Bob Robotti is the president and CIO (Chief Investment Officer) of Robotti & Company. Before founding Robotti & Company in 1983, Robotti worked as a vice president of Gabelli & Company. Robotti has an MBA in Accounting from Pace University and B.S. from Bucknell University. Robotti’s “Robotti Robert” hedge fund is currently among the top performing hedge funds on the basis of a 3-year annualized weighted return. Let’s take a look at the top 10 holdings of Bob Robotti.

Top 10 Holdings Of Bob Robotti

We have referred to the latest 13F filing of Robotti Robert (June 30, 2022) to come up with the top 10 holdings of Bob Robotti.

-

Insteel Industries

Founded in 1953 and headquartered in Mount Airy, N.C., this company makes and sells steel wire reinforcing products for concrete construction applications. Robotti established a position in Insteel Industries Inc (NYSE:IIIN) in Q2 2015 and presently owns 255,961 shares of it. These shares have a market value of more than $8 million and account for 2.05% of Robotti’s portfolio. Insteel Industries shares are down by almost 24% year to date and down over 26% in the last three months.

-

Lincoln Electric Holdings

Founded in 1895 and headquartered in Cleveland, Ohio, this company makes arc welding equipment, consumable welding products and other welding and cutting products. Robotti established a position in Lincoln Electric Holdings, Inc. (NASDAQ:LECO) in Q4 2008 and presently owns 70,278 shares of it. These shares have a market value of more than $8 million and account for 2.06% of Robotti’s portfolio. Lincoln Electric Holdings shares are up by over 1% year to date and up almost 4% in the last three months.

