Having dry powder is always the best ammunition when the market is in a free fall. While the 2022 bear market could still have a way to go, now is the time for savvy investors to start looking at the stocks they would like to add at a substantial discount. Some of the best technology ideas are cheap and pay very enticing dividends.

The reasons for the sell-off this year are plentiful, and none are going away any time soon, despite the recent rally. Massive inflation, very hawkish Federal Reserve policy, a bitter war in Ukraine, supply chain issues, the periodic COVID-19 lockdowns in China and a host of additional issues will keep the pressure on stock prices. Many across Wall Street feel that the actual bottom for the venerable S&P 500 could be as low as 3,400. That is close to 15% or so downside from Wednesday’s closing print of 3,959.

We screened the BofA Securities technology sector universe looking for quality companies that have been absolutely crushed and found five that investors with a higher degree of risk tolerance may want to start buying partial positions in. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

ASE Technology

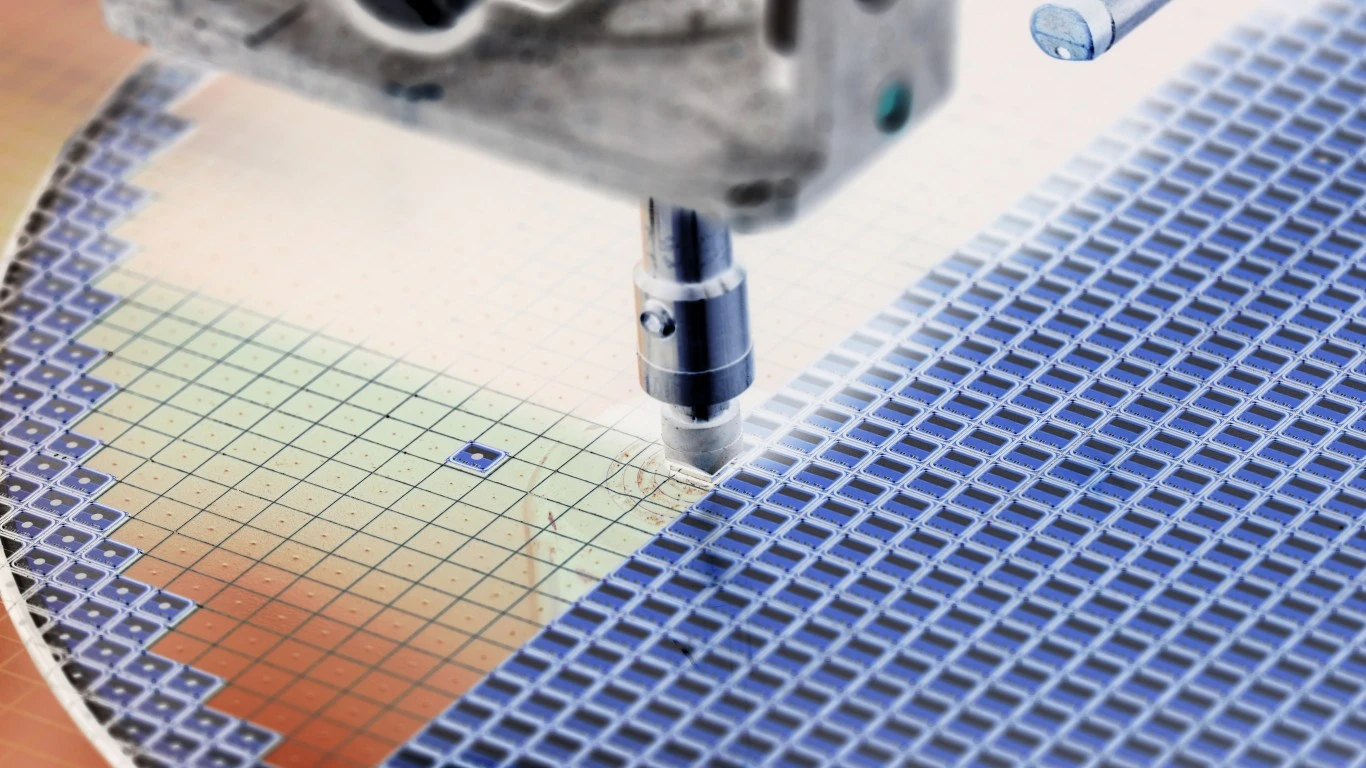

While perhaps a touch off-theadar, this stock offers investors massive total return potential. ASE Technology Holding Co. Ltd. (NYSE: ASX) provides a range of semiconductor packaging and testing, as well as electronic manufacturing services, in the United States, Asia, Europe and elsewhere.

The company offers packaging services, including flip-chip ball grid array (BGA), flip-chip chip-scale package (CSP), advanced chip-scale packages, quad flat packages, low-profile and thin quad flat packages, bump chip carrier and quad flat no-lead (QFN) packages, advanced QFN packages, plastic BGAs and 3D chip packages. It offers stacked die solutions in various package types and copper and silver wire bonding solutions.

ASE also provides advanced packages, such as flip-chip BGA; heat-spreader FCBGA; flip-chip CSP; hybrid FCCSP; flip-chip package in package and package on package (POP); advanced single-sided substrate; high-bandwidth POP; fan-out wafer-level packaging; SESUB; and 2.5D silicon interposer.

In addition, it offers IC wire bonding packages; system-in-package products (SiP) and modules; and interconnect materials, as well as assembles automotive electronic products. It provides a range of semiconductor testing services, including front-end engineering testing, wafer probing, logic/mixed-signal/RF module and SiP/MEMS/discrete final testing and other testelated services, as well as drop shipment services.

ASE also develops, constructs, sells, leases and manages real estate properties; produces substrates; offers information software, equipment leasing, investment advisory and warehousing management services; processes and sells computer and communication peripherals, electronic components, telecommunications equipment and motherboards; and imports and exports goods and technology.

ASE Technology stock investors receive a 6.35% dividend. BofA Securities has a Buy rating and an $8.80 target price. The consensus target is $7.97, and shares closed on Wednesday at $5.58.

Broadcom

This stock has been crushed, and while suitable only for more aggressive investors, Wall Street continues to like the company for dividend growth. Broadcom Inc. (NASDAQ: AVGO) has an extensive semiconductor product portfolio that addresses applications within the wired infrastructure, wireless communications, enterprise storage and industrial end markets.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.