There has been no ambiguity from Federal Reserve Chair Jerome Powell. He and the rest of Washington, D.C., over the past 17 months have had to face the music over spiraling inflation and the rampant government spending that took that inflation to the highest levels in over 40 years. While the searing inflation has fallen from above 9% back down to about 3%, that decline comes after a 5.5% increase in the federal funds rate. There is still a good chance we see another 25-basis-point hike at the end of September, depending on incoming data, like the August consumer price index report that hits September 13.

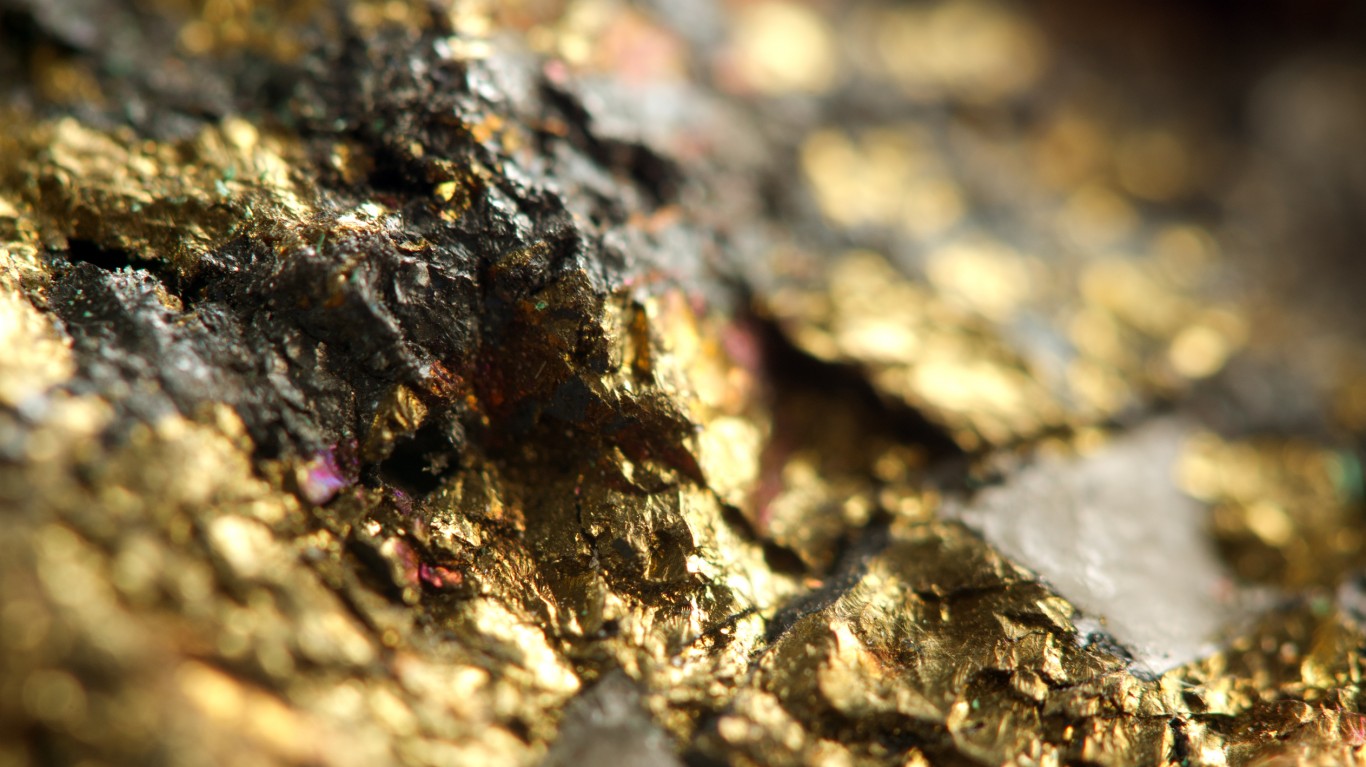

While we frequently have written about always owning a position in gold and other precious metals, investors may have one of the biggest opportunities for a gold short-squeeze in some time. The current gold short position by institutional traders is estimated to be a stunning $30 billion. In addition, some Wall Street firms also estimate that commodity trading advisors need to buy a stunning $60 billion in gold futures in a big up tape. The last time an event like this happened in August of 2019, gold was up 20% over the next 90 days.

We screened our 24/7 Wall St. gold research database looking for stocks that could soar on a big gold short squeeze and found 6 top companies that are all rated Buy at BofA Securities. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Agnico Eagle Mines

This is one of Wall Street’s most preferred North American gold producers. Agnico Eagle Mines Ltd. (NYSE: AEM) is a senior Canadian gold-mining company that has produced precious metals since 1957. It has declared a cash dividend every year since 1983.

Its eight mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions, as well as in the United States and Sweden. The company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. The stock backed up as gold has sold off March highs and with continued, albeit lower inflation you can bet many savvy portfolio managers are ready to add back top companies like this.

Shareholders receive a 3.26% dividend. The BofA Securities price target for Agnico Eagle Mines stock is $65. The consensus is higher at $66.39, but shares ended Wednesday trading at $49.14 apiece.

Barrick Gold

This is another top company in the sector, and its stock still offers a very solid entry point. Barrick Gold Corp. (NYSE: GOLD) and Randgold Resources completed their merger on January 1, 2019. This created the world’s largest gold company in terms of production, reserves and market capitalization.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.