-

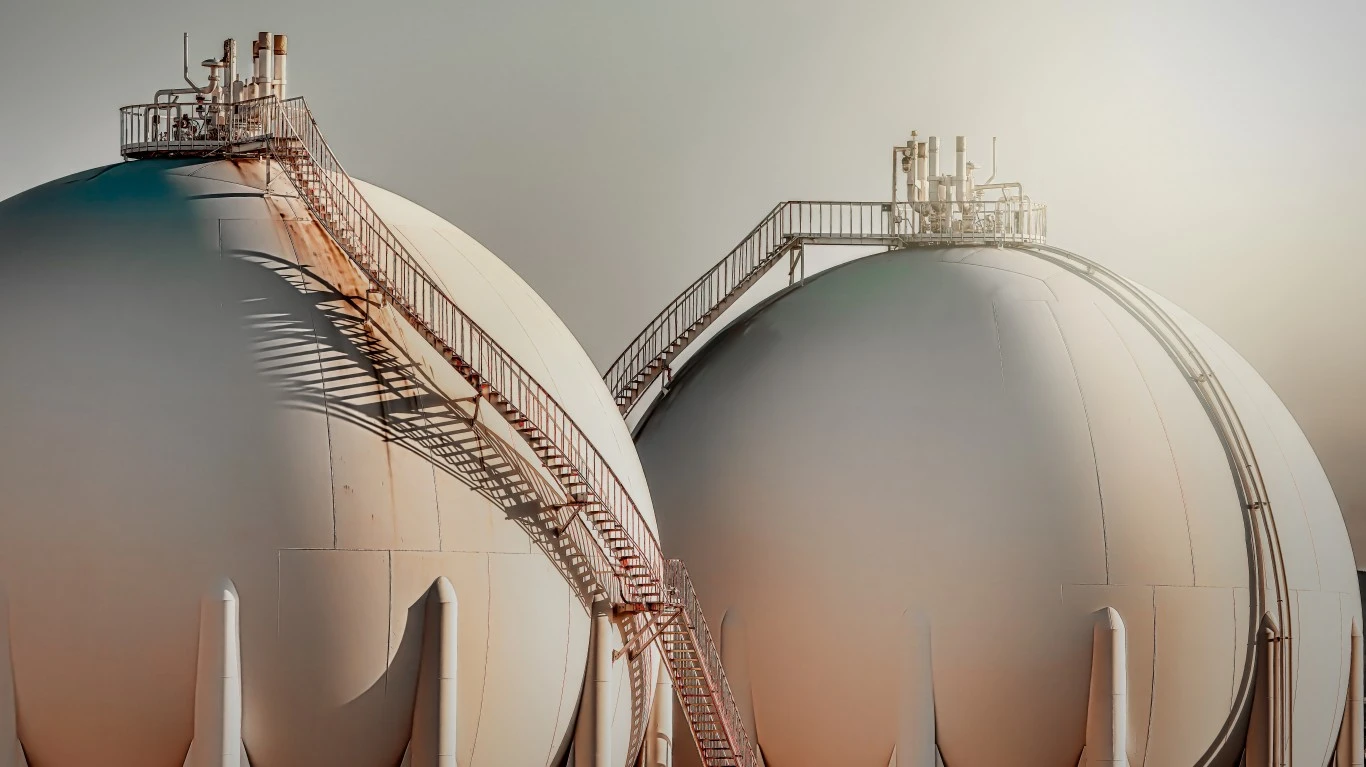

Canadian Natural Resources

Founded in 1973 and headquartered in Calgary, Canada, it is an oil and natural gas production company. Robotti established a position in Canadian Natural Resources Ltd (NYSE:CNQ) in Q4 2003 and presently owns 179,234 shares of it. These shares have a market value of more than $9 million and account for 2.29% of Robotti’s portfolio. Canadian Natural Resources shares are up by almost 35% year to date but are down by almost 15% in the last three months.

-

Jefferies Financial Group

Founded in 1968 and headquartered in New York City, this company provides financial services. Robotti established a position in Jefferies Financial Group Inc (NYSE:JEF) in Q4 2003 and presently owns 435,741 shares of it. These shares have a market value of more than $12 million and account for 2.86% of Robotti’s portfolio. Jefferies Financial Group shares are down by over 16% year to date and down almost 2% in the last three months.

-

Skyline Champion

Founded in 2018 and headquartered in Troy, Mich., this company makes and sells mobile homes and other manufactured housing. Robotti established a position in Skyline Champion Corp (NYSE:SKY) in Q1 2009 and presently owns 262,870 shares of it. These shares have a market value of more than $12 million and account for 2.97% of Robotti’s portfolio. Skyline Champion shares are down by almost 26% year to date but are up by almost 8% in the last three months.

-

Westlake

Founded in 1986 and headquartered in Houston, this company makes and sells petrochemicals, polymers and fabricated building products. Robotti established a position in Westlake Corp (NYSE:WLK) in Q4 2015 and presently owns 230,381 shares of it. These shares have a market value of more than $22 million and account for 5.37% of Robotti’s portfolio. Westlake shares are up by over 10% year to date but are down by almost 19% in the last three months.

-

LSB Industries

Founded in 1968 and headquartered in Oklahoma City, this company makes and sells chemical products for the agricultural, mining, and industrial markets. Robotti established a position in LSB Industries, Inc. (NYSE:LXU) in Q2 2010 and presently owns over 1.60 million shares of it. These shares have a market value of more than $23 million and account for 5.57% of Robotti’s portfolio. LSB Industries shares are up by over 48% year to date but are down by over 16% in the last three months.

-

West Fraser Timber

Founded in 1955 and headquartered in Vancouver, Canada, it is a diversified wood products company. Robotti established a position in West Fraser Timber Co. Ltd. (NYSE:WFG) in Q1 2021 and presently owns 327,501 shares of it. These shares have a market value of more than $25 million and account for 5.98% of Robotti’s portfolio. West Fraser Timber shares are down by over 2% year to date but are up by almost 4% in the last three months.

-

Tidewater

Founded in 1995 and headquartered in Dallas, this company offers offshore marine support and transportation services. Robotti presently owns over 3.60 million shares of it. These shares have a market value of more than $69 million and account for 16.55% of Robotti’s portfolio. Tidewater Inc. (NYSE:TDW) shares are up by over 103% year to date but are down by over 21% in the last three months.

-

Builders FirstSource

Founded in 1998 and headquartered in Dallas, this company makes and supplies building materials. Robotti established a position in Builders FirstSource in Q2 2009 and presently owns over 1.78 million shares of it. These shares have a market value of more than $95 million and account for 22.81% of Robotti’s portfolio. Builders FirstSource, Inc. (NYSE:BLDR) shares are down by over 27% year to date and down almost 7% in the last three months.

This article originally appeared on ValueWalk

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.