Investing in real estate is well-known as one of the most effective ways to increase your wealth. However, you can also benefit by generating passive income, which allows you to clear out your daily schedule and pursue other passions.

Unfortunately, most people don’t understand how they can invest in real estate or even the terminology associated with the industry.

Below you will find some initial info you’ll want to know when considering your real estate strategy!

Jargon and Basic Processes

The real estate game can seem a little overwhelming when you are just getting used to the industry’s terminology.

Let’s explore some you’re most likely to encounter when you start shopping for a property or are about to make your first offer!

Terms Related to the Purchase Process

Offer / Purchase Agreement

An offer or purchase agreement is a document you as the buyer give to the seller, which expresses the amount you are offering to pay and the terms of your offer. The seller would sign this document, and at that point, you would have a completed “purchase agreement.”

With this, the next step would be to “open escrow.”

Escrow / Title

Technically the term “escrow” refers to money being held by a third party until specific conditions are met or so that a particular party can fulfill certain financial obligations.

For instance, when a buyer borrows money for a home through a lender, the lender sets up an escrow account used to receive monthly payments from the borrower.

The term “escrow” is used in a few different ways when transacting on real estate. Generally speaking, you “open escrow” after signing a purchase agreement.

Now, it’s true that this process is for the financial transfers mentioned above, but it’s also the case that during “escrow,” the buyer has the opportunity to do their due diligence.

Towards the end, when people talk about completing the transaction, they refer to it as “close of escrow.”

Sometimes you might hear the term “title” interchanged with “escrow.” In many states, the title company also handles the escrowing of the funds. In other states, you have separate escrow and title companies.

Earnest Money / Deposit

Your “deposit” or “earnest money” is an agreed-upon sum that you put down to secure the sales contract and open escrow. If you don’t meet all the terms and deadlines in the purchase agreement, you may have to exit the sale and forfeit your deposit.

If you meet all your terms and deadlines during escrow, and the transaction completes or “closes,” your deposit will go toward the purchase price you pay.

Title Company / Title Insurance

You must do title research to ensure the property is clear of any outstanding obligations and ready to be sold. A lien, for example, could be discovered during this process and delay the finalization of the sale.

A title company does the research mentioned above, and they provide an insurance policy that you can purchase for security. The insurance covers the policy owner from an entity coming out of the woodwork and saying they have some interest in the property.

Customarily in a transaction, the seller will pay for the “buyers title policy,” while the buyer will pay for the “lender’s title policy.”

As mentioned above, sometimes, the title company also acts as the escrow company. Someone might say to you, “You need to get your deposit over to ‘Title,’” but technically, your deposit goes into escrow.

Due Diligence

“Due diligence” is the steps you take to ensure the property you are buying meets your expectations. This work may include some or all of the following:

- Title research (mentioned above)

- Performing a home inspection

- Reviewing any HOA or Condo Association rules and fees

- Researching any permitting issues associated with the property

- Getting the property appraised

- Securing your financing

Contingencies

These are conditions that need to be satisfied before the sale is completed. One commonly seen contingency is when a buyer’s loan must be approved before the sale of the home takes place (this is the Financing Contingency). The three standard contingencies include:

- Inspection Contingency

- Appraisal Contingency

- Financing Contingency

Each of these will be assigned a date in the escrow process, by which they will need to be “waved” by the buyer (the buyer agrees they can no longer use this as an opportunity to bail out of the purchase).

The buyer has a right to cancel the transaction before the assigned date if: they don’t like the inspection, the house doesn’t appraise for the sale price, or their financing doesn’t come through.

Keep in mind that contingencies are negotiable. As a buyer, you can make an offer that has no contingencies at all if you want a property. However, this would be ill-advised unless you are a very seasoned pro.

Closing

The “closing” process is a meeting where the sale of a home is finalized, and all parties sign all associated documents. It’s a huge pile of paperwork.

You can go into the escrow or title office to sign your paperwork, or if you cannot do that, they can send a mobile notary to your location for an extra fee!

