Cryptocurrency or crypto is everywhere, from news headlines to celebrity Twitter accounts. But, it’s easy to get lost with over 18,000 different currencies, as of April 2022. Cryptocurrency is a vast topic that can easily span pages on pages explaining its past and current uses. But here are the basics.

The Rundown on Crypto

Cryptocurrencies are a form of digital currency that works through a computer network and does not rely on banking systems to verify transactions, making online payments more secure.

Instead of using paper money or a debit card where verification is traced back to banks, crypto purchases solely exist as entries in an online database for any transaction. These transactions get recorded in a single public spreadsheet called a ledger.

What Makes Cryptocurrency More Secure?

Cryptocurrency received its name because it uses encryption to verify transactions. Advanced coding is involved in storing and transmitting cryptocurrency data between wallets and public ledgers. Encryption aims to provide security and safety.

There is one public ledger and many copies of it available to anyone on the network. Instead of one bank confirming one transaction, each transaction is verified across these ledgers crosseferencing each copy to verify the purchase. Verifying across multiple copies makes it easier to spot fraud-type activity.

What to Do With Crypto

Walking into the grocery store or gas station, you’ll be hard-pressed if you try to pay for your food or gas with cryptocurrency. Only a few venues started to accept cryptocurrency as a form of payment for goods and services, although that may be changing.

Users see cryptocurrency as an investment and purchase these digital assets to sell for a profit. Buying cryptocurrency is similar to buying on the stock exchange. Like stock investments, cryptocurrencies are volatile, so their value can decrease or increase depending on the market.

For example, Bitcoin saw tremendous highs compared to its initial value. Bitcoin began trading at just $0.0008 on the cryptocurrency market. On April 9, 2022, a single Bitcoin reached over $42,000 in value, and that’s not even a historical high.

An Ethereum coin, another popular cryptocurrency, reached over $3,000 on that same day. Ethereum hit its highest market value, as of now, in November 2021 at over $4,000 per coin.

Collecting That Crypto

Users can obtain cryptocurrencies by purchasing them through an exchange, a broker, or mining. It’s crucial to weigh all options before deciding on the right fit for your crypto endeavor.

Exchange

An exchange is a designated platform for buyers and sellers to trade cryptocurrencies. Popular cryptocurrency exchanges are Coinbase, Gemini, eToro, and Binance US. However, there are many more to choose from, and researching is the best way to pick an exchange.

Exchanges typically have low fees compared to brokers. However, the standard trading interfaces are more complex and can intimidate the crypto novice. Users can opt for amateur-friendly options on their chosen exchange platform, however, take caution it will cost more to purchase the same cryptocurrency this way than through the standard interface.

Brokers

Brokers provide user-friendly interfaces that interact with exchanges on the user’s behalf.

Brokers are convenient, but there are drawbacks. For example, users may have less control over moving their assets off the broker’s platform. In addition, many brokers such as Sofi and Robinhood charge higher fees than an exchange, sell user trading information, and won’t always complete your trade at the best possible market price.

Check out our top picks of Robinhood alternatives for cryptocurrency and investing.

Once you choose an exchange or broker, the next step is to create and verify your account. You can then deposit cash to invest, order your currency, and choose a way to store the currency. You can store cryptocurrency either through different types of wallets or by leaving them on the exchange.

Mining

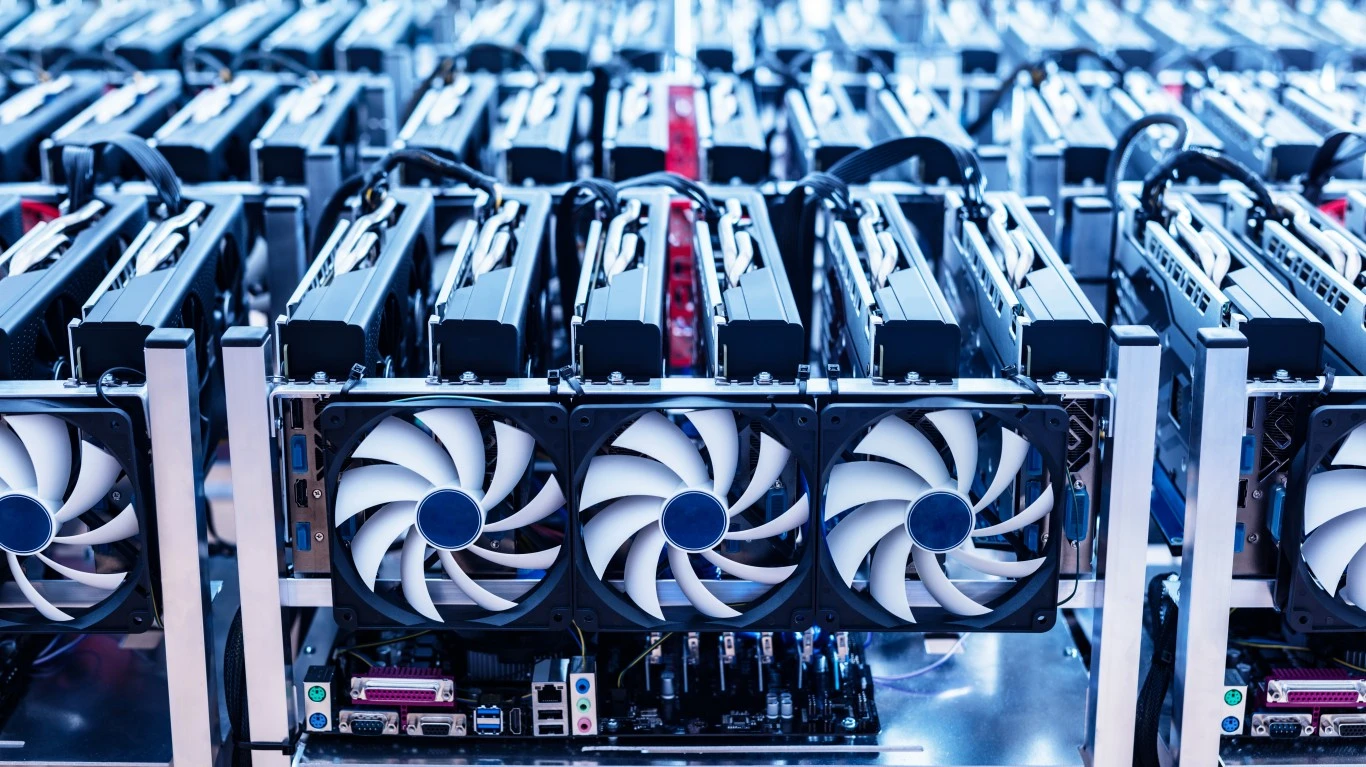

Cryptocurrency mining is how new coins enter circulation. Remember when we talked about verification across different ledgers? These ledgers don’t verify themselves automatically; programmed computers work to solve complex problems to verify the transactions.

By verifying each transaction, the person who set up the computer earns coins in return for their service. This is known as bitcoin mining.

Although mining can still turn a profit, it requires vast amounts of energy and expensive machinery. Therefore, it isn’t ideal for users just starting.

Which Crypto Do I Pick?

It is easy to get overwhelmed with the thousands of different cryptocurrencies to invest in.

Start From the Top: Market Capitalism

Researching cryptocurrencies by market capitalism rank is one way of choosing which to invest in. Start from the top, work your way down, and research.

Crypto Is Limited: Current Supply

There is a limited supply of all cryptocurrency types. For example, there will only ever be 21 million Bitcoins in existence. After mining all 21 million coins, no new coins become available, impacting the market value.

When choosing what to invest in, check out the supply versus demand of that particular currency.

Read White Papers

Every cryptocurrency has a white paper detailing the coin, its reason for creation, what it solves, the technology behind it, the creator’s goal for the coin, and more.

Reading the white paper can help make an informed decision on which cryptocurrency to invest in. It also helps to understand a white paper’s claims so investors can gauge if it is implemented as time passes and choose to keep their investment or pull out.

Use Cases

While reading the white paper, readers learn that each cryptocurrency claims to have different functions to tempt investors into one over the other. Instead, choosing one with the best use cases helps investors make informed choices on their investments.

Let’s Wrap it Up

Cryptocurrency is a vast subject that even seasoned investors haven’t scratched the surface on. Therefore, new investors should start small and only invest what they’re willing to lose, only invest if you understand the technology behind it, and only purchase if you can hold into it for the next three to five years to allow the asset to grow.

Note: This is not financial advice and is for educational purposes only.

Originally published at Wealth of Geeks

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.