Over the past two years, semiconductor manufacturers and their customers have missed out on some $500 billion in sales because of chip shortages. More than $210 billion was lost in auto sales alone.

The good news, according to Deloitte’s 2022 semiconductor industry outlook, is that the industry is expected to grow by 10% this year and surpass $600 billion in sales for the first time. Supply chain issues are expected to ease in the second half of the year, although some components could face shortages well into 2023.

While well-known mega-caps like Intel and Taiwan Semiconductor deservedly get much of the attention in the space, there are small-cap and mid-cap equipment makers that also have fallen out of favor and, like so many tech stocks, have seen their share prices and ratings slide.

Analysts Brian Chin, Patrick Ho and Denis Pyatchanin at Stifel recently interviewed executives of several companies operating in the “semiconductor manufacturing (process control and test), high-performance computing, and industrial/warehouse automation sectors.” These smaller companies operate upstream of the industry’s big players and “generally reiterated strong short-and-longer term outlooks.”

Based on these conversations, Stifel’s analysts think the market may have deated these stocks twice and that when market sentiment reverses, “we see an opportunity for a double reate, with kickers tied to improving sector as well as stock-specific sentiment.”

Cohu

Stifel maintained its Buy rating on Cohu Inc. (NASDAQ: COHU), a maker of semiconductor test equipment that also provides services to chip makers in China, Taiwan, the United States and elsewhere. The company’s market cap is around $1.3 billion, and the stock price has dropped by about 25% over the past 12 months. Intel’s share price has declined by nearly 32% over the same period.

The analysts believe that Cohu is successfully evolving into a higher value supplier to the chip industry and that recent new orders for test equipment are “an important sign of the pivot toward a sustainably higher margin/ profitability revenue mix, which should help dampen cyclicality as well.”

The 12-month price target on the stock is $45, which implies upside potential of 64.8%, based on a current price of around $27.30. The stock’s 52-week range is $25.06 to $39.86.

FormFactor

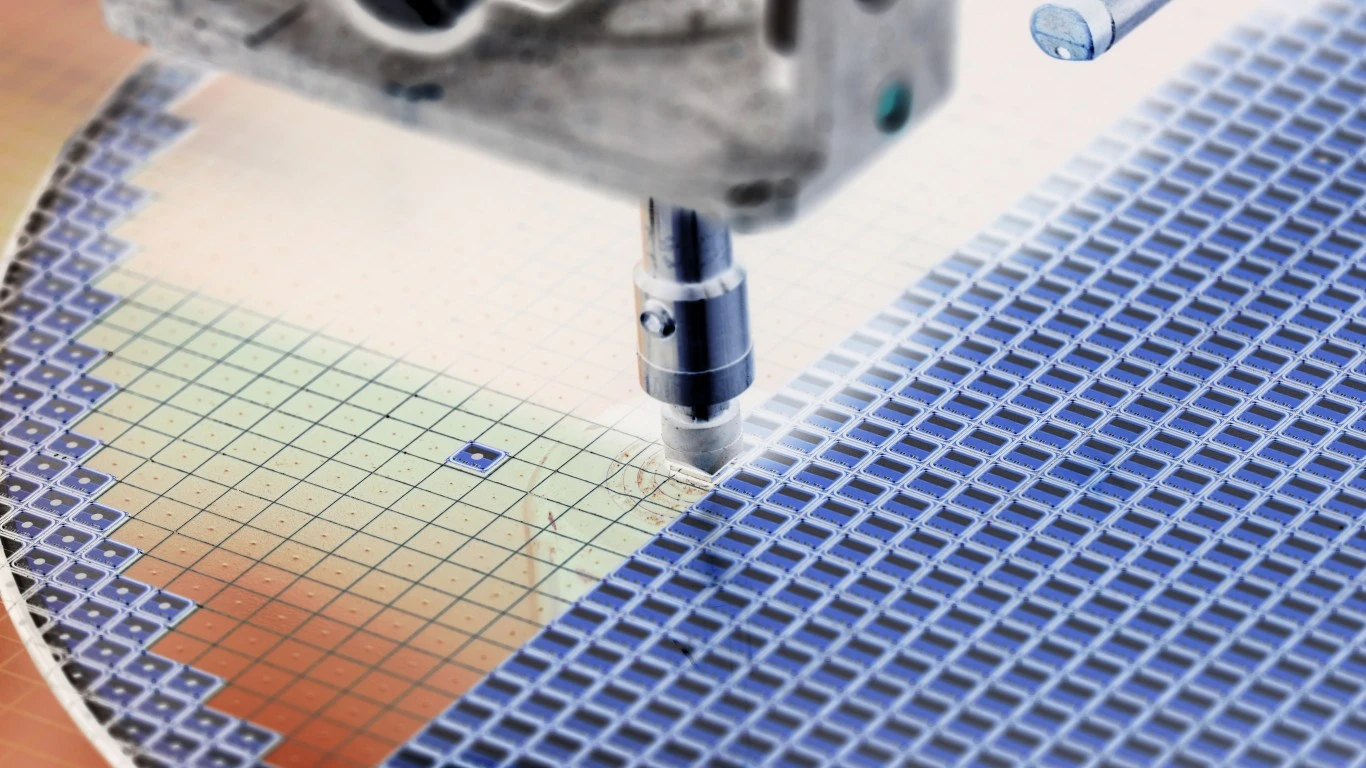

FormFactor Inc. (NASDAQ: FORM) designs, manufactures and sells a range of electronic testing probes and systems for a variety of semiconductor devices. The company’s market cap is around $2.85 billion, and the share price has added about 4.4% over the past 12 months. Since reaching a 52-week high in January, the shares have retreated about 21.5%. The stock is rated a Buy by Stifel’s analysts.

Company management said that its estimated $2 billion serviceable available market for probes in 2023 may happen more quickly due to “strengthening customer roadmaps for increasingly complex logic/SoC [system-on-a-chip] devices utilizing increased levels of advanced heterogeneous die integration.”

Stifel’s analysts noted that the company’s customers (including Taiwan Semiconductor and Intel) “are moving forward at/above expected rates” and that regardless of chip sales demand, FormFactor’s products are “more driven more by chip/test complexity, customer yield challenges, and release of new designs.”

Stifel’s 12-month price target is $47, implying upside potential of 28% based on a price of around $36.70. The stock’s 52-week range is $32.71 to $47.48.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.