Terms Related to the Financing Process

Closing Costs

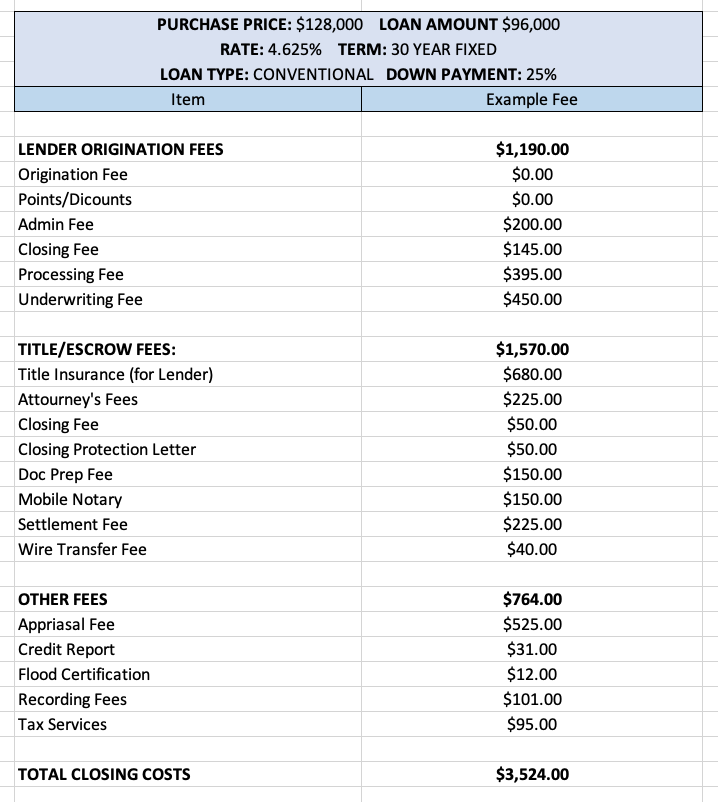

In general, “closing costs” are approximately 2-3% of the home’s total value, depending on the exact terms of your loan. Here is a breakdown of closing costs you might run into:

* These example fees were taken from one of my closing statements. It was a purchase of a rental property in Memphis, TN, in September of 2016. The types and names of your fees will change a bit from state to state.

* Some people will include your pre-paid interest, property tax, and pre-paid insurance as a “closing cost,” but I do not. Instead, I consider those “ongoing costs” required to own the property.

* The above fees are customarily paid by the buyer, while other fees are customarily paid by the sellers, such as transfer tax and the buyer’s title policy. Of course, buyers and sellers can negotiate who pays what at their discretion. But usually, everyone follows what is customary.

* Also, note that I use a lender geared toward investors. They charge a flat fee for their services, but it’s worth it for my needs. You can often get a loan with no points, origination fees, or lender fees for a first-time residence. You can also put much less down

Escrow / Impound Account

If you have a loan, the lender will, by default, set up and administer an “escrow” or “impound” account on your behalf. They collect your annual property tax and insurance via estimated monthly payments on your monthly loan bill.

Then the lender will pay these items when they are due out of your impound account. They do this because if you fail to pay for these items, it can create problems for them, so they do this for free!

It’s a very convenient service, but realize that it is not always mandatory. Often you can refuse the impound account and handle those payments yourself.

Taxes & Insurance

If you buy the property with a loan, the bank will require that you have insurance for it. But you should always have insurance, even if you own it outright!

Property taxes are annual fees you pay to your county for all the city and county’s services for your home.

When you secure your loan, they will provide a list of “closing costs” that you will have to pay. In addition, they often will include the portion of tax and insurance that you had to send into your impound account in this list.

Of course, in reality, they are not closing costs. They are ongoing costs you will have to keep paying!

Amortization / Annual Percentage Rate

The term “amortization” often leaves those new to the industry in a state of confusion. To clear it up for you, it simply refers to reducing or paying off a debt with regular payments.

When it comes to mortgage amortization, the payment includes both interest and principle. With each payment, the amount of interest getting paid gets smaller, and more of the principal is paid.

The amortization’s exact formula depends on the APR and the term or length of the loan.

