(k) defined contribution retirement plan. In these plans, money is taken from your paycheck and invested in mutual funds or other investment options. You specify how much should be withdrawn each pay period, and as you contribute funds to the plan, your money grows.

The main benefit of a 401(k) is that the contributions are deducted before income taxes are charged. Therefore, your taxable income is reduced by year’s end. Once you retire, you can pull funds from your traditional 401(k), but you will have to pay taxes on the withdrawals. This can be useful if you expect your tax bracket to be lower in retirement.

You may also contribute to a Roth 401(k), if your employer offers such a plan, but these contributions are from your after-tax income. Because of that, taxes are not deducted when you later make qualified withdrawals. This can be useful if you expect to earn more later in life or in general for diversifying your tax strategy.

2. Does your employer match 401(k) contributions?

Another major perk of a 401(K) is the matching contribution option by your employer. In this setup, your company can contribute as much as you do. However, your employer may also limit its contribution and decide to contribute a lower percentage of your annual wages. For example, you may contribute 5% of your salary, but the employer may decide on a ceiling of 3% of your salary.

3. Where will you retire?

Thinking about retiring on a beach in Hawaii or California? Well, you may need to pad your 401(k) even more. States with high taxes and high cost of living expenses require a heftier nest egg. Research where you want to escape to in retirement and know how much it will cost in taxes and everyday outlays. Texas, for one, does not levy state income taxes, but property taxes are high in the Lone Star State. Perhaps it will be cheaper to move to a less costly state like Montana or New Hampshire.

4. When will you retire?

Social Security may kick in at 62, but you may want to work beyond that age. With advances in medicine, people are living longer. Retiring in your early 60s or at 65 means you will need enough funds to live on for possibly another 25 years. Deciding when to retire is a personal decision based on your health and how physically demanding your job is. Try to estimate a retirement age and save accordingly.

5. What kind of retirement lifestyle will you lead?

You can expect your household expenses to decrease during retirement, but the question is by how much. Using age 65 as the benchmark, an Employee Benefit Research Institute study on the Expenditure Patterns of Older Americans estimated household expenses drop by 19% by age 75 and 34% by age 85.

A general rule is that you will need 80% of your preetirement income to support your lifestyle in your golden years. That means if you earned $100,000 a year when you reitred, you will require $80,000 a year to live comfortably after leaving the workforce. Of course, you may need more if you plan an active retirement of extensive travel or other expensive activities.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.