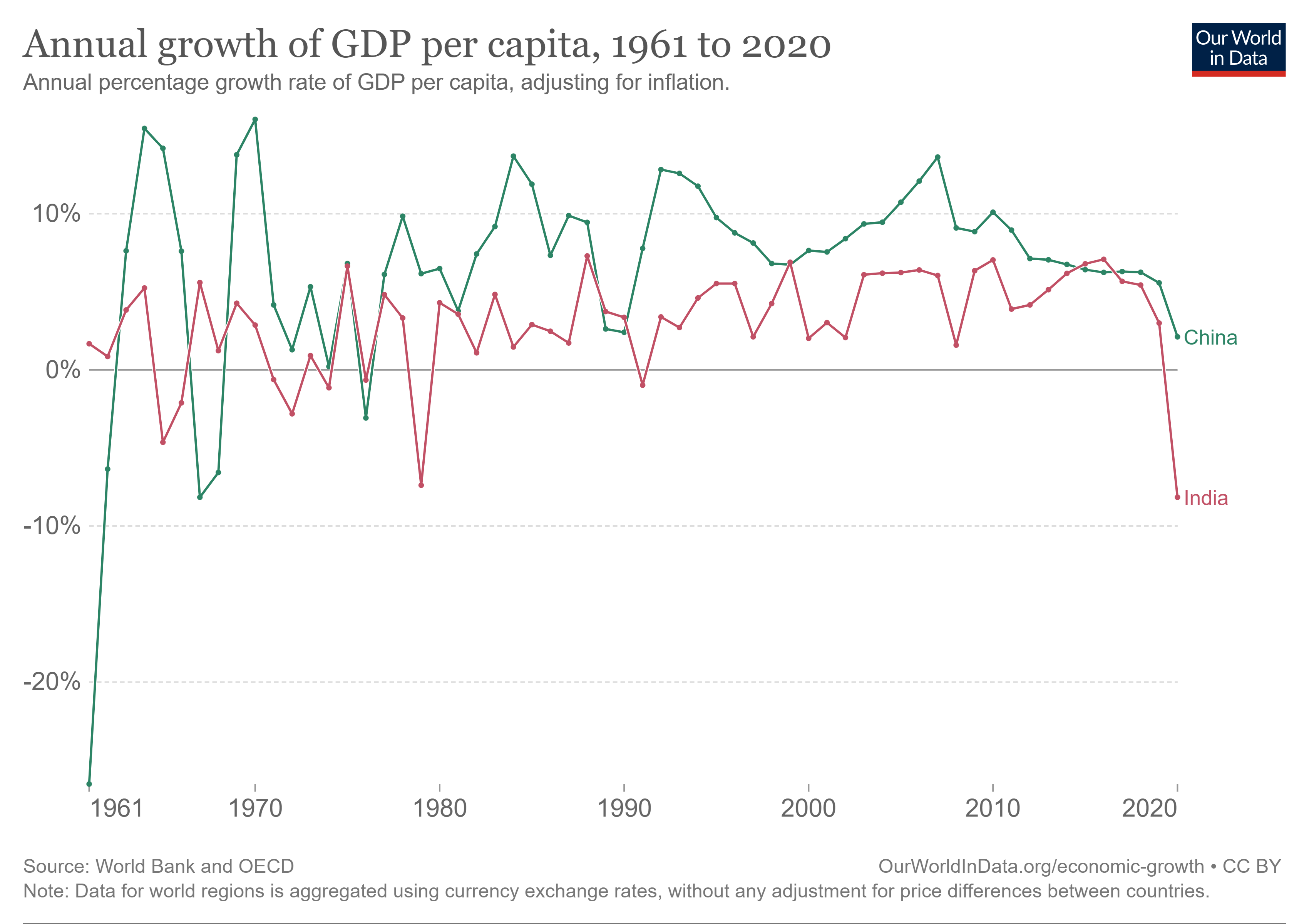

India’s economy is the world’s fifth largest, having just overtaken the United Kingdom to trail only the United States, China, Japan and Germany. Until the pandemic of 2020 absolutely clobbered India’s GDP per capita growth rate, China and India were growing at nearly the same pace.

There may be good reasons for the United States to maintain friendly relations with China, but protecting Silicon Valley’s market share ought to be way down the list.

Nvidia did report a strong first-quarter performance after U.S. markets closed on Wednesday. The company then estimated that second-quarter revenue would come in at around $11 billion — some 52% above the consensus estimate. The increase is largely driven by demand for the company’s high-end chips and all the software that goes along with them to support the massive run into generative AI. CEO Jensen expects spending to amount to $1 trillion over the next several years, and he also expects Nvidia to get a big piece of that.

Shares of Nvidia opened Thursday morning at $385.24 (a new 52-week high), up nearly 21% from Wednesday’s close. The company’s market cap has soared to more than $917 billion.

Originally published at 24/7 Wall St.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.