Equity

The term “equity” in real estate refers to the percentage of a home you own. For example, if your home is worth $500,000 and you only owe 400K remaining on your loans, you have $100,000 in equity.

All the Acronyms

Along with real estate terminology, there’s also a handful of acronyms you’ll want to be aware of so you don’t get confused.

- APR – Annual Percentage Rate

- COO or C of O – certificate of occupancy

- CMA – comparative market analysis

- COCR or CCR – cash on cash return

- CRE – commercial real estate

- DEDRS – Deed Restrictions

- DTI – debt to income ratio

- FSBO -for sale by owner

- FHA – Federal Housing Administration

- FMR – fair market rent

- FMV – fair market value

- GRM – gross rent multiplier

- HML –hard money lender

- HOA – Homeowners Association

- HUD – The Department of Housing and Urban Development

- IRR – internal rate of return

- JV – a joint venture

- L/O – lease option

- LTV – loan to value

- MFH – multi-family home

- MLS – multiple listing service

- NNN – triple net lease

- NOI – net operating income

- NOO – non-owner occupied

- OO – owner-occupied

- PITI – Principal, interest, taxes, and insurance

- REI – real estate investing

- REO – real estate owned

- ROI – return on investment

- SFH- single-family home

- TT – transfer tax

While there are many more than this list that you’ll undoubtedly encounter, knowing these basics will help you better understand listings, conversations with agents, etc.

Most Common Ways to Invest

Buying a home and holding onto it is an obvious way to make money in real estate. You’ll be profiting as long as the property’s value rises over time (through the market or your renovations).

However, there are other ways to grow your money through real estate.

Own Your Residence

It should be no surprise that owning a home for yourself is one of the most straightforward ways to invest in real estate. It can also be one of the most valuable due to all the tax benefits your receive.

You may have seen or heard people debate over the value of owning your residence. Some people claim that it’s not an actual investment or that you are better off renting your home. I couldn’t disagree more!

I explain my reasons in this article: Renting vs. Owning: Why You Need to Own the Real Estate You Live In (You Will Be the World’s Best Renter!)

House Hacking

This term refers to owning a single-family or multi-family rental property. You can live in one section of the property while you rent out other parts to different tenants.

You would rent out a bedroom and have a roommate in a single-family home. However, if it’s a multi-family home, you would live in one unit and rent out the others. In this scenario, you could even rent out a bedroom in your unit if you want to get crazy!

Under the right circumstances, the rental income you receive from your tenants will be able to both cover your mortgage and allow you to profit.

The great thing about this situation is that even though you have a rental property at play, you get all an owner occupant’s financing and tax benefits.

I would 100% recommend this method as your first real estate investment. It’s just a winner all around!

Rental Property

You can purchase a home or apartment, then rent it out to tenants. Your goal is to have the incoming rent be more than all the carrying costs and ongoing expenses, thereby creating “positive cash flow”!

For example, your PITI (principal, interest, taxes, and insurance) on an SFH (single-family home) could be $900 per month, but your tenants’ rental payments total $1,500. This means you have $600 of income after paying your mortgage. Subtract from that an estimate of 25% for vacancy and maintenance, and you have $225 of potential positive cash flow every month.

However, cash flow isn’t the only way you are making money on a rental property or all real estate investments. Check out this article explaining how you can get a return: The 5 Critical Components of Real Estate Investing Returns.

For those of you searching for an easier way to invest in rental property, you can look for a “Turnkey Provider.” They find a property, fix it up, rent it out, sell it to an investor, and handle ongoing property management.

I bought a handful of turnkey properties out of state because purchasing rental property in LA was tough to justify. But first timer’s beware: “the more you put in, the more you get out” concept applies here.

Vacation Rentals (VRBO & AirBnB)

For owners who have available space in their residence (even just a spare bedroom or “mother-in-law” unit), Airbnb can bring fruitful results if you live in an area that’s popular for business or travel.

Furthermore, many investors buy a property with the sole intention of renting it out as a vacation rental. This strategy has become more viable since the invention of vacation rental sites like VRBO and Airbnb.

There is money to be made here, but it comes with more ongoing maintenance versus and traditional rental with a one-year lease.

House Flipping

Although this strategy requires extensive knowledge of the local market and access to more significant investable funds, it also has substantial earning potential.

House flipping refers to purchasing a home (often under the market value because it’s in disrepair) and renovating it to make it more attractive to future buyers. Then, you sell it for a large profit (hopefully).

It’s a simple concept and, in theory, a relatively easy execution if you understand the renovation process. But you need a good network of contractors and sub-contractors. Also, If you try to have ALL the work done by others, your likelihood of a profit is much lower.

Commercial Property

For those who don’t want to manage residential tenants in a home, commercial property is a reliable option with sky-high potential for income.

Office buildings are costly to invest in, but the rent per tenant can be higher than a residential property. Additionally, many lease agreements for office space are commonly five years, allowing you to better predict your income over an extended period.

Commercial property is a more advanced step in real estate investing. The stakes can be much higher, and the processes involved are more complex. Therefore, this is not a good first investment.

Wholesaling

This term is quite the opposite of house flipping regarding how the process works. For example, a real estate wholesaler will buy and sell houses within a short time without making repairs, renovations, etc.

They don’t even “buy” the home at all. Wholesalers find deals, get a house under contract, and then sell the deal to buy the home (or option/contract) to another investor. You do all the legwork to find deals, then pass them to other investors for a fee.

Theoretically, there is no risk for a wholesaler in that if they can’t find an investor to take the deal, they can bail before their contingencies are up and get their deposit back!

That said, a wholesaler risks their time and effort. It’s very time-consuming to find a deal that is so good that you can make money on it without doing anything to the property. Plus, you have to spend lots of time (years even) building up a network of investors/buyers.

Real Estate Syndications

Syndication is investing that can be participated in from a couple of angles as “the syndicator” (provider or sponsor) or “the investor.”

If you put syndication deals together, you identify an opportunity (let’s say a simple flip, for example), model out the investment on paper, then try to raise money from investors to execute the plan.

You take a fee for putting the whole deal together and seeing it through to completion, and you might own a piece of the pie.

If you are going to be a syndicator, you need to have experience with real estate deals and the “art of raising money.” Beyond that, you also need to understand all the legalities around offering investments to the public, of which there are many!

On the flip side, you can participate in syndication by being an investor. It’s one of the most passive forms of real estate investing because, as the investor, you just write a check. But again, the more you put into something, the more you are likely to get out!

Read more about Real Estate syndication in the other article I wrote: How Does Real Estate Syndication Work?

Crowdfunded Real Estate

Crowdfunded real estate is a shiny new term and category that has popped up in the last five to ten years, primarily because of advancements in technology. It means you pool your money with other investors into real estate projects looking to raise capital.

You can jump into real estate investment through some crowdfunding real estate platforms with much less money than you would need for a down payment. And you skip all the headaches associated with buying a property as well!

I see crowdfunded real estate companies in one of two ways.

1) They are large syndicators with a layer of tech that allows them to market their projects, collect funds, and manage the process.

2) The company is just the actual layer of tech that connects syndicators with investors! They essentially act as a third-party marketplace taking a fee for their service.

Currently, some of the more popular crowdfunding sites include Fundraise, Crowdstreet, Yieldstreet, and Diversyfund.

Public Markets REITs (Real Estate Investment Trusts)

REITs generally own and/or manage income-producing real estate, whether the properties themselves or the mortgages on those properties. You can invest in these companies directly or through an exchange-traded fund that combines multiple REIT investments into one.

There are many types of REITs available, including Retail REITs, Residential REITs, Healthcare REITs, Office REITs, and Mortgage REITs.

REITs are THE MOST PASSIVE form of real estate investing out there. It’s just like investing in “stocks.” You are simply buying stock in a company that invests in real estate!

Developing Your Real Estate Strategy Can Seem Difficult

But it doesn’t have to be.

With the above information about creating a real estate strategy in mind, you’ll be well on your way to optimizing your chances of success in the industry.

Originally published at Wealth of Geeks.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.