With the Memorial Day weekend upon us, heralding the unofficial start to the summer, many Americans planning summer vacations are keeping a sharp eye on gasoline prices, which continue to surge to the highest levels ever. In California, prices have jumped to over $6 per gallon in some places. For those ready to hit the highway, the pain at the pump could be severe, and for those looking to hop on a flight to faraway destinations, jet fuel is also at sky-high levels.

What has cruised under the radar is the price of natural gas, which has jumped briefly above the $9 level for the first time since 2008. While most consumers will not yet see it in their home heating bills as warm weather is upon us, in most parts of the country, air conditioning costs from power plants are expected to jump big-time for consumers.

Investors looking to take advantage of the strong pricing should look at the top natural gas stocks that pay a dividend. We found seven that make sense now, and all are rated Buy at major Wall Street firms. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Cheniere Energy

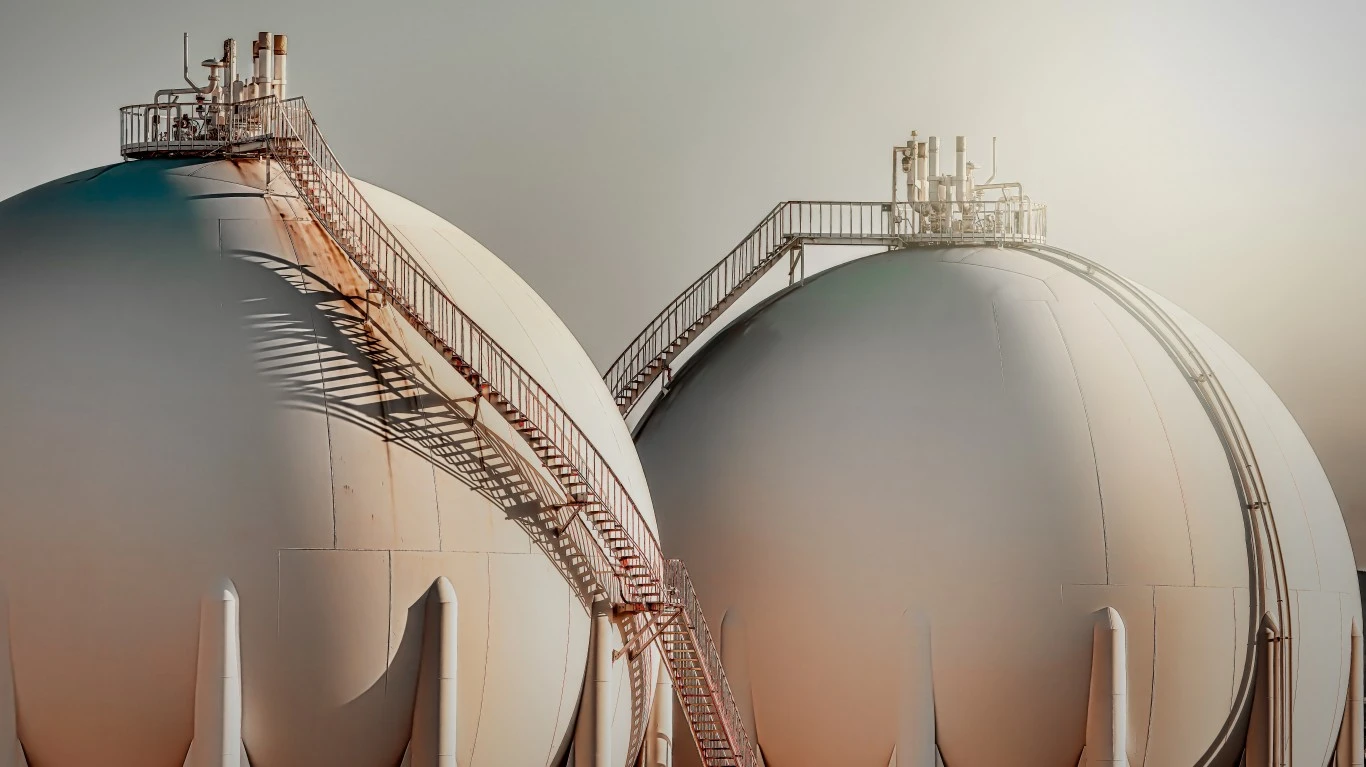

This top liquefied natural gas (LNG) play has made a huge move off the October 2020 lows. Cheniere Energy Inc. (NYSEAMERICAN: LNG) is an energy company primarily engaged in LNGelated businesses. The company operates through two segments.

Cheniere’s LNG terminal segment consists of the Sabine Pass and Corpus Christi LNG terminals. Its LNG and natural gas marketing segment consists of LNG and natural gas marketing activities by Cheniere Marketing.

Cheniere Marketing is developing a portfolio of long- and medium-term sale and purchase agreements with professional staff based in the United States, the United Kingdom, Singapore, and Chile. The company conducts its business through its subsidiaries, including the development, construction, and operation of its LNG terminal business and the development and operation of its LNG and natural gas marketing business.

Cheniere Energy stock investors receive a 1.01% dividend. J.P. Morgan has a $192 price target, and the consensus target is just $158.55. The shares closed on Thursday at $136.09 apiece.

Coterra Energy

This company was formed by the closing of the $17 billion merger of Cabot Oil & Gas and Cimarex Energy in 2021. Coterra Energy Inc. (NASDAQ: CTRA) is an independent oil and gas company engaged in the development, exploration and production of oil, natural gas and natural gas liquids (NGLs) in the United States. It primarily focuses on the Marcellus Shale, with approximately 177,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.