1. What is a 401(k)

A 401(k) is an employer-based tax-deferred defined contribution retirement plan. Each pay period, your company deducts a predetermined amount from your paycheck to invest in a menu of options, such as mutual funds or exchange-traded funds (ETF)s. You set how much money you want deducted.

Some companies may offer a matching contribution. When you retire, you’ll receive your 401(k) in a lump sum to fund your leisure years. Because contributions are not taxed as you build up your account, you’ll have to pay taxes on the 401(k) funds when you withdraw.

2. Roth 401(k)s

A Roth 401(k) is similar to a regular 401(k) except for one major difference: You put after-tax money into the Roth 401(k). Since you’ve already paid taxes on those funds, you don’t have to pay taxes when you withdraw.

3. What is an annuity

An annuity is a contract between you and an insurance company. To purchase an annuity, you hand over your money to an insurer, either in one large amount or a series of premium payments.

Like a 401(k), the annuity investment grows over many years. The insurer then sends you a check each month after you retire to your death. If you buy an annuity with pre-tax money, you will be taxed on withdrawals. One important fact to consider about annuity payments is that the amount doesn’t change with inflation.

4. 401(k) are only available if your employer has one

401(k) plans are increasing in popularity among employers. According to the Bureau of Labor Statistics, 65% of private industry employees had access to the benefit. If retirement savings are important to you, check to see if a potential employer offers a 401(k).

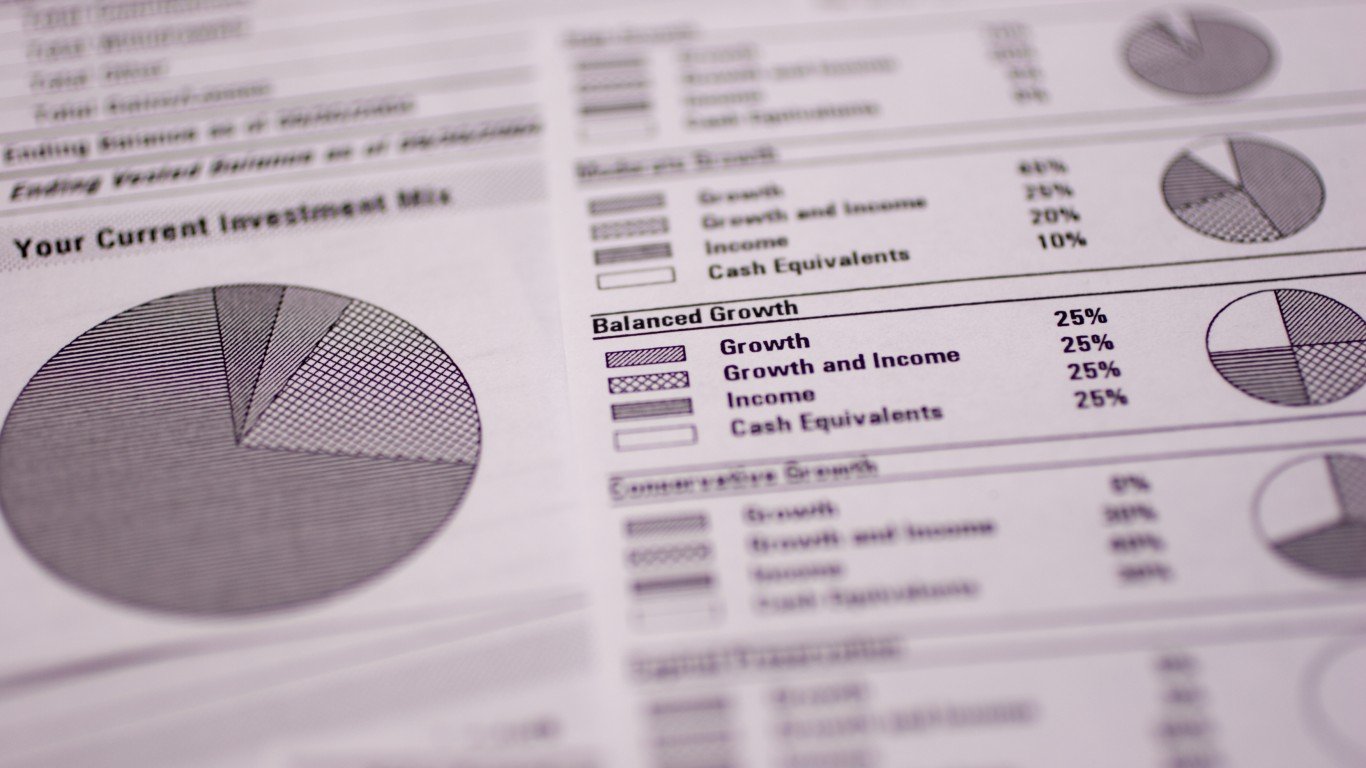

5. Differences in fees

Both annuities and 401(k) deduct fees, but you may pay more with an annuity. Your plan administrator at your workplace can show you how much your 401(k) account is being charged. Annuity fees can be complicated. You may be paying sales commissions, benefit rider fees, and other charges.

Sponsored: Tips for Investing

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.