Three U.S. Senators earlier this month introduced legislation to establish an Office of Global Competition Analysis that would “assess how the United States fares in key emerging technologies relative to other countries to inform policy and strengthen U.S. competitiveness.”

One of the bill’s co-sponsors, Republican Ben Sasse of Nebraska, said at the time, “We are currently in a tech war with China, and the urgency to keep the upper hand is growing.” Another co-sponsor, Democrat Michael Bennet of Colorado, added that the legislation would “help us better understand U.S. competitiveness in technologies critical to our national security and economic prosperity and inform responses that will boost U.S. leadership.”

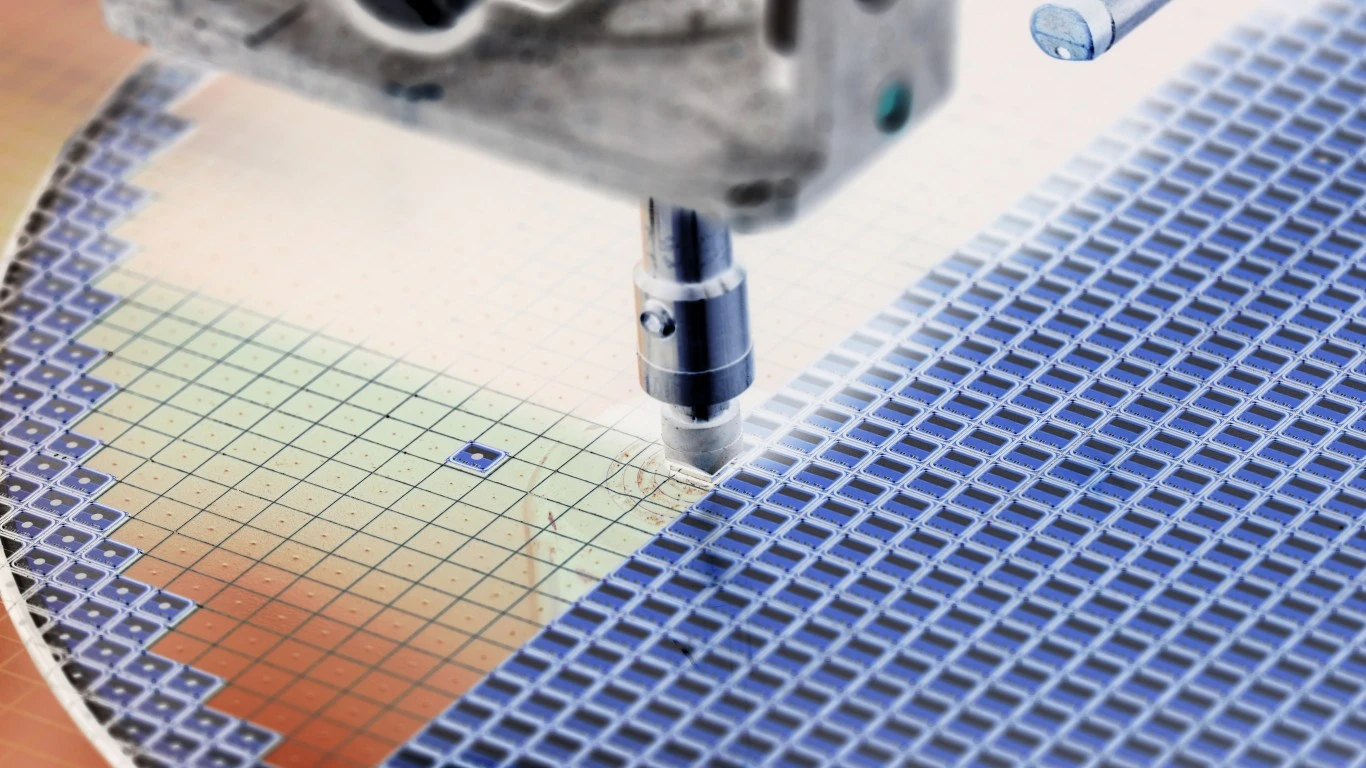

National security was also a point emphasized by Harvard professor Graham Allison and former Google CEO Eric Schmidt who, in a Wall Street Journal op-ed earlier this week, cited TSMC founder Morris Chang’s observation that spending $52 billion is nothing but “a very expensive exercise in futility.” The authors commented, “While [Chang] may be correct that U.S. firms are unlikely to overtake TSMC, that isn’t the point: Complete dependence on Taiwan for advanced semiconductors puts American national security at risk.”

Sujai Shivakumar and Charles Wessner at the Center for Strategic and International Studies don’t pull any punches on national security either:

[T]he erosion of U.S. capabilities in microelectronics is a direct threat to the United States’ ability to defend itself and its allies. Moreover, the U.S. civilian economy is deeply dependent on semiconductor-based platforms for its daily operations. Ensuring U.S. leadership in semiconductor technology and securing the integrity of the value chains that design, manufacture, package, and distribute these chips are perhaps the preeminent economic and national security concerns of the modern era.

Not everyone agrees. Writing in The Diplomat, Chi-hung Wei of Taiwan’s Academia Sinica, took a different view:

Today, it has become conventional wisdom in the United States that semiconductor manufacturing is a security issue. But that view is mistaken. Dependence on East Asia for manufacturing is unlikely to pose a challenge to U.S. security.

Wei includes U.S. allies Taiwan, Japan and South Korea in his East Asian club of chipmakers. He argues that if TSMC’s manufacturing operations were expanded in Taiwan, that would also assure U.S. and Taiwanese security:

U.S. security professionals have persuaded TSMC to open new fabs on U.S. soil, but Chinese President Xi Jinping would be incentivized to invade the island if TSMC’s role as Taiwan’s “silicon shield” were weakened. Conversely, Xi would be deterred from attacking Taiwan if Taiwan’s semiconductor industry remains important to U.S. interests, in addition to if Taiwan’s geographic location remaining vital to U.S. grand strategies in the Western Pacific. If Xi understands that the United States would come to Taiwan’s defense to protect chip supply chains, war would become a remote possibility.

Citing a White House report published last year that recommended that “the private sector must take the lead” in addressing the semiconductor shortage, Wei concludes:

Security professionals in the Biden administration should not subsidize semiconductor production in ways China has adopted, but instead give the market a bigger role. … [T]here is no single path to security, and security may be achieved by the market rather than security politics.

Schmidt and Allison challenge that argument: “If Beijing develops durable advantages across the semiconductor supply chain, it would generate breakthroughs in foundational technologies that the U.S. cannot match. … America is on the verge of losing the chip competition.”

Originally posted at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.