Publicly traded bitcoin miners hold about 46,000 bitcoin, more than 20% of the 800,000 bitcoin held by all miners, public and private. But maybe not for long.

Bitcoin miners have sold 30% of their stockpiles in the first four months of 2022, as the falling price for the cryptocurrency has tumbled and mining profitability has fallen by 80% since the peak of around $68,900 reached in November 2021.

Based on an electricity cost of $40 per megawatt-hour, a miner with the most advanced hardware could realize a profit of around $60,000 per bitcoin in November. That profit has now dwindled to around $13,000 per coin, according to Arcane research. Miners using older hardware are losing $3,000 on every bitcoin they mine.

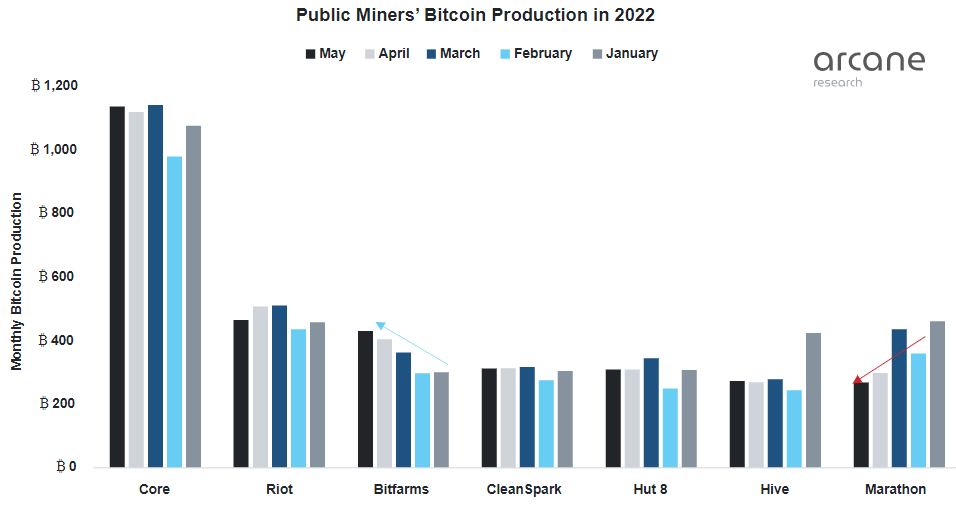

It is no wonder, they are selling their stashes. The following chart shows bitcoin mining productions in each of the first five months of this year by seven publicly traded miners, all of which report bitcoin holdings on their balance sheets: Core Scientific Inc. (NASDAQ: CORZ), Riot Blockchain Inc. (NASDAQ: RIOT), Bitfarms Ltd. (NASDAQ: BITF), CleanSpark Inc. (NASDAQ: CLSK), Hut 8 Mining Corp. (NASDAQ: HUT), Hive Blockchain Technologies Ltd. (NASDAQ: HIVE) and Marathon Digital Holdings Inc. (NASDAQ: MARA). Month over month, production is about flat at Core, Riot, CleanSpark and Hut 8 but down sharply at Hive and Marathon. Only Bitfarms has been increasing production this year.

As of May, Marathon was the largest holder (or hodler) of bitcoin with 9,673 BTC in its hoard. Core Scientific was second with 9,618, followed by Hut 8 (6,769), Riot (6,320), Bitfarms (5,648), Hive (2,832) and CleanSpark (448).

Marathon, which in December had touted itself as the only pure-play bitcoin investment, purchased 4,813 bitcoin on the open market to add to their pile. Marathon, Bitfarms and some others had until recently never sold any of the bitcoin they mined. Raising equity and debt to pay operating expenses was easy.

Since the market for tech stocks started its slide late last year, the easy money mostly has disappeared, the profit per coin has tumbled, and one miner, Bitfarms, sold almost half its bitcoin stash (3,000) last week, cutting its holdings to 3,349 bitcoin, including June production to date.

Here is a quick look at how mining stocks have done over the past year.

Core Scientific’s 52-week trading range is $1.97 to $14.98. The stock has dropped by about 77% in the past year and recently traded at around $2.21, down 4.5% for the day.

Riot Blockchain’s 52-week range is $4.36 to $46.28. The stock has dropped by nearly 85% in the past year and recently traded at around $4.90, down nearly 4% for the day.

Bitfarms’s 52-week range is $1.28 to $9.36. The stock has dropped by about 66% in the past year and recently traded at around $1.39, down 0.4% for the day.

CleanSpark’s 52-week range is $4.06 to $23.6. The stock has dropped by nearly 72% in the past year and recently traded at around $4.70, down 0.6% for the day.

Hut 8’s 52-week range is $1.52 to $16.57. The stock has dropped by about 54% in the past year and recently traded at around $1.64, down 0.3% for the day.

Hive Blockchain’s 52-week range is $4.36 to $46.28. The stock has dropped by about 73% in the past year and recently traded at around $3.05, down 0.9% for the day.

Marathon Digital’s 52- week range is $6.12 to $83.45. The stock has dropped by nearly 74% in the past year and recently traded at around $7.16, down about 0.9% for the day.

Originally posted at 24/7 Wall St